Comparative data

The following information is intended to provide additional context

regarding the total remuneration for executive directors.

Relative importance of pay spend

In 2014, the total dividend for the year of 37.6 pence represented

an increase of 7% over last year’s 35.3 pence. As a result of the

sale of the Retail Dispense divisions an additional special return

of £620m was made to shareholders in 2014 and there was a

consolidation of the Group’s equity with the issue of seven new

shares for every eight held. During the same period the total

pay spend decreased by 15% reflecting the sale of the Retail

Dispense divisions.

Relative percentage change in remuneration for

Chief Executive

Mark Selway was appointed Chief Executive designate in

October 2013 and was not considered for an increase in base

salary for 2014. As such, his appointment as Chief Executive

during the year under review means that it is not possible to

provide a comparison this year. We will revert to normal practice

next year when comparable data is available.

The Committee actively considers any increases in base

pay for the Chief Executive relative to the broader employee

population. However, benefits and bonus payments are not

typically compared given they are driven by a far broader

range of factors, such as local practices, eligibility, individual

circumstances and role.

Historical performance and remuneration

In addition to considering executive remuneration in the context

of internal comparisons, the Committee reviews annually

historical outcomes under the variable pay plans.

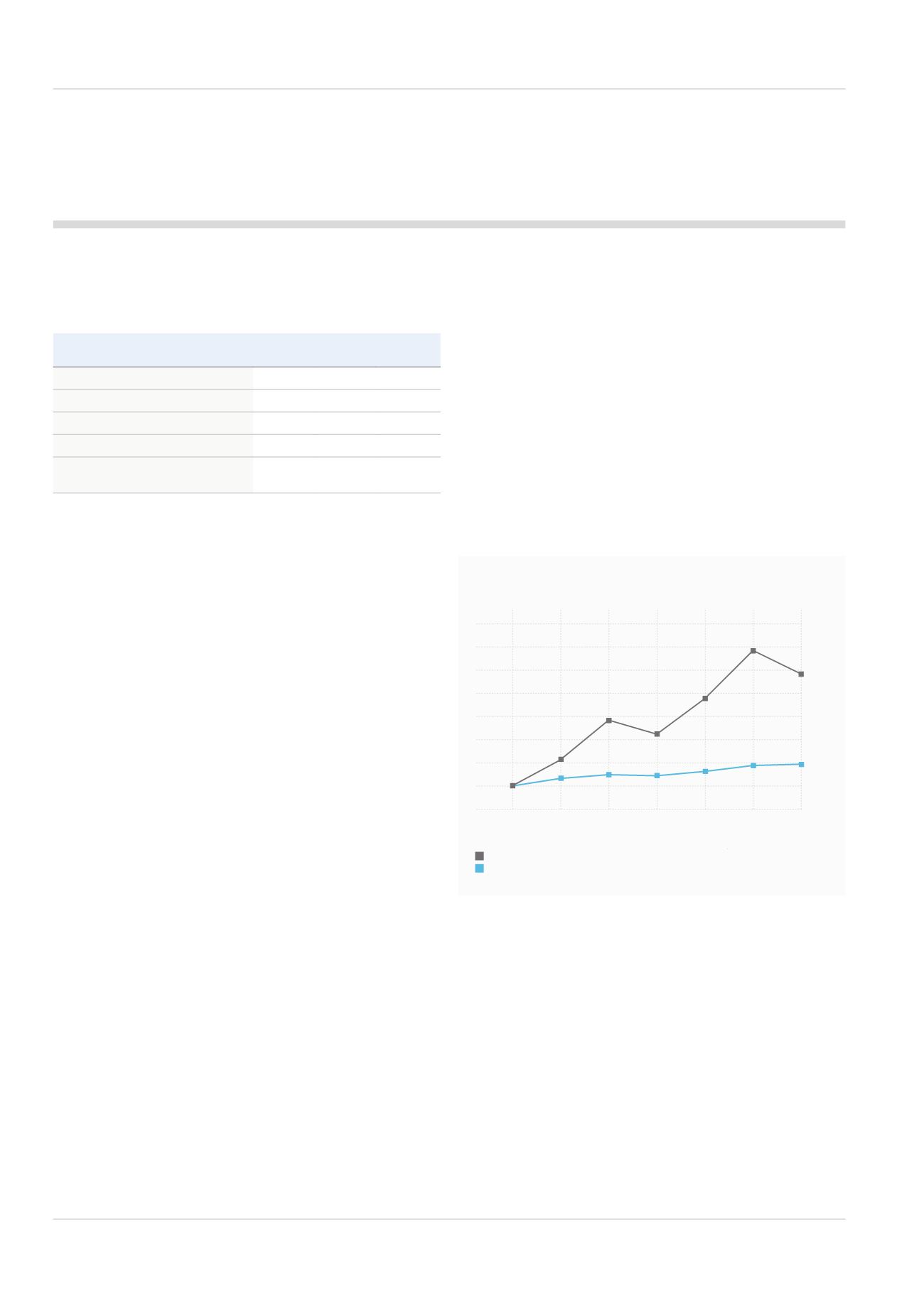

The following graph compares IMI’s TSR to the FTSE100 over

the last six years. We compare performance to the FTSE100

as it represents the broad market index within which IMI shares

are traded. TSR measures the returns that a company has

provided for its shareholders, reflecting share price movements

and assuming reinvestment of dividends (source: DataStream),

with data averaged over the final 30 days of each financial year.

As the graph below illustrates, IMI’s absolute and relative TSR

performance has been strong over the last six years. This is

reflected in the outcomes under our variable pay plans, which

are largely driven by the financial performance of the Group

and IMI’s share price.

2014

£m

2013

£m

Change

Acquisitions

-

7.8

-100%

Dividends

97.3

106.2

-8%

Return of Cash

620.3

-

-

Purchase of own shares

40.0

195.7

-80%

Total employment costs for Group*

(see Section 2.1.3 on page 97)

535.5

630.1

-15%

400

300

200

500

100

0

600

£580

£195

700

800

£

2008

2009

2010

2011

2012

2013

2014

IMI

FTSE100

Total return from a hypothetical £100 investment

Directors’ Remuneration Report (cont’d)

* As per Companies Act requirements, the total employment costs for the Group reported in 2013 included the Retail

Dispense divisions. The total employment cost in 2013 excluding Retail Dispense was £505.2m.

70

IMI plc