94

IMI plc

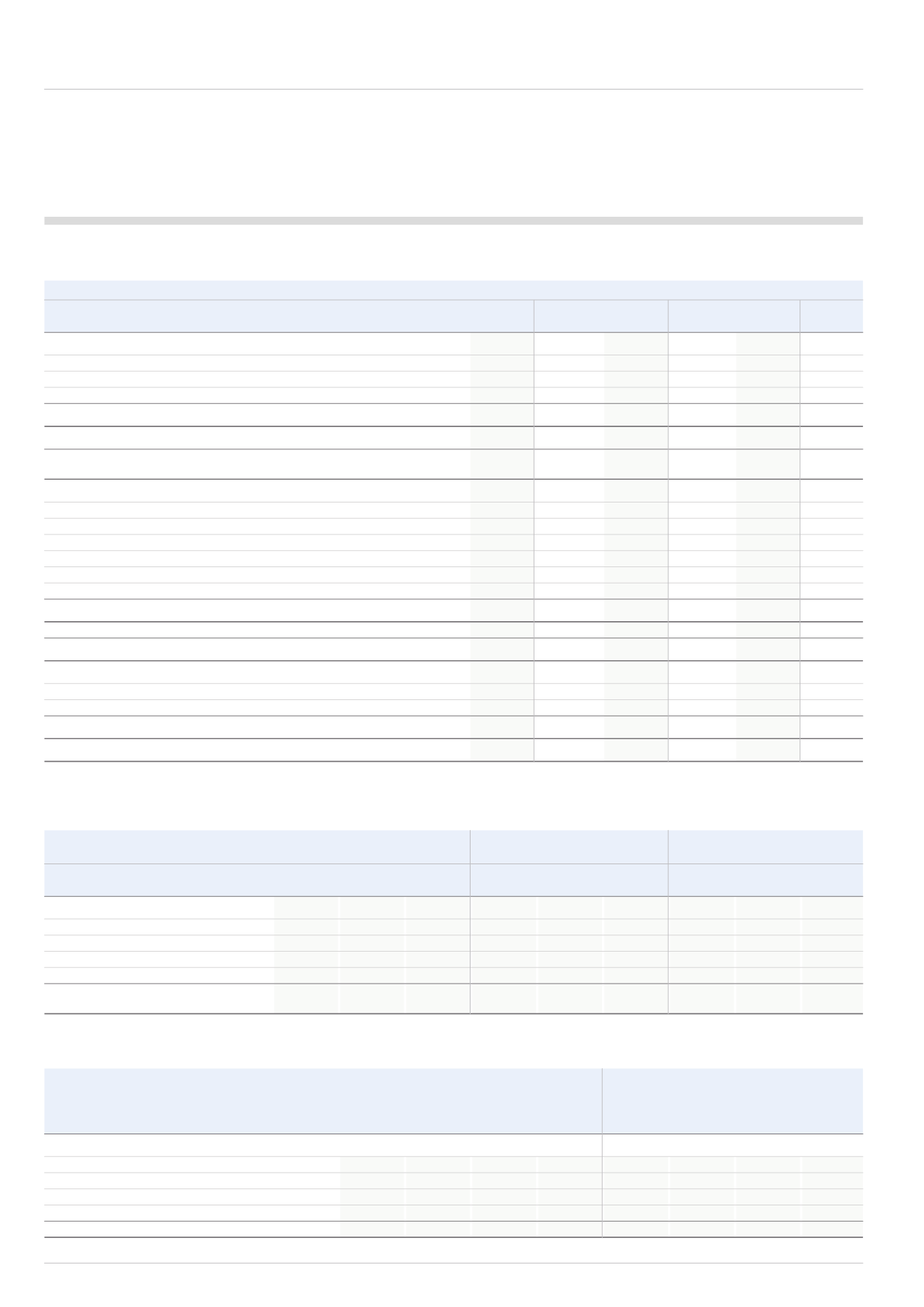

The following table illustrates how the results for the segments reconcile to the overall results reported in the income statement.

Revenue

Operating profit

Operating margin

2014

2013

2014

2013

2014

2013

£m

£m

£m

£m

%

%

Continuing operations

IMI Critical Engineering

692

716

119.8

116.8

17.3%

16.3%

IMI Precision Engineering

710

723

126.4

140.5

17.8%

19.4%

IMI Hydronic Engineering

284

305

51.9

64.3

18.3%

21.1%

Total continuing segmental revenue/operating profit/operating margin

1,686

1,744

298.1

321.6

17.7%

18.4%

Restructuring costs (non-exceptional)

(2.6)

-

Total segmental revenue/operating profit/operating margin after

non-exceptional restructuring

1,686

1,744

295.5

321.6

17.5%

18.4%

Reversal of net economic hedge contract losses/(gains)

6

(1)

3.9

(5.1)

Restructuring costs (exceptional)

(8.6)

(14.2)

Gains on special pension events

7.0

-

Impairment losses

(40.8)

-

Acquired intangible amortisation

(19.6)

(21.9)

Gains on disposal of subsidiaries

34.2

-

Acquisition and disposal costs

(1.8)

(9.9)

Total revenue/operating profit reported

1,692

1,743

269.8

270.5

Net financial expense

(24.1)

(21.2)

Profit before tax from continuing operations

245.7

249.3

Retail Dispense - discontinued operations

Beverage Dispense

-

337

-

51.2

-

15.2%

Merchandising

-

174

-

29.8

-

17.1%

Discontinued segmental revenue/operating profit

-

511

-

81.0

-

15.9%

Total Group revenue/operating profit

1,686

2,255

298.1

402.6

17.7%

17.9%

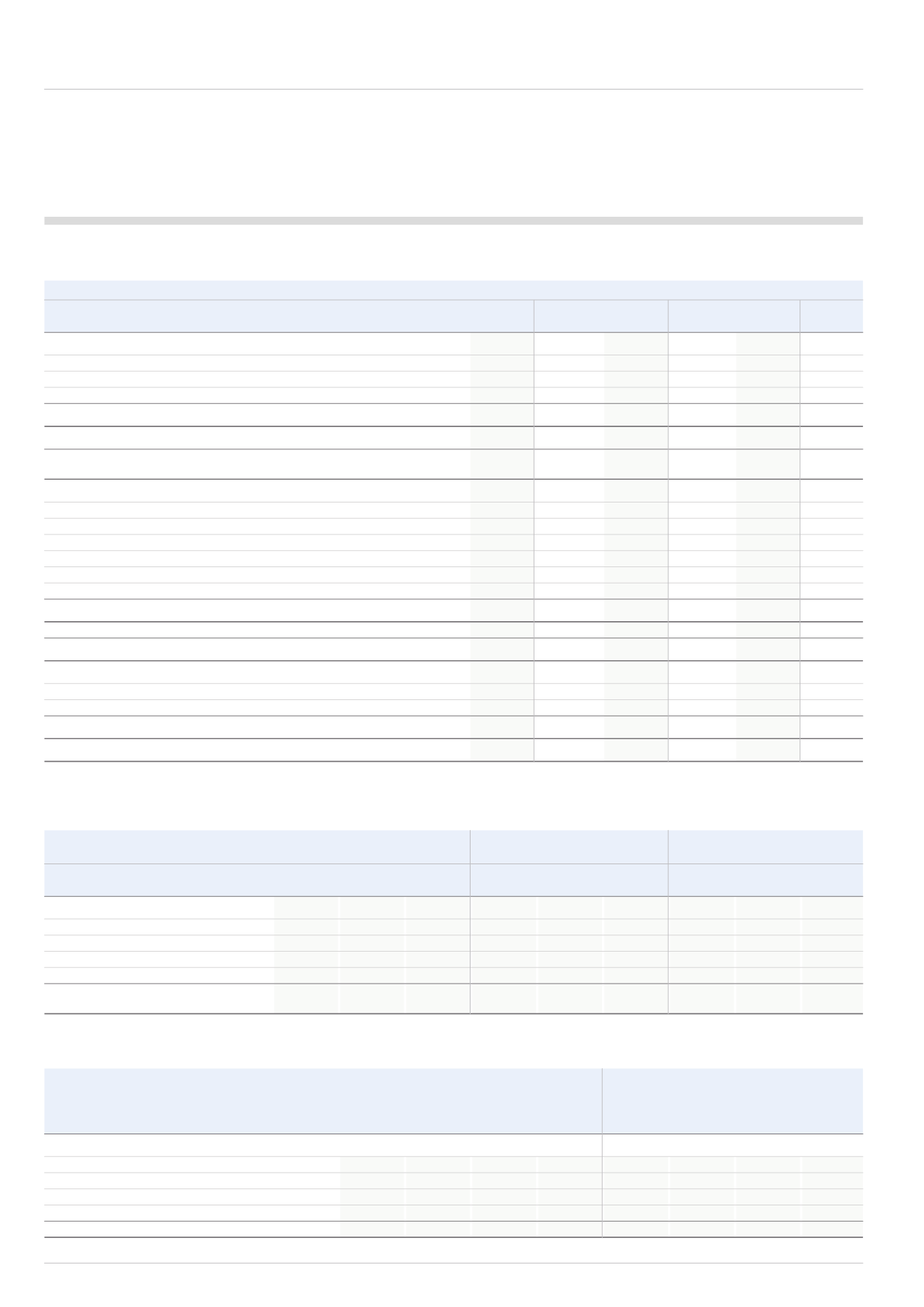

As explained on the previous page, the following table illustrates how the Group’s 2014 segmental reporting would be presented on the new basis to be used

for our 2015 reporting.

Revenue

Operating profit

Operating margin

2014

2014

2014

First half Second half

Total

First half Second half

Total

First half Second half

Total

£m

£m

£m

£m

£m

£m

%

%

%

Continuing operations

IMI Critical Engineering

315

377

692

56.1

75.3

131.4

17.8% 20.0% 19.0%

IMI Precision Engineering

355

355

710

69.4

69.1

138.5

19.5% 19.5% 19.5%

IMI Hydronic Engineering

139

145

284

25.8

31.0

56.8

18.6% 21.4% 20.0%

Corporate Costs

(14.1)

(14.5)

(28.6)

Total continuing segmental revenue/

operating profit/ operating margin

809

877

1,686

137.2

160.9

298.1

17.0% 18.3% 17.7%

The following table illustrates how revenue and operating profit have been impacted by movements in foreign exchange, acquisitions and disposals.

Revenue

Operating profit

IMI Critical

IMI Precision IMI Hydronic

IMI Critical

IMI Precision IMI Hydronic

Engineering Engineering Engineering

Total

Engineering Engineering Engineering

Total

£m

£m

£m

£m

£m

£m

£m

£m

31 December 2013

716

723

305

1,744

116.8

140.5

64.3

321.6

Organic growth

16

25

(2)

39

10.6

(3.8)

(9.1)

(2.3)

Movement in foreign exchange

(37)

(40)

(19)

(96)

(6.9)

(7.6)

(3.3)

(17.8)

Impact of acquisitions and disposals

(3)

2

-

(1)

(0.7)

(2.7)

-

(3.4)

31 December 2014

692

710

284

1,686

119.8

126.4

51.9

298.1

Organic growth %

2% 4% -1% 2% 10% -3% -15% -1%

SECTION 2 – RESULTS FOR THE YEAR

Continued