Strategic report External landscape

Morses Club believes that there will always be a segment of the population that relies on Home Collected Credit (HCC).

Our developing technology platforms and expertise will not only give us the ability to better support our customers and agents, but also enable us to address other segments of the far larger UK non-standard lending market.

Download section PDF

The Non-Standard Consumer Credit Market

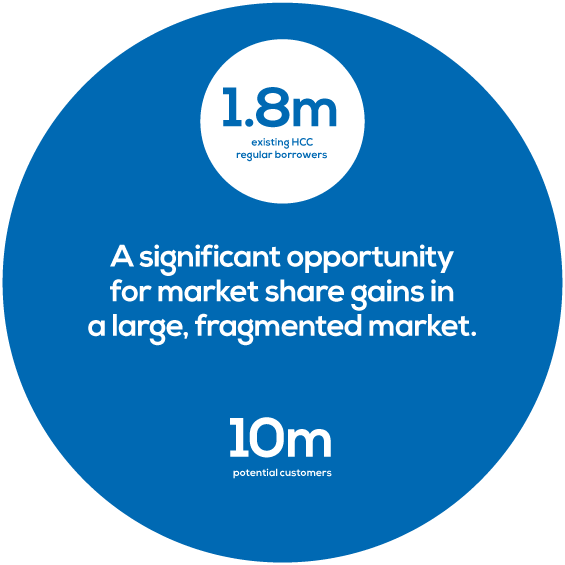

Home Collected Credit (HCC) is part of the wider UK non-standard credit market. This market consists of secured and unsecured lending and is made up of approximately 10 million people.

Non-standard credit is the provision of secured and unsecured credit to consumers other than through mainstream lenders. Lenders providing non-standard credit typically lend on an unsecured basis and the market is characterised by high-frequency borrowing.

HCC is a specialised and well-established segment of the non-standard credit market, with approximately 1.8m people using its services regularly.

HCC customers are generally part of the C2, D and E socio-economic groups. Loans are small and unsecured and typically given in cash; this model is facilitated via self-employed agents. Other forms of non-standard credit, eg instalment loans, do not operate in the same way as HCC and rely on fully-online lending.

Other forms of non-standard credit e.g. instalment loans, do not operate in the same way as HCC and rely on fully-online lending.

Regulatory landscape

Regulatory responsibility for HCC was transferred from the Office of Fair Trading to the Financial Conduct Authority (FCA) in April 2014.

Morses Club operates within a legislative and regulatory framework set out in the Consumer Credit Act 1974 and 2006 along with the FCA’s handbook and associated guidance notes.

Morses Club’s HCC business currently operates on an interim permission from the FCA whilst application for full authorisation is considered. Morses Club has provided all of the requested information to the FCA and is continuing an open dialogue with the FCA regarding full authorisation. Full permission is anticipated during 2017.

Morses Club conducts its business taking account of all relevant legislation, secondary legislation, regulation and practice applicable to UK HCC lenders.

Shelby Finance Limited, trading as Dot Dot Loans, is operating under full authorisation.

Competitor Landscape

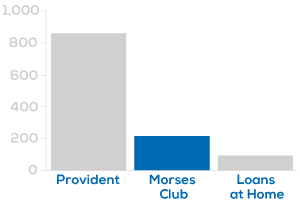

The largest three HCC lenders have an aggregate market share of approximately 65%. Below this level, the market is highly fragmented with multiple small lenders operating at a local level.

Morses Club is currently the second largest HCC lender with c.216,000 customers nationwide.

The number of HCC lenders in the UK has decreased due to tighter rules and regulations. Morses Club has acquired several smaller HCC businesses as a result of this and these acquisitions continue to make up part of our growth strategy in 2017.

Digital Opportunity

We believe that new digital technologies will change the way many traditional HCC lenders interact with their customers. This is already happening through online loan applications, automated credit approval processes and the use of pre-paid cards, like the Morses Club Card, in addition to cash.

We are exploring further enhancements we can make to customer communications and loan management using digital technology and will be looking to create an online customer portal. Our monthly customer satisfaction surveys have shown that there is significant customer interest in this, particularly among the 18-35 customer demographic.

Digital technology and communications are there to underpin and enhance the relationship between agents and customers in the HCC space, not to replace it.

Second Largest Player in the HCC Market

Morses Club is the second largest player in the UK HCC Market with c.216,000 customers. Our customers are based throughout the UK, and we operate using nine regional networks which contain multiple branches. Managers and agents from each branch are relatively local to the areas they serve and are often part of their customer communities.

Our customer numbers have grown by 9% in the last 12 months and due to our robust credit policy, as well as affordability checks and general forbearance, we have increased our level of good quality customers.

Annual Report 2017

Annual Report 2017