Strategic reportInvestment Highlights and KPIs

Strategy and Performance

On flotation, we identified a number of investment highlights for investors.

Download section PDFBuilding a Market-leading UK Nonstandard Consumer Finance Company

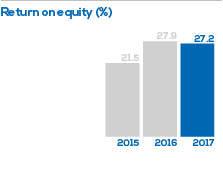

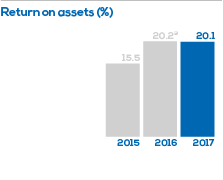

- Long-established UK Home Collected Credit (HCC) market player with strong returns

- Proven track record of KPI-enhancing acquisitions and organic growth

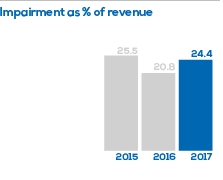

- Prudent credit control and shorter duration loans improve both impairment and profitability

- Consolidation opportunities created by regulatory change

- Initiatives to future-proof the core business

- Highly invested IT platform

- Progressive dividend policy supported by strong cash generation

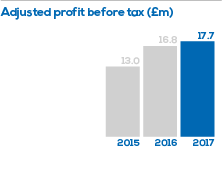

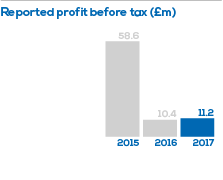

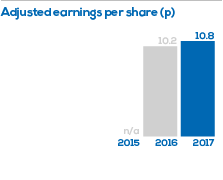

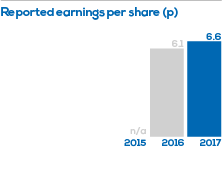

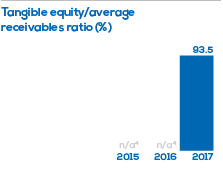

Our KPIs below comprise a set of performance metrics used by management to help gauge the meaningful progress of our business. The set is not exhaustive and management may also consider other measures when assessing performance.

Annual Report 2017

Annual Report 2017