Strategic report Highlights

Strategic Highlights

-

All agents now using tablets to ensure the highest levels of compliance, quality lending and customer outcomes.

-

Developed a broader range of products with the introduction of cashless lending (Morses Club Card) and online lending (Dot Dot Loans).

-

Developed our core business and supplemented it with 105 new agent territory builds in the year.

-

Completed 7 acquisitions with a gross receivables value of £6.8m with full integration into our core loans platform and credit policy regimes.

Download section PDF

Operational Highlights

-

Customer base grew from 198kto 216k, an increase of 9%.

-

Net receivables grew from £56.8m to £61.2m, an increase of 8%.

-

Achieved year on year sales (credit issued) growth of 18%.

-

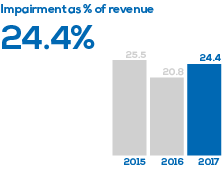

Managed impairment at 24.4% (FY16: 20.8%) – comfortably within our target range of 22.0% to 27.0%.

-

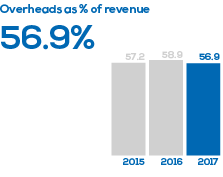

Delivered cost-efficiency improvements, with costs as a percentage of income declining from 58.9% to 56.9%.

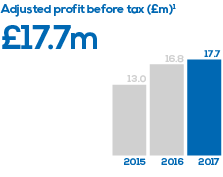

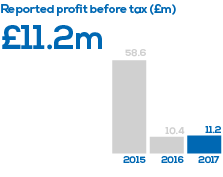

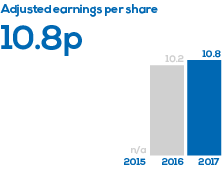

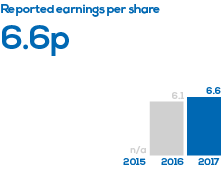

1. A reconciliation between adjusted and reported PBT is provided on the Investment Highlights and KPIs page.

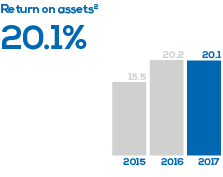

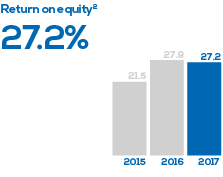

2. Return on assets and return on equity are calculated on adjusted PBT less a national tax rate of 21%.

Annual Report 2017

Annual Report 2017