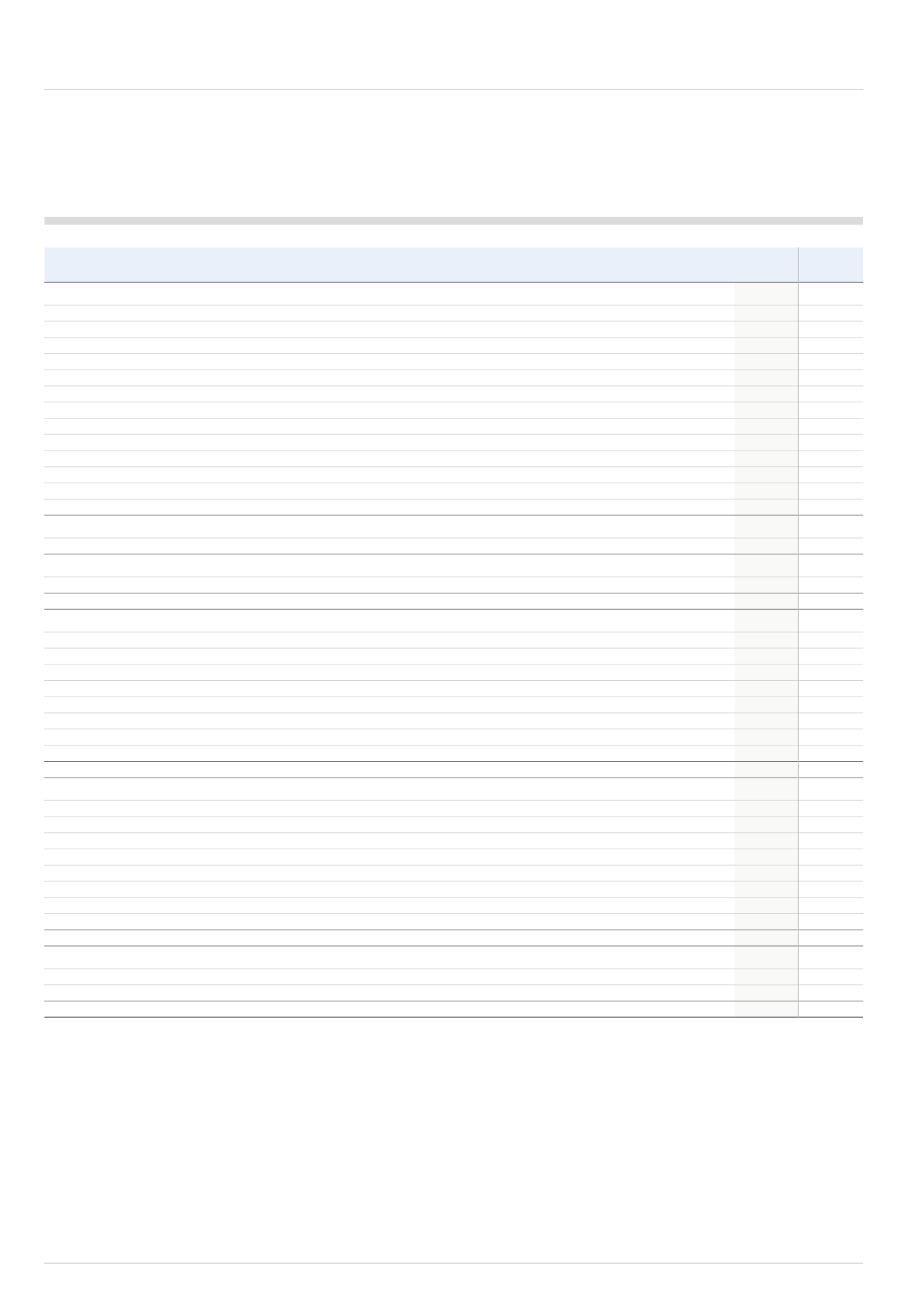

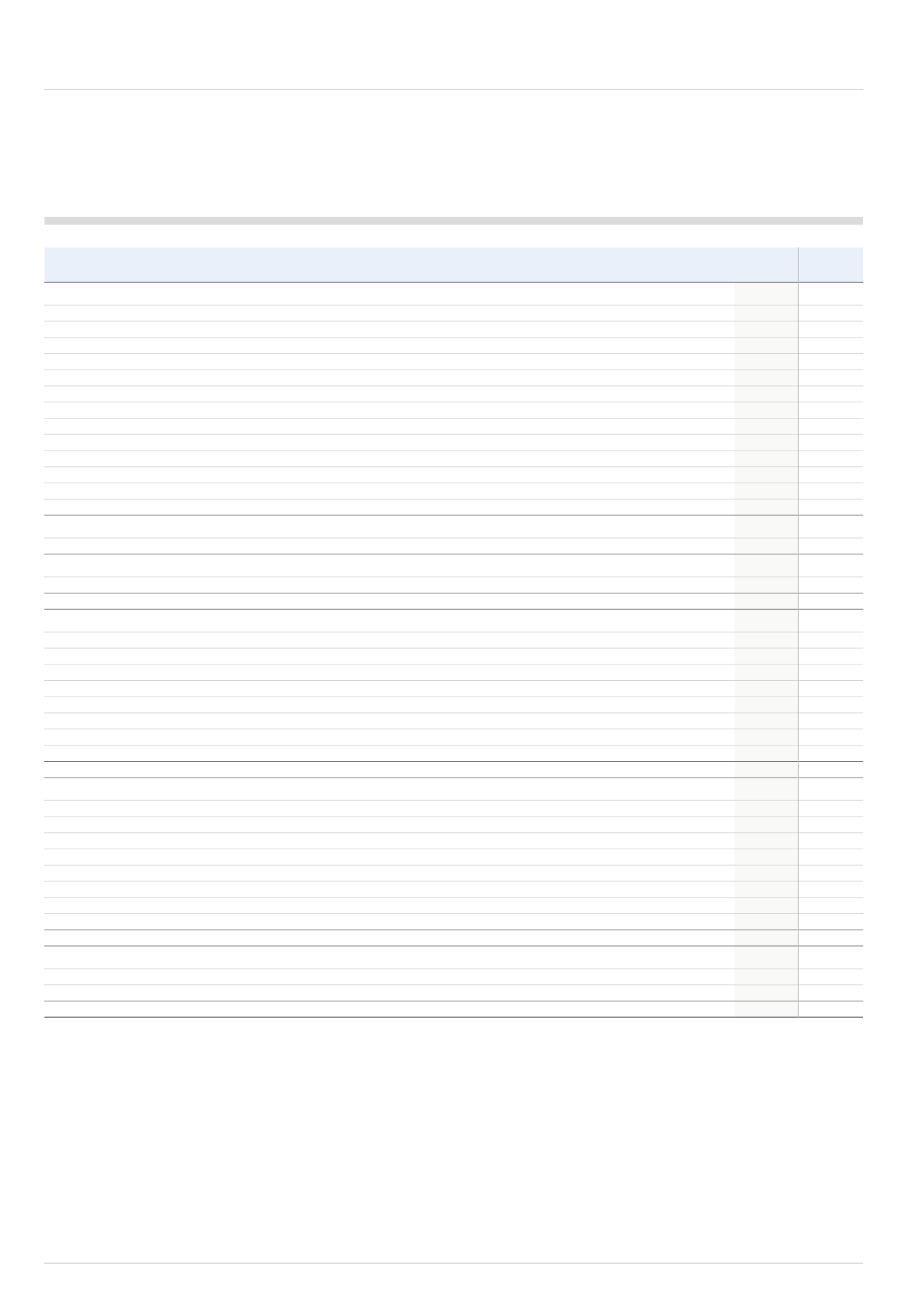

90

IMI plc

2014

2013

£m

£m

Cash flows from operating activities

Operating profit for the year from continuing operations

269.8

270.5

Operating profit for the year from discontinued operations

1.0

73.0

Adjustments for:

Depreciation and amortisation

57.6

66.3

Impairment of property, plant and equipment and intangible assets

43.5

1.3

Gain on disposal of subsidiaries

(34.2)

-

Gain on special pension events

(7.0)

-

Loss on sale of property, plant and equipment

1.2

0.8

Equity-settled share-based payment expense

4.4

11.2

Decrease in inventories

5.8

1.4

Increase in trade and other receivables

(37.7)

(10.0)

Decrease in trade and other payables

(18.9)

(17.0)

Decrease in provisions and employee benefits

(13.7)

(1.2)

Cash generated from the operations

271.8

396.3

Income taxes paid

(67.2)

(41.7)

Cash generated from the operations after tax

204.6

354.6

Additional pension scheme funding - UK and overseas

(87.0)

(35.3)

Net cash from operating activities

117.6

319.3

Cash flows from investing activities

Interest received

1.1

4.4

Proceeds from sale of property, plant and equipment

1.1

2.3

Purchase of investments

(3.6)

(0.3)

Settlement of transactional derivatives

(0.2)

3.8

Settlement of currency derivatives hedging balance sheet

36.7

(6.0)

Acquisitions of controlling interests

-

(7.8)

Acquisition of property, plant and equipment and non-acquired intangibles

(70.8)

(53.4)

Proceeds from disposal of subsidiaries net of cash

696.3

-

Net cash from investing activities

660.6

(57.0)

Cash flows from financing activities

Interest paid

(15.4)

(20.4)

Payment to non-controlling interest

(4.4)

(4.4)

Shares acquired for employee share scheme trust

(30.7)

(24.2)

Share buyback programme including acquisition expenses

-

(164.3)

Proceeds from the issue of share capital for employee share schemes

1.9

1.6

Net (repayment)/drawdown of borrowings

(80.7)

51.0

Dividends paid to equity shareholders and non-controlling interest

(97.5)

(106.3)

Return of cash to equity shareholders

(620.3)

-

Net cash from financing activities

(847.1)

(267.0)

Net decrease in cash and cash equivalents

(68.9)

(4.7)

Cash and cash equivalents at the start of the year

90.3

96.5

Effect of exchange rate fluctuations on cash held

(0.6)

(1.5)

Cash and cash equivalents at the end of the year*

20.8

90.3

* Net of bank overdrafts of £23.0m (2013: £9.6m). Cash and cash equivalents at 31 December 2013 includes £28.7m of cash and £1.7m of overdrafts in respect of

assets and liabilities held for sale.

Notes to the cash flow appear in section 4.1.

For the year ended 31 December 2014

CONSOLIDATED STATEMENT OF CASH FLOWS