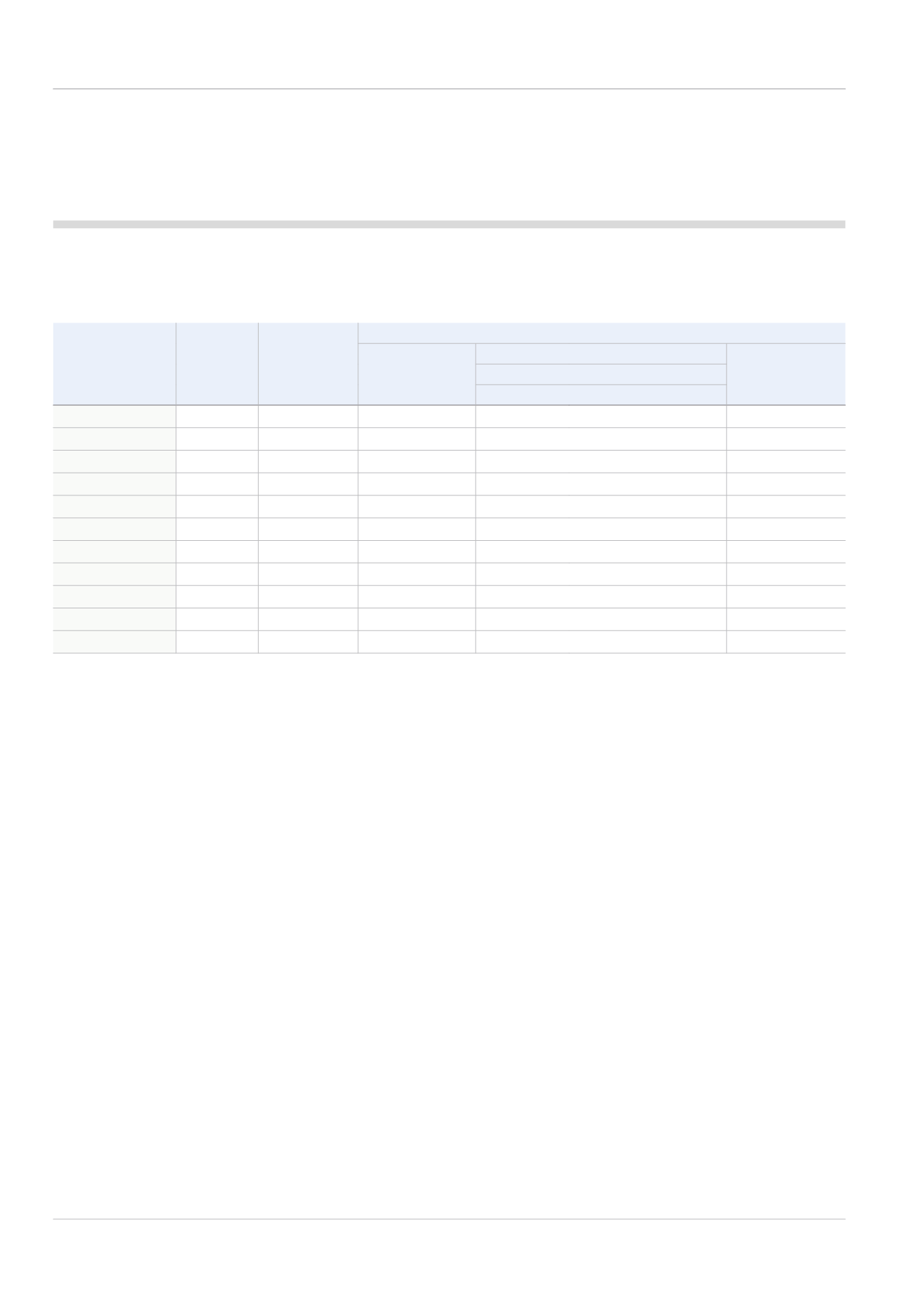

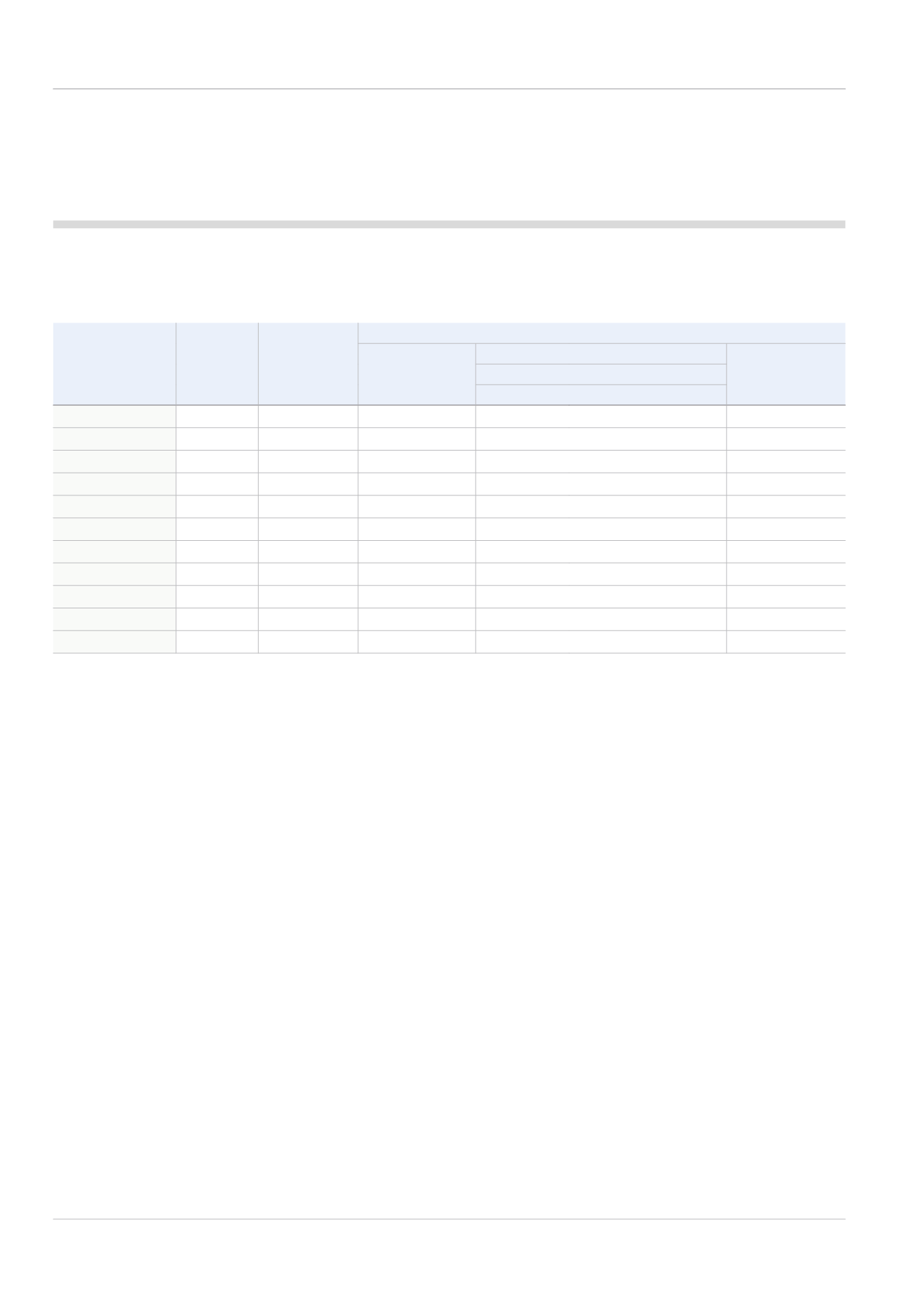

Directors’ shareholdings and achievement of share ownership guidelines (audited)

The following table summarises the share interests of any director who served during the year as at 31 December 2014 or at the date

of retirement from the Board.

1

Share interests as at 8 May 2014.

2

During the period 31 December 2014 to 26 February 2015 there were no changes

in the interests of any current director from those shown save for purchases within

the IMI All Employee Share Ownership Plan on 13 January 2015 of 10 shares on

behalf of M W Selway, and 11 shares on behalf of each of R M Twite and D M Hurt

at 1210p per share and 10 February 2015 of 9 shares on behalf of each of M W

Selway, D M Hurt and R M Twite at 1377p per share.

From 2015, the Committee requires Mark Selway to build up

a shareholding of at least 250% of salary, 200% of salary in

the case of Roy Twite and 150% of salary for Daniel Shook,

to mirror the IMI Incentive Plan Award. At the end of the year

Douglas Hurt and Roy Twite significantly exceeded the share

ownership guideline and Mark Selway, who was appointed on

1 October 2013, made progress towards his guideline through

direct market purchase of shares and the full deferral of his

2013 annual bonus.

Application of the Directors’ Remuneration Policy in 2014

Daniel Shook’s appointment as Finance Director

The details of Daniel Shook’s remuneration were agreed by

the Committee in accordance with the remuneration policy

approved on 8 May 2014. In summary Daniel has been

appointed on a salary of £400,000 from 1 January 2015.

His pension allowance is worth 20% of salary and he will

participate in the standard benefits offered to executives.

His bonus opportunity will be 125% of salary and he will be

eligible for an annual award under the IMI Incentive Plan worth

150% of salary. In accordance with his relocation to the UK, the

Committee has agreed to reimburse expenses up to £75,000.

No other payments or awards were made or promised.

Douglas Hurt’s retirement arrangements

As previously announced, Douglas Hurt notified the Board in

September 2014 of his intention to retire. It was agreed that

Douglas would remain as a director until the 2015 AGM, at

which point he will step down as a director and retire.

In line with his contractual rights, the Committee has approved

and agreed the following terms and payments which will be fully

disclosed in next year’s single figure table:

• Payment of salary (frozen at £430,000), contractual benefits

and pension allowance until cessation of employment;

• Eligible for pro-rata annual bonus in respect of the time

served as a director in 2015, payable at the usual time

around March 2016;

• Under the terms of the plan rules, the Committee has pro-

rated the outstanding 2013 and 2014 share awards under

both the Share Matching Plan and Performance Share Plan

to 7 May 2015. Performance will be measured and applied

in the normal manner to determine vesting, with the shares

released on the normal vesting date for each award;

• No participation in the IMI Incentive Scheme (‘IIP’) for 2015;

and

• Pension benefits are being provided as described elsewhere

in this Report, on the basis of service up to the date of

retirement. The exact sums will be disclosed in an appropriate

manner when they are known.

Director

Total

interests

Beneficial

interests

Scheme interests

With performance

conditions

Nil-cost options

All-employee

share plans

2

With performance conditions

Unvested Vested but unexercised

M W Selway

214,831

8,739

205,927

205,927

-

165

D M Hurt

1,021,393

184,421

832,410

413,879

418,531

4,562

R M Twite

637,357

111,410

520,070

389,398

130,672

5,877

M J Lamb

1

1,487,537

103,973

1,377,965

636,762

741,203

5,599

R Quarta

6,195

6,195

-

-

-

-

P Bentley

7,000

7,000

-

-

-

-

C-P Forster

2,625

2,625

-

-

-

-

A M Frew

6,562

6,562

-

-

-

-

B Nørgaard

2,625

2,625

-

-

-

-

R J Stack

13,125

13,125

-

-

-

-

R McInnes

-

-

-

-

-

-

Directors’ Remuneration Report (cont’d)

78

IMI plc