91

Annual Report and Accounts 2014

COMMENTARY ON THE CONSOLIDATED

CASH FLOW STATEMENT

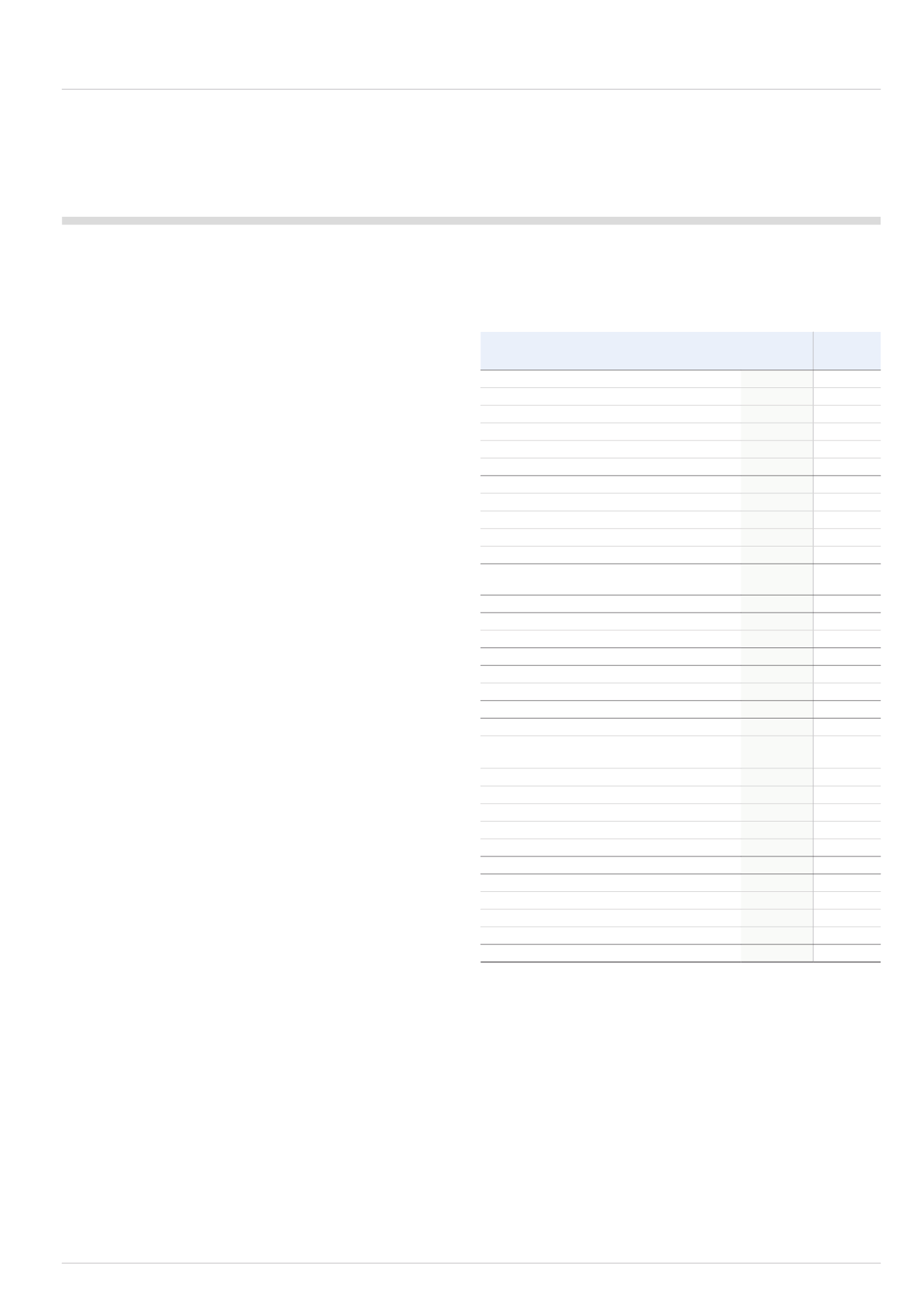

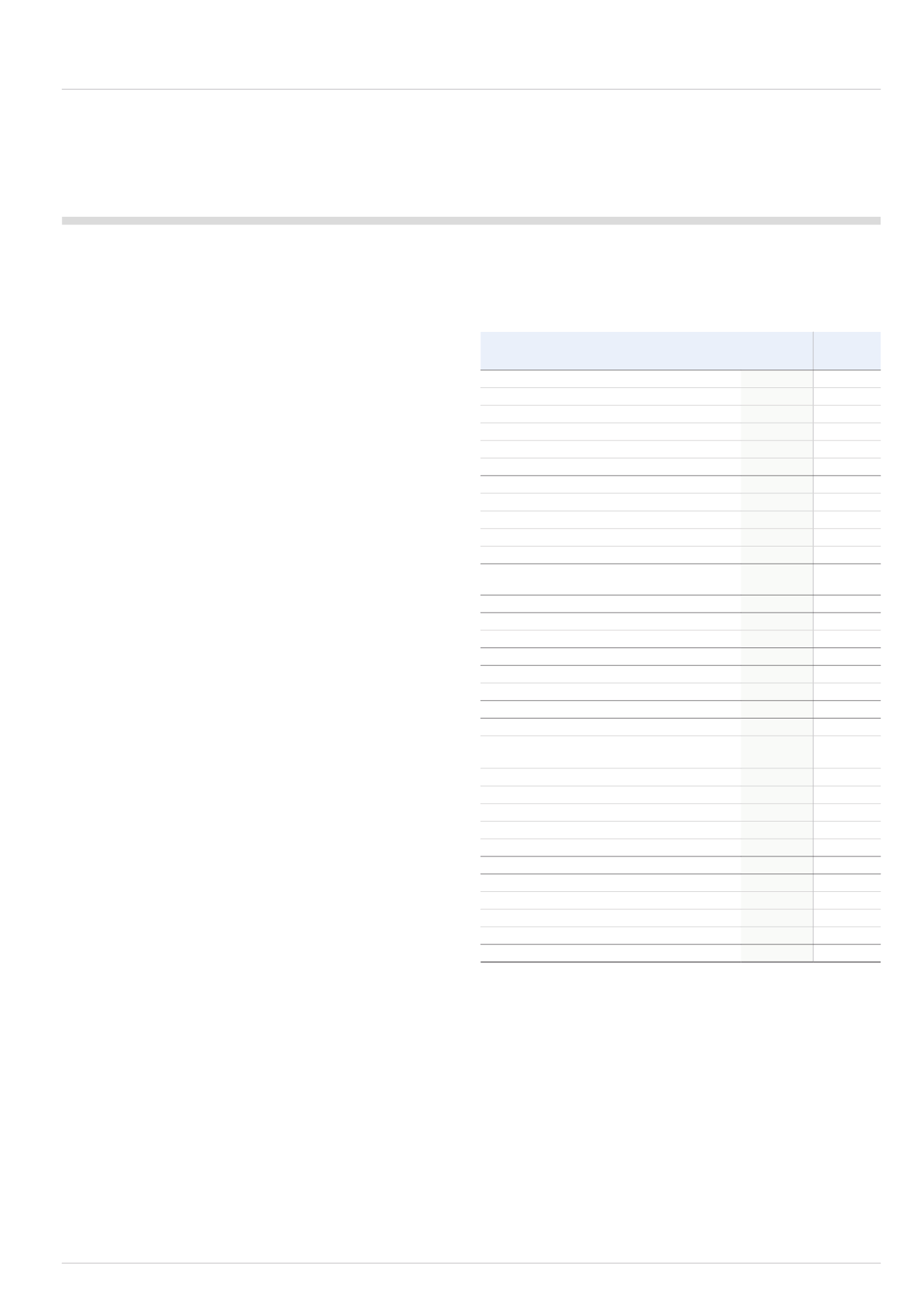

Reconciliation of EBITDA to movement in net debt

The Group’s consolidated statement of cash flows is shown on the opposite

page, which reconciles the operating profit for the year to the change in cash

and overdrafts in the balance sheet as required for financial reporting purposes.

However, because the Group’s debt financing also includes other interest-

bearing liabilities, it is more insightful to consider the effect of the transactions

in the year on the net debt in the balance sheet. Accordingly, a reconciliation

between EBITDA and net debt is shown in the column opposite, upon which

this section provides commentary.

Operating cash flow

The operating cash flow for continuing operations was £205m (2013: £283m).

This represents a conversion rate of total Group segmental operating profit after

restructuring costs of £287m into operating cash flow of 71% (2013: 92%).

Net working capital balances increased by £51m (2013: £26m) during the year.

Payables decreased by £19m (2013: £17m) due to the timing of payments

to suppliers, receivables increased by £38m (2013: £10m) and inventories

decreased by £6m (2013: £1m) as the benefits of lean activities start to

accrue in the business.

Cash spent on property, plant and equipment and other non-acquired

intangibles in the year was £71m (2013: £53m) which was equivalent to

1.9 times (2013: 1.2 times) depreciation and amortisation thereon.

Continuing research and development spend including capitalised intangible

development costs of £6m (2013: £3m) totalled £52m (2013: £53m).

In 2014 the Group paid tax of £67m (2013: £42m) which was 109%

(2013: 64%) of the underlying tax charge for the year. This reflects the timing

of estimated tax payments on account. In addition, there was a £37m cash

inflow (2013: outflow £6m) following the settlement of currency derivatives

hedging the balance sheet.

After payment of interest and tax, the free cash flow generated from operations

was £154m (2013: £285m).

Free cash flow before corporate activity

As noted in the balance sheet commentary, £70m of pension contributions

were made into the UK Pension Funds and a further £17m payment was

also made in Sweden. Free cash flow before corporate activity was £67m

(2013: £250m).

Net cash outflow (excluding debt movements)

Dividends paid to shareholders totalled £98m (2013: £106m) and there was a

cash outflow of £29m (2013: £23m) for net share purchases to satisfy employee

share options. Disposal of subsidiaries resulted in cash inflows of £725m which

were primarily used to fund the return of cash of £620m and the £70m UK

pension contribution.

The total net cash inflow (excluding debt movements) was £41m

(2013: outflow of £56m).

Closing net debt

The opening net debt was £199m (2013: £144m). There were exchange

rate losses of £12m (2013: £3m gains), principally on US dollar-denominated

borrowings. After the net cash inflow in the year of £41m (2013: £56m outflow)

and cash disposed of £29m closing net debt was £200m (2013: £199m).

Movement in Net Debt

2014

£m

2013

£m

EBITDA* from continuing operations

370.9

331.5

Working capital movements

(50.8)

(16.5)

Capital and development expenditure

(70.8)

(45.0)

Gain on disposal of subsidiaries

(34.2)

-

Gain on special pension events

(7.0)

-

Other

(3.0)

13.0

Operating cash flow from continuing operations

205.1

283.0

EBITDA from discontinued operations

1.0

79.6

Working capital movements

-

(9.1)

Capital and development expenditure

-

(8.4)

Other

(7.6)

(0.2)

Operating cash flow from

discontinued operations

(6.6)

61.9

Operating cash flow**

198.5

344.9

Tax paid

(67.2)

(41.7)

Interest/derivatives

22.2

(18.2)

Operating cash flow after interest and tax

153.5

285.0

Additional pension scheme funding - UK

(70.0)

(33.6)

Additional pension scheme funding - overseas

(17.0)

(1.7)

Free cash flow before corporate activity

66.5

249.7

Acquisitions

-

(7.8)

Dividends paid to equity shareholders

and non-controlling interest

(97.5)

(106.3)

Return of cash

(620.3)

-

Disposal of subsidiaries

725.3

-

Payment to non-controlling interest

(4.4)

(4.4)

Share buyback programme

-

(164.3)

Net purchase of own shares

(28.8)

(22.6)

Net cash flow (excluding debt movements)

40.8

(55.7)

Opening net debt

(199.4)

(143.8)

Net cash disposed

(29.0)

-

Debt acquired

-

(2.5)

Foreign exchange translation

(12.4)

2.6

Closing net debt

(200.0)

(199.4)

* Earnings before interest (£24m), tax (£53m), depreciation (£33m), amortisation

(£25m) and impairment (£44m).

** Operating cash flow is the cash generated from the operations shown in

the consolidated statement of cash flows less cash spent acquiring property,

plant and equipment, other non-acquired intangible assets and investments;

plus cash received from the sale of property, plant and equipment and the

sale of investments.