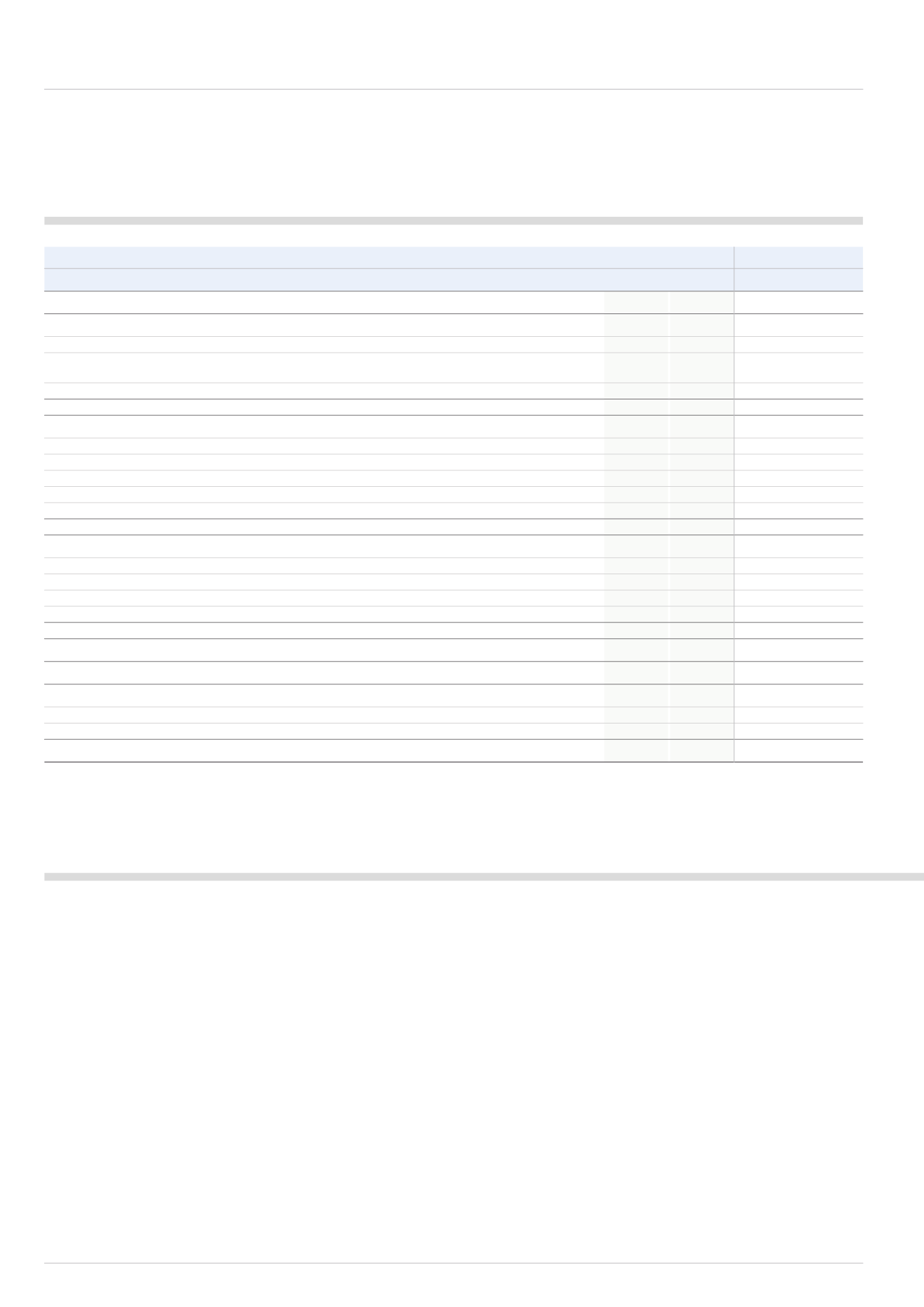

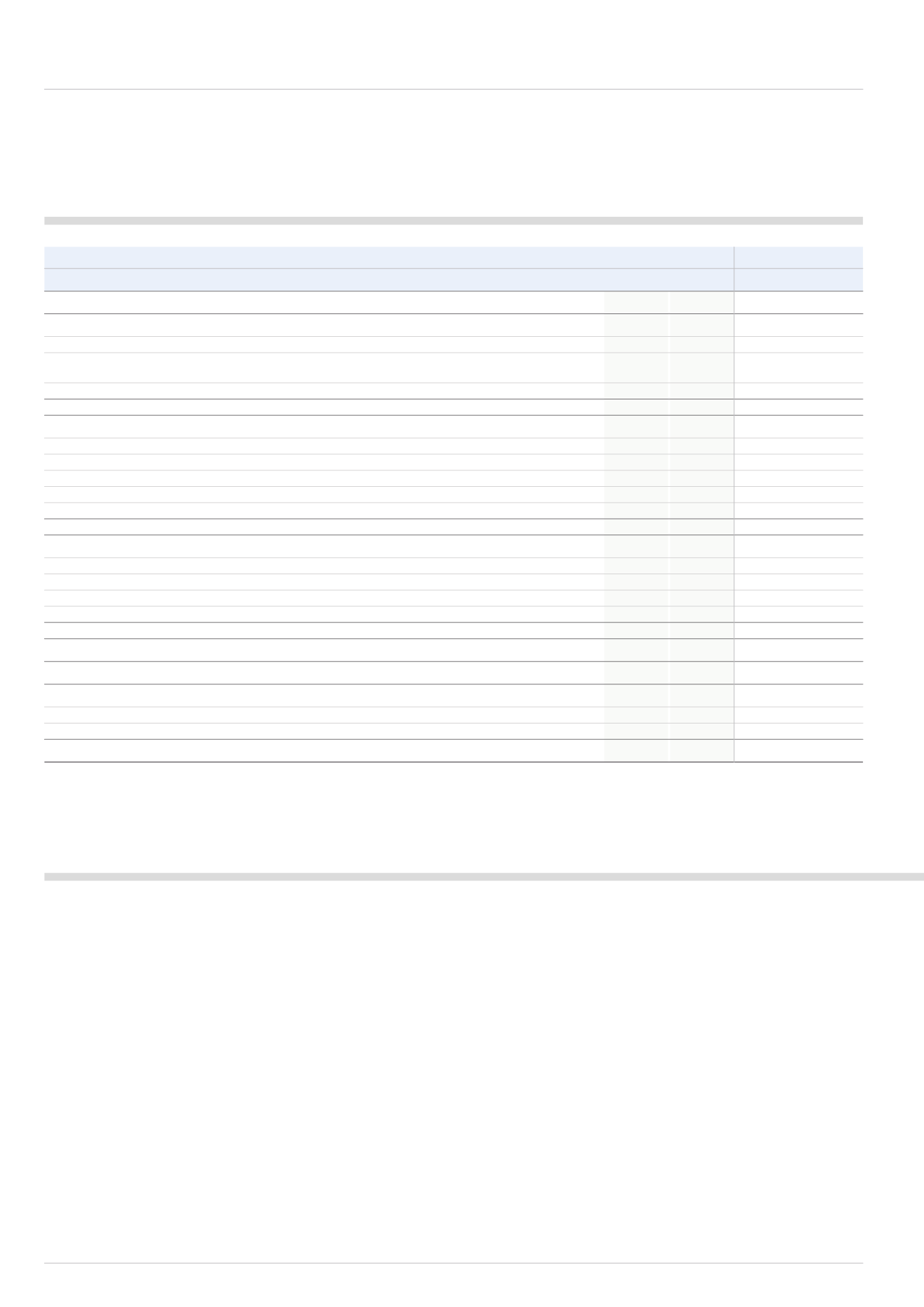

86

IMI plc

For the year ended 31 December 2014

2014

2013

£m

£m

£m

£m

Profit for the year

671.3

227.0

Items reclassified to profit and loss in the year

Foreign exchange gain reclassified to income statement on disposal of operations

(3.9)

-

Realised gain on settlement of deal-contingent forward relating to disposal proceeds

reclassified to income statement

(11.2)

-

Related tax effect on items reclassified to profit and loss

2.4

-

(12.7)

-

Items that may be reclassified to profit and loss

Change in fair value of effective net investment hedge derivatives

3.6

3.4

Exchange differences on translation of foreign operations net of hedge settlements and funding revaluations

(14.7)

(16.9)

Change in fair value on deal-contingent forward relating to disposal proceeds

(3.0)

14.2

Fair value gain/(loss) on available for sale financial assets

1.1

(0.5)

Related tax effect on items that may subsequently be reclassified to profit and loss

1.0

(2.5)

(12.0)

(2.3)

Items that will not subsequently be reclassified to profit and loss

Re-measurement gain on defined benefit plans

16.6

41.4

Related taxation effect in current year

(2.2)

(11.4)

Taxation in relation to restructure of UK Pension Fund

(6.6)

-

Effect of taxation rate change on previously recognised items

-

(9.9)

7.8

20.1

Other comprehensive (expense)/income for the year, net of taxation

(16.9)

17.8

Total comprehensive income for the year, net of taxation

654.4

244.8

Attributable to:

Owners of the parent

651.6

241.7

Non-controlling interests

2.8

3.1

Total comprehensive income for the year, net of taxation

654.4

244.8

COMMENTARY ON THE CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME AND THE CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Movements in shareholders’ equity

Shareholders’ equity at the end of 2014 was £509m (2013: £601m).

Movements in shareholders’ equity can be split into three categories:

• the profit for the year attributable to the equity shareholders of £669m (2013:

£224m). This is discussed on the page opposite the income statement.

• other comprehensive income movements in the year reduced shareholders’

equity by £17m (2013: increased £18m). These are discussed below.

• movements taken directly to equity in the year reduced shareholders’ equity

by £743m (2013: reduced £227m). These are discussed overleaf.

Other comprehensive income

When the Group makes unrealised gains or losses on assets and liabilities,

upon disposal of the Retail Dispense businesses £4m of foreign exchange

gains were recycled to the income statement.

The deal-contingent forward used to hedge the proceeds of the Retail Dispense

disposal was revalued on 1 January 2014 which resulted in a reduction in the fair

value of the derivative by £3m. Following the receipt of the proceeds a gain of

£11m was realised in the income statement. The tax effect on items reclassified

to profit and loss amounted to £2m.

When the Group makes unrealised gains or losses on assets and liabilities,

instead of being recorded in the income statement, they are credited or

charged to reserves and recorded in the statement of comprehensive income.

In accordance with the amendment to IAS1, these items are allocated between

those items that have been recycled to the income statement, those that may be

recycled to the income statement and those items that may not be recycled to

the income statement.

Any net investment hedge derivatives which have not settled by the year-end

are marked to market on the balance sheet at the year-end and the movements

are recorded in the hedging reserve. This movement is also included in other

comprehensive income and in 2014, amounted to income of £4m (2013: £3m)

including the related taxation effect.

The Group’s foreign denominated net assets are translated into sterling using

exchange rates prevailing at the year-end. To the extent that these differ from the

rates used at the previous year-end to translate net assets at that date and from

the average exchange rate used to translate foreign denominated income during

the year, a difference on reserves arises. This is included in other comprehensive

income, along with the settlement of net investment hedge derivatives and

revaluations of foreign debt, which are used to protect the Group from this

exposure. These items (including the related taxation effect) amounted to a

loss of £13m in 2014 (2013: loss of £16m).

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME