96

IMI plc

The following table shows a geographical analysis of the location of the Group’s property, plant and equipment and intangible assets (‘PPE&IA’) and assets held

for sale (‘AHFS’).

Total

PPE&IA

AHFS

Total

2014

2013

2013

2013

£m

£m

£m

£m

UK

77.0

69.7

41.9

111.6

Germany

130.9

147.0

3.3

150.3

Rest of Europe

208.2

254.1

1.0

255.1

USA

123.6

114.2

89.3

203.5

Asia Pacific

35.4

32.4

3.2

35.6

Rest of World

19.1

35.9

0.5

36.4

Total

594.2

653.3

139.2

792.5

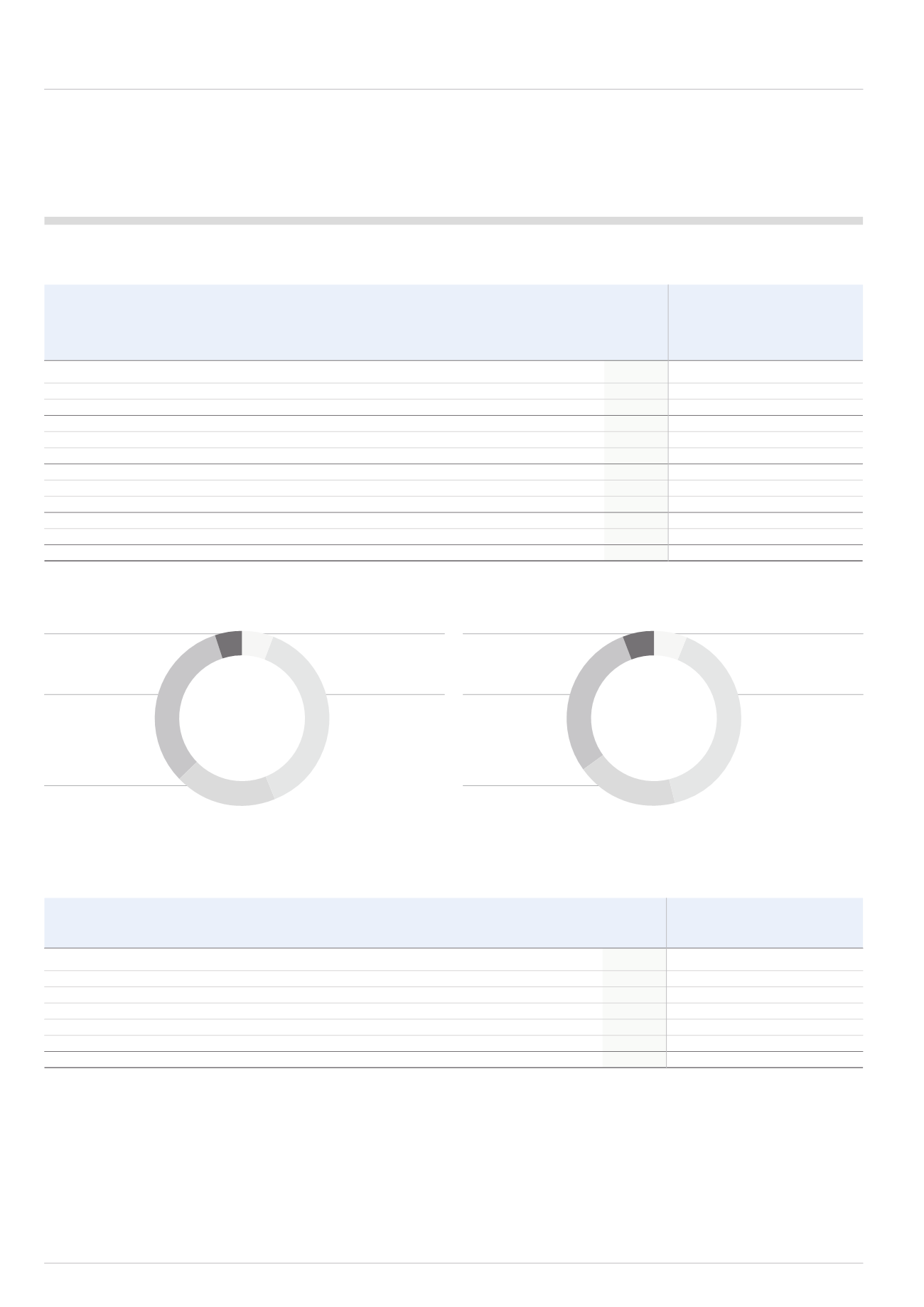

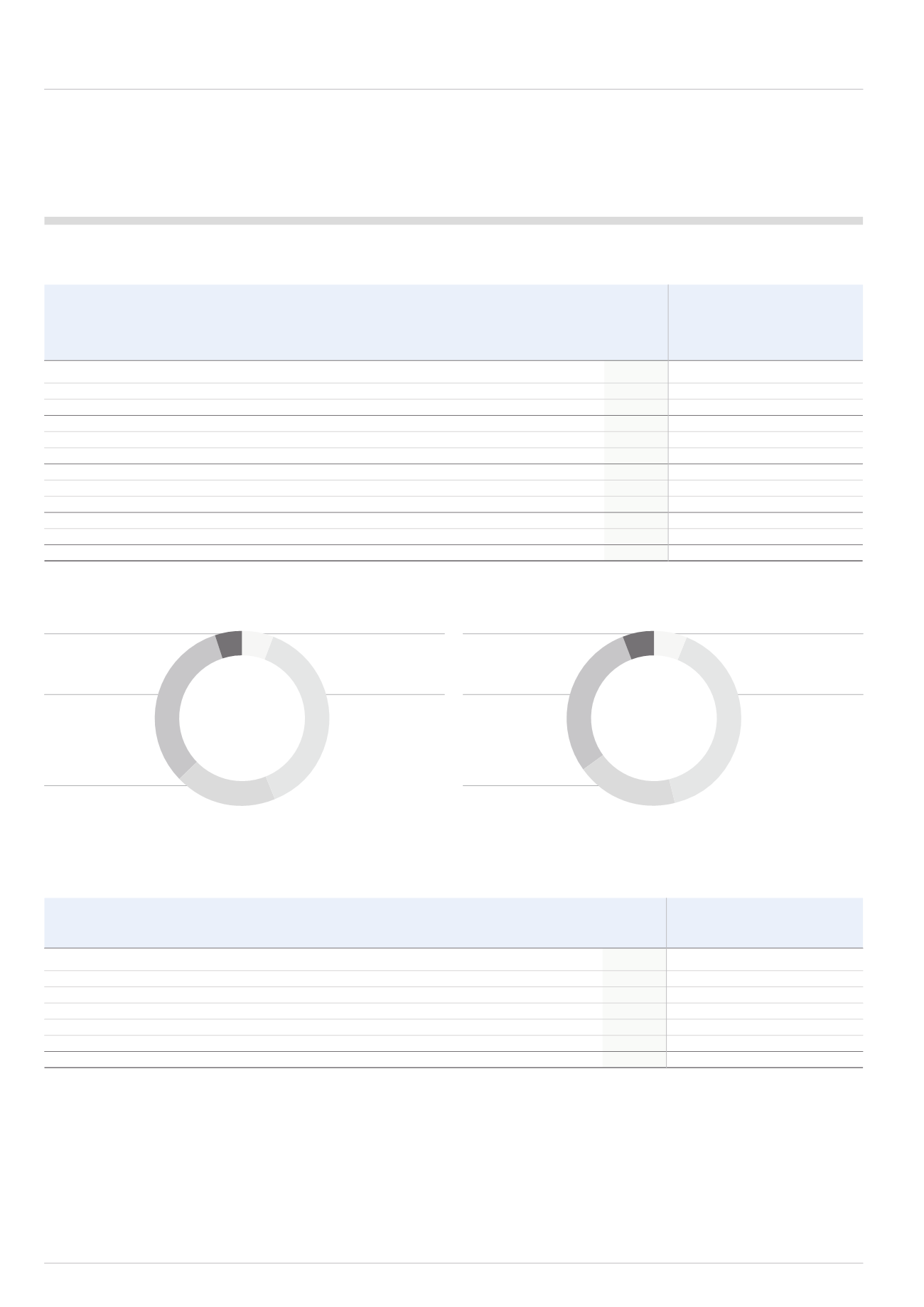

Continuing revenue by destination (2013)

Continuing revenue by destination (2014)

SECTION 2 – RESULTS FOR THE YEAR

Continued

Emerging

Markets

32%

Emerging

Markets

29%

North America

19%

Western Europe

38%

Rest of the

World

5%

Rest of the

World

6%

UK

6%

UK

6%

North America

19%

Western Europe

40%

The following table shows a geographical analysis of how the Group’s revenue is derived by destination.

Continuing

Continuing

Segmental

Segmental

Discontinued

Revenue

Revenue Operations

Total

2014

2013

2013

2013

£m

£m

£m

£m

UK

98

104

38

142

Germany

235

247

23

270

Other Western Europe

409

439

30

469

Western Europe

644

686

53

739

USA

300

314

346

660

Canada

18

24

7

31

North America

318

338

353

691

Emerging Markets

544

504

60

564

Rest of World

82

112

7

119

Total segmental revenue

1,686

1,744

511

2,255

Reversal of economic hedge contract losses/(gains)

6

(1)

-

(1)

Total

1,692

1,743

511

2,254