AFLAC U.S. SEGMENT

Aflac U.S. Pretax Operating Earnings

Changes in Aflac U.S. pretax operating earnings and profit margins are primarily affected by morbidity, mortality,

expenses, persistency and investment yields. The following table presents a summary of operating results for Aflac U.S.

for the years ended December 31.

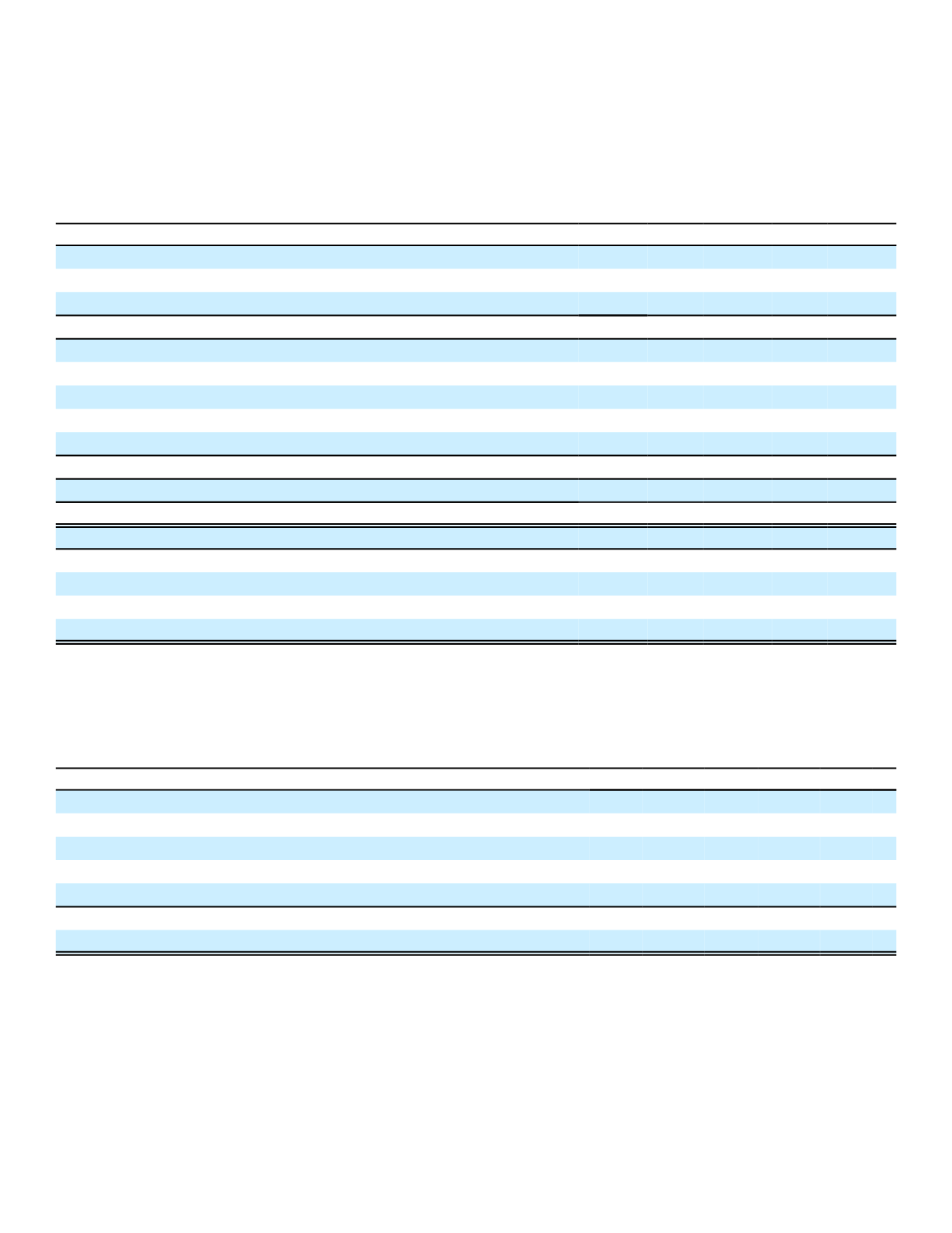

Aflac U.S. Summary of Operating Results

(In millions)

2016

2015

2014

Net premium income

$ 5,454

$ 5,347

$ 5,211

Net investment income

703

678

645

Other income

10

8

3

Total operating revenues

6,167

6,033

5,859

Benefits and claims

2,869

2,873

2,853

Operating expenses:

Amortization of deferred policy acquisition costs

497

488

459

Insurance commissions

580

585

590

Insurance and other expenses

1,013

986

884

Total operating expenses

2,090

2,059

1,933

Total benefits and expenses

4,959

4,932

4,786

Pretax operating earnings

(1)

$ 1,208

$ 1,101

$ 1,073

Percentage change over previous period:

Net premium income

2.0%

2.6%

1.1%

Net investment income

3.8

5.0

2.1

Total operating revenues

2.2

3.0

1.2

Pretax operating earnings

(1)

9.7

2.7

3.3

(1)

See the Insurance Operations section of this MD&A for our definition of segment operating earnings.

Annualized premiums in force increased 2.4% in 2016, 1.6% in 2015 and 1.8% in 2014. Annualized premiums in force

at December 31 were $5.9 billion in 2016, compared with $5.8 billion in 2015 and $5.7 billion in 2014.

The following table presents a summary of operating ratios for Aflac U.S. for the years ended December 31.

Ratios to total revenues:

2016

2015

2014

Benefits and claims

46.5%

47.6%

48.7%

Operating expenses:

Amortization of deferred policy acquisition costs

8.1

8.1

7.8

Insurance commissions

9.4

9.7

10.1

Insurance and other expenses

16.4

16.3

15.1

Total operating expenses

33.9

34.1

33.0

Pretax operating earnings

(1)

19.6

18.3

18.3

(1)

See the Insurance Operations section of this MD&A for our definition of segment operating earnings.

The benefit ratio decreased in 2016, compared with 2015, due to a mix of business changes and continued favorable

claims experience. The operating expense ratio remained relatively stable in 2016, compared with 2015. In total, the

pretax operating profit margin improved in 2016, compared with 2015, due to lower benefit ratios. In 2017, we expect the

benefit and expense ratios to remain relatively stable.

49