Strategic report At a glance

This report covers Morses Club PLC, Shelby Finance Limited (trading as Dot Dot Loans) and Shopacheck Financial Services Limited (together the “Group” and “Morses Club”).

The report gives greater emphasis to matters significant to Morses Club PLC and its subsidiary undertakings when viewed as a whole.

Morses Club PLC receives full FCA authorisation – Read more hereOur vision is to become the UK’s market-leading, non-standard credit company, with our customers at the very heart of our business. As an established, relationship-driven consumer finance provider, we focus on responsible lending and fair, helpful service to meet the needs of customers with complex credit histories throughout the UK.

What We Do

Our customers are usually ineligible for credit from mainstream lenders. By offering small, affordable loans of up to £1,000, either in cash or on a Morses Club Card, we proudly provide our customers with an essential service. The Group is currently in the process of obtaining its full regulatory permissions with the Financial Conduct Authority (FCA) and continues to operate under interim permissions (Please see update below). We operate primarily via a network of self-employed agents from the same communities as their customers. Loans are finalised in person by a Morses Club agent who then collects the repayments each week. These personal connections allow us to know our customers and their needs, developing strong relationships that often endure for many years.

Treating Customers Fairly

We are a responsible lender and our commitment to fair customer treatment is woven throughout our business. In independent satisfaction surveys, over 95% of both employees and agents said they understood the importance of treating customers fairly.

Every time a customer borrows from us, their agent conducts an affordability check with them in person, helping to ensure good customer outcomes. We make our rates clear and never charge missed or late payment fees or interest. Our customer-centric approach to lending helps to keep our customer satisfaction scores consistently high.

Investment Opportunity:

- Experienced executive team

- c.80 years of Home Collected Credit experience

- No. 2 market share, c.216,000 customers across the UK

- Highly invested IT platform, widening product offering and improving infrastructure

- Well placed to capitalise on regulatory-driven market consolidation

- Untapped market potential of c.8m people

- Focus on loan quality

- Cash generative business model that allows for a progressive dividend policy

branch locations

employees

self-employed agents

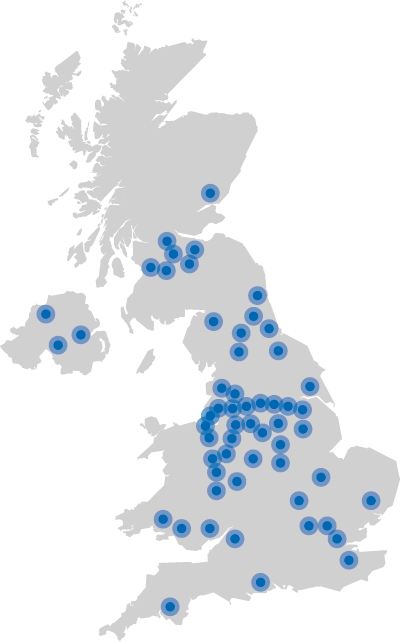

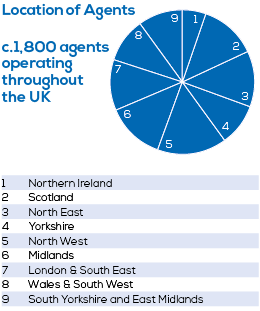

Where We Operate

Morses Club operates through a series of local branches based all over the UK. Our field management team operate from these branches, working with our network of self-employed agents. Our central support centre is based in Birstall, near Leeds.

Annual Report 2017

Annual Report 2017