87

Annual Report and Accounts 2014

For the year ended 31 December 2014

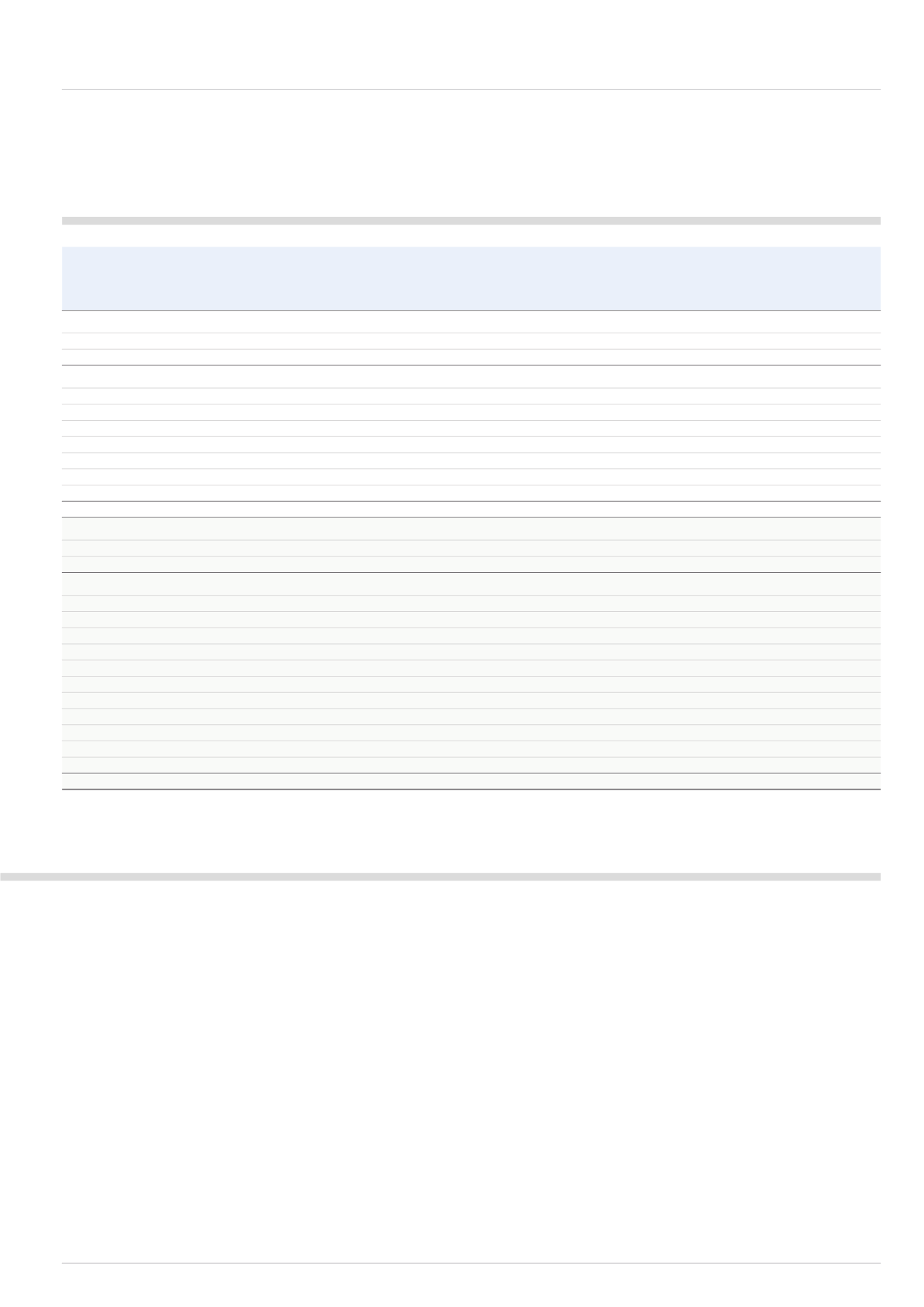

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share

Capital

Total

Non-

Share

premium redemption

Hedging Translation

Retained

parent

controlling

Total

capital

account

reserve

reserve

reserve

earnings

equity

interests

equity

£m

£m

£m

£m

£m

£m

£m

£m

£m

As at 1 January 2013

85.2

170.3

7.9

5.1

32.6

334.4

635.5

48.0

683.5

Profit for the year

223.9

223.9

3.1

227.0

Other comprehensive income/(expense)

13.9

(15.9)

19.8

17.8

17.8

Total comprehensive income/(expense)

13.9

(15.9)

243.7

241.7

3.1

244.8

Issue of share capital

0.1

1.5

1.6

1.6

Dividends paid

(106.2)

(106.2)

(0.1)

(106.3)

Share-based payments (net of tax)

16.8

16.8

16.8

Shares acquired for:

employee share scheme trust

(24.2)

(24.2)

(24.2)

share buyback programme

(164.3)

(164.3)

(164.3)

Income earned by partnership

(4.4)

(4.4)

As at 31 December 2013

85.3

171.8

7.9

19.0

16.7

300.2

600.9

46.6

647.5

Changes in equity in 2014

Profit for the year

668.5

668.5

2.8

671.3

Other comprehensive income/(expense)

(8.3)

(17.1)

8.5

(16.9)

(16.9)

Total comprehensive income/(expense)

(8.3)

(17.1)

677.0

651.6

2.8

654.4

Issue of share capital

0.1

1.8

1.9

1.9

Issue of ‘B’ shares - capital option

151.9

(151.9)

-

-

Issue of ‘C’ shares - income option

10.9

(10.9)

-

-

Redemption of ‘B’ and ‘C’ shares

(162.8)

162.8

(162.8)

(162.8)

(162.8)

Cancellation of treasury shares

(3.7)

3.7

-

-

Dividends paid on ‘C’ shares

(457.5)

(457.5)

(457.5)

Dividends paid

(97.3)

(97.3)

(0.2)

(97.5)

Share-based payments (net of tax)

3.2

3.2

3.2

Shares acquired for:

employee share scheme trust

(30.7)

(30.7)

(30.7)

Income earned by partnership

(4.4)

(4.4)

As at 31 December 2014

81.7

10.8

174.4

10.7

(0.4)

232.1

509.3

44.8

554.1

Movements in available-for-sale assets, which are principally used to fund defined

benefit obligations in the US, are also recorded in other comprehensive income

and amounted to a gain of £1m (2013: nil) including the related taxation effect.

Actuarial movements in the Group’s defined benefit pension obligations are also

recorded in other comprehensive income. These movements are explained in

detail in section 4.5 on page 123. Together with the taxation effect, the gain

in the year was £14m (2013: gain of £20m). A deferred taxation asset of £7m

was reversed in relation to the Group’s restructure of the UK Pension Fund.

Items recognised directly in equity

Movements in reserves which represent transactions with the shareholders of the

Group are recognised directly in equity rather than in the income statement or

through other comprehensive income.

0.4m (2013: 0.3m) shares were issued during the year, realising £2m (2013: £2m)

in the share capital and share premium account.

The 2013 final dividend of 22.5p (2013: 20.7p) per share and the 2014 interim

dividend of 13.6p (2013: 12.8p) per share were paid during the year, which

reduced equity by £97m (2013: £106m).

Effect of the return of cash on shareholders’ equity

The B and C Share Scheme was accompanied by a share consolidation, which

is a commonly used arrangement to ensure that the Group’s share price after

the return of capital is broadly equivalent to the share price prior to the return of

capital, which ensures that targets and prices in the Group’s various share-based

remuneration schemes remain appropriate. The costs of the interim dividend,

final dividend and dividend cover have therefore been calculated on the number

of shares held on the record date, on a post-consolidation basis. The return of

cash resulted in a reduction in retained earnings of £620m.

The credit for share-based payments, which reverses the amount charged

through the income statement in the year, thereby deferring the reduction in

reserves until such time as the options are exercised, is also recognised here,

which together with its tax credit, amounted to £3m (2013: £17m).

The charge to reserves relating to the purchase of shares by the employee trust

to satisfy share options, net of amounts received from employees representing

the price on exercise for those options was £31m (2013: £24m), refer to section

4.6 for more information.