Main Section Title [H1]

|

Subsection Title [H2]

AFLAC INCORPORATED

2017 PROXY STATEMENT

70

Proposal 5: Proposal to Approve the Aflac Incorporated Long-Term Incentive Plan

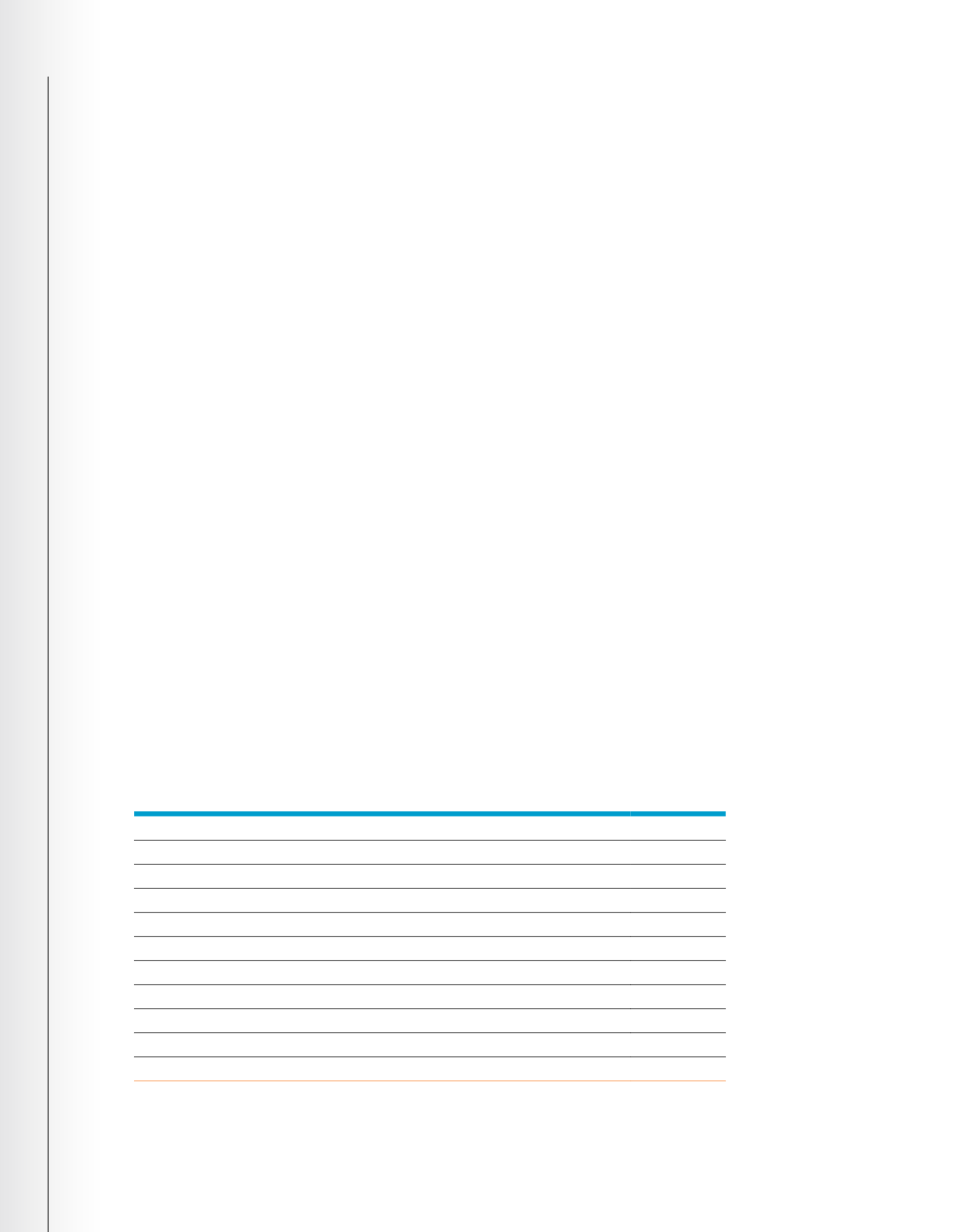

Name and Position

Number of Shares

Daniel P. Amos, Chairman and Chief Executive Officer

1,818,551

Frederick J. Crawford, Executive Vice President, Chief Financial Officer

43,882

Kriss Cloninger III, President

619,419

Paul S. Amos II, President, Aflac

285,333

Eric M. Kirsch, Executive Vice President, Global Chief Investment Officer, Aflac

147,481

Executive Officers as a Group

3,687,606

Non-employee Directors as a Group

281,146

Each Nominee for Election as a Director

3,004,449

Each Associate of any of the Foregoing

–

Each Other Person Who Received at Least 5% of all Options Granted

–

All Employees as a Group (exclusive of Executive Officers)

7,860,075

or disability, no such minimum vesting period shall be required, (ii) awards to Non-employee Directors granted on

the date of an annual meeting of shareholders of the Company may vest as early as the date of the subsequent

annual meeting of the shareholders, and (iii) over the life of the 2017 LTIP up to 1,875,000 shares may be made

subject to such awards without minimum vesting requirements (which number includes awards previously granted

under the LTIP that required no such minimum vesting).

PROHIBITED ACTIONS

Without the approval of the shareholders of the Company, no action taken by the Committee (or any delegate of

the Committee) under the 2017 LTIP shall have the effect of:

●●

lowering the exercise or grant price of an option or stock appreciation right after it is granted;

●●

canceling any previously granted option or stock appreciation right in exchange for another award if

the exercise or grant price exceeds the fair market value of a share of our common stock, other than in

connection with a reorganization, merger or consolidation of the Company, a sale, exchange or transfer of

all or substantially all of the Company’s property or one of its business units, the direct or indirect acquisition

of all or substantially all of the outstanding voting shares of the Company, or any other change in control or

recapitalization event; or

●●

canceling in exchange for cash any previously granted award with an exercise or grant price exceeding the fair

market value of a share of our common stock.

AMENDMENT OR TERMINATION OF THE 2017 LTIP

The Board of Directors may, at any time, suspend or terminate the 2017 LTIP or revise or amend it in any respect

whatsoever; provided, however, that shareholder approval shall be required (i) for any amendment to the 2017

LTIP that would have the effect of (A) increasing the number of shares available for issuance under the 2017 LTIP

(other than in respect of changes in capitalization and similar events), (B) expanding the class of individuals eligible

for participation in the 2017 LTIP, (C) materially increasing the benefits available to participants under the 2017

LTIP, or (D) lowering the exercise or grant price of an option or stock appreciation right after it is granted, and (ii) if

and to the extent necessary to satisfy Sections 162(m) or 422 of the IRC, other applicable law or applicable stock

exchange requirements. However, no action taken under the 2017 LTIP may, without the consent of a participant,

adversely affect the participant’s rights under any outstanding award. No awards may be granted under the

2017 LTIP after February 13, 2027, but awards granted prior to that time will continue in effect after such time in

accordance with their terms.

2017 LTIP BENEFITS

On March 1, 2017, the closing price per share of our Common Stock on the NYSE was $72.98.

As of such date, stock options with respect to our Common Stock had been granted under the LTIP to the

following individuals covering the number of shares shown: