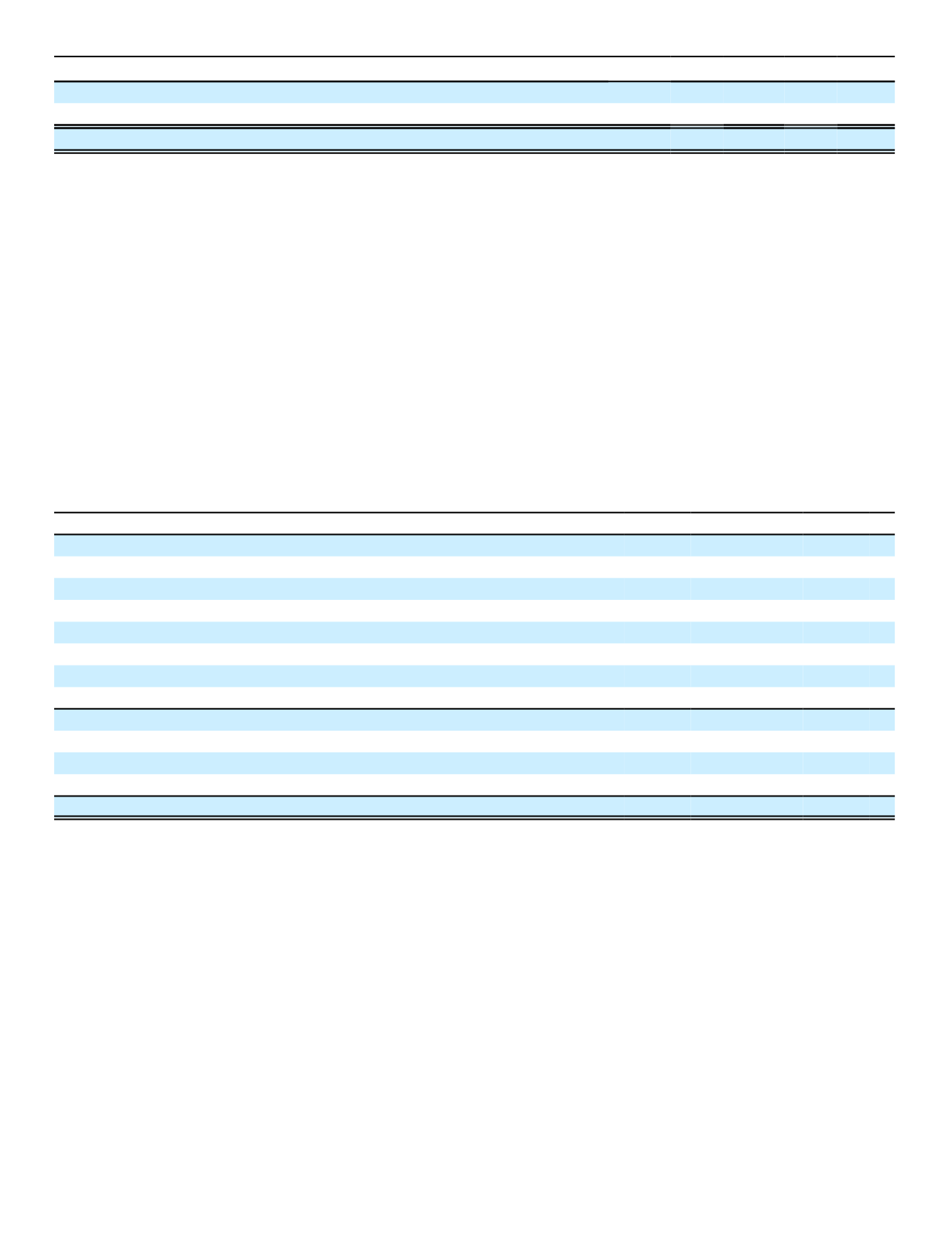

2016

(1)

2015

(1)

2014

(1)

New money yield

(2)

1.40%

2.89% 2.07%

Return on average invested assets, net of investment expenses

(3)

2.68

2.80

2.80

Portfolio book yield, including dollar-denominated investments, end of period

(2)

2.62%

2.80% 2.83%

(1)

Yields are reported before the cost of foreign currency forwards that hedge foreign exchange risk of U.S. dollar-denominated publicly

traded corporate bonds.

(2)

Includes fixed maturities and perpetual securities, loan receivables, and equities

(3)

Number reflected on a quarterly average basis

On January 1, 2016, the company revised its definition of purchases to include the reinvestment of proceeds related

to unplanned sale activity. New purchases include all purchases related to fixed maturities and perpetuals, loan

receivables, and equities. Securities lending/repurchase agreement activity and capital contributions to alternatives are

excluded. The definition of new money yield has also been revised to reflect this change. Yields for equities are based on

the assumed dividend yield at the time of purchase. Historical amounts have been revised to reflect the new definitions.

The decrease in the Aflac Japan new money yield in 2016 was primarily due to the increased allocation to Japan

Government Bonds (JGBs) and other high quality yen-denominated investments, as well as lower U.S. and Japan interest

rates during much of the investment period.

The following table presents the composition of total investments by sector, at cost or amortized cost, and cash for

Aflac Japan ($91.9 billion in 2016 and $85.1 billion in 2015) as of December 31.

Composition of Portfolio by Sector

2016

2015

Debt and perpetual securities, at amortized cost:

Banks/financial institutions

(1)

9.6%

11.5%

Government and agencies

47.4

43.8

Municipalities

.9

.8

Public utilities

8.3

8.9

Sovereign and supranational

3.9

4.1

Mortgage- and asset-backed securities

1.3

.5

Other corporate

(2)

24.8

28.6

Total debt and perpetual securities

96.2

98.2

Equity securities

1.2

.5

Other investments

1.1

.2

Cash and cash equivalents

1.5

1.1

Total investments and cash

100.0%

100.0%

(1)

Includes 1.4% and 1.9% of perpetual securities at December 31, 2016 and 2015, respectively

(2)

Includes .2% of perpetual securities at December 31, 2016 and 2015, respectively

Our highest sector concentration is in government and agencies. See Note 3 of the Notes to the Consolidated

Financial Statements and the Market Risks of Financial Instruments - Credit Risk subsection of MD&A for more

information regarding the sector concentrations of our investments.

Yen-denominated debt and perpetual securities accounted for 76.1% of Aflac Japan's total debt and perpetual

securities at December 31, 2016, compared with 72.8% at December 31, 2015, at amortized cost.

The overall credit quality of Aflac Japan's investments remained high. At the end of 2016, 94.8% of Aflac Japan's debt

and perpetual securities were rated investment grade, on an amortized cost basis.

See Notes 3, 4 and 5 of the Notes to the Consolidated Financial Statements and the Analysis of Financial Condition

section of this MD&A for additional information on our investments and hedging strategies.

48