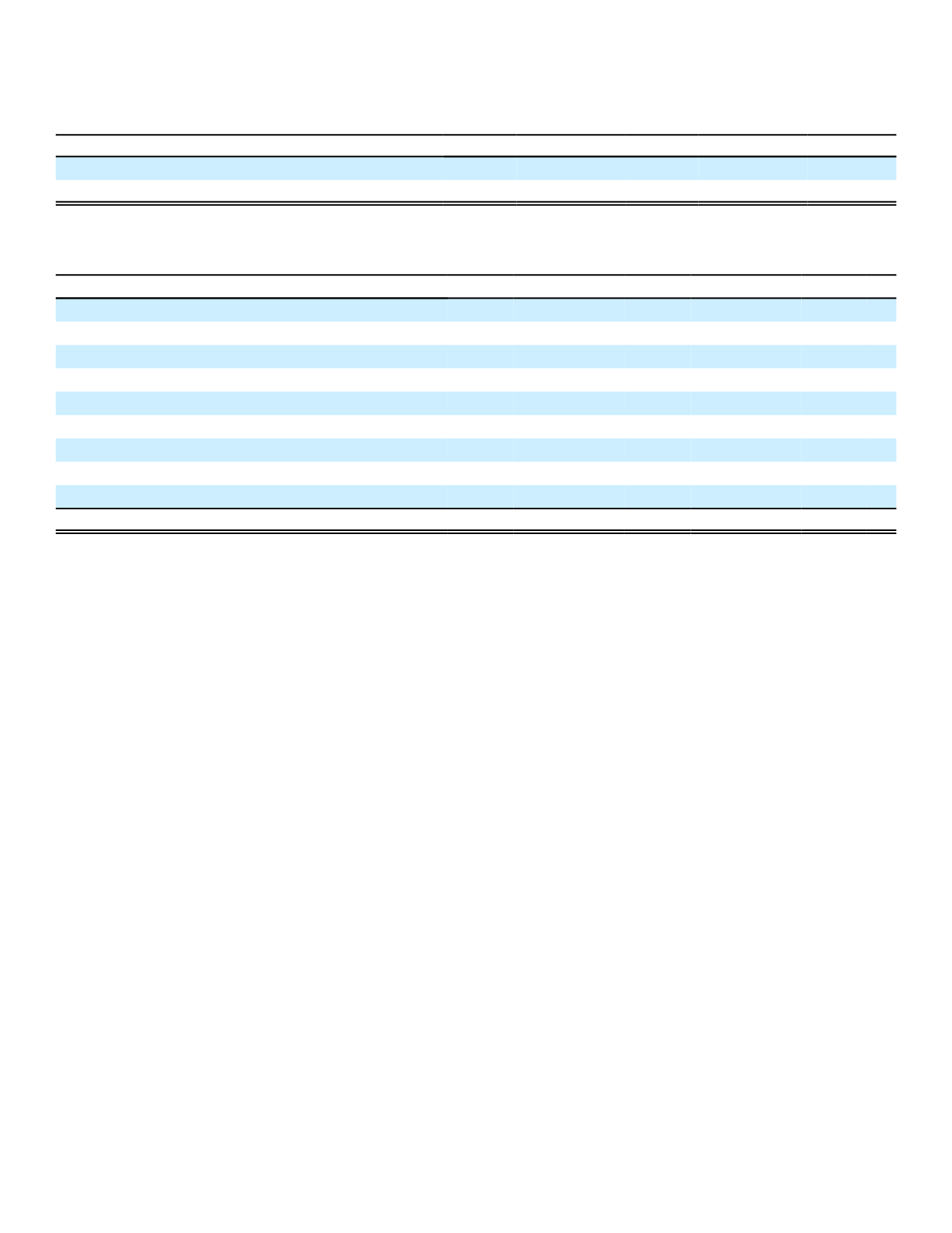

Aflac U.S. Sales

The following table presents Aflac's U.S. new annualized premium sales for the years ended December 31.

(In millions)

2016

2015

2014

New annualized premium sales

$1,482

$ 1,487

$ 1,433

Increase (decrease) over prior period

(.3)%

3.7%

.7%

The following table details the contributions to new annualized premium sales by major insurance product category for

the years ended December 31.

2016

2015

2014

Income-loss protection:

Short-term disability

23.5%

23.2%

22.4%

Life

5.1

5.2

5.8

Asset-loss protection:

Accident

29.5

29.9

28.1

Critical care

(1)

22.1

21.9

21.4

Supplemental medical:

Hospital indemnity

14.8

14.6

16.4

Dental/vision

5.0

5.2

5.9

Total

100.0%

100.0%

100.0%

(1)

Includes cancer, critical illness and hospital intensive care products

New annualized premium sales for accident insurance, our leading product category, decreased 1.5%, short-term

disability sales increased .9%, critical care insurance sales (including cancer insurance) increased .4%, and hospital

indemnity insurance sales increased .7% in 2016, compared with 2015.

The addition of group products has expanded our reach and enabled us to generate more sales opportunities with

larger employers, brokers, and our traditional sales agents. We anticipate that the appeal of our group products will

continue to enhance our opportunities to connect with larger businesses and their employees. Our portfolio of group and

individual products offers businesses the opportunity to give their employees a more valuable and comprehensive

selection of benefit options.

In 2016, our traditional U.S. sales forces included more than 9,000 U.S. associates who were actively producing

business on a weekly basis. We believe that the average weekly producer equivalent metric allows our sales

management to monitor progress and needs. In 2016, sales through employers with less than 100 workers were relatively

flat. In 2017, we will continue to focus our career sales agents on selling to this segment.

Beyond expanding the size and capabilities of our traditional sales force, we remain encouraged about establishing

and developing relationships with insurance brokers that typically handle the larger-case market. Broker sales to groups

with 1,000 or more employees experienced double-digit percentage growth in 2016.

We believe that changes we have made to our career and broker management infrastructure since 2014 have

provided a platform for expanded long-term growth opportunities. During 2014, Aflac U.S. implemented tactical initiatives

centered around providing competitive compensation to our career agent sales hierarchy and positioning us to more

effectively and consistently execute on the U.S. sales strategy across all states. These measures were designed to more

effectively link sales management's success to Aflac's success. For example, we enhanced compensation through an

incentive bonus for the first level of our sales management, district sales coordinators, who are primarily responsible for

selling Aflac products and training new sales associates. Additionally, we eliminated the commission-based position of

state sales coordinator. To better manage our state operations, we introduced the new position of market director, effective

October 1, 2014. Market directors are salaried with the opportunity to earn sales-related bonuses. We believe these

changes have enhanced and will continue to enhance performance management and better align compensation with new

business results.

50