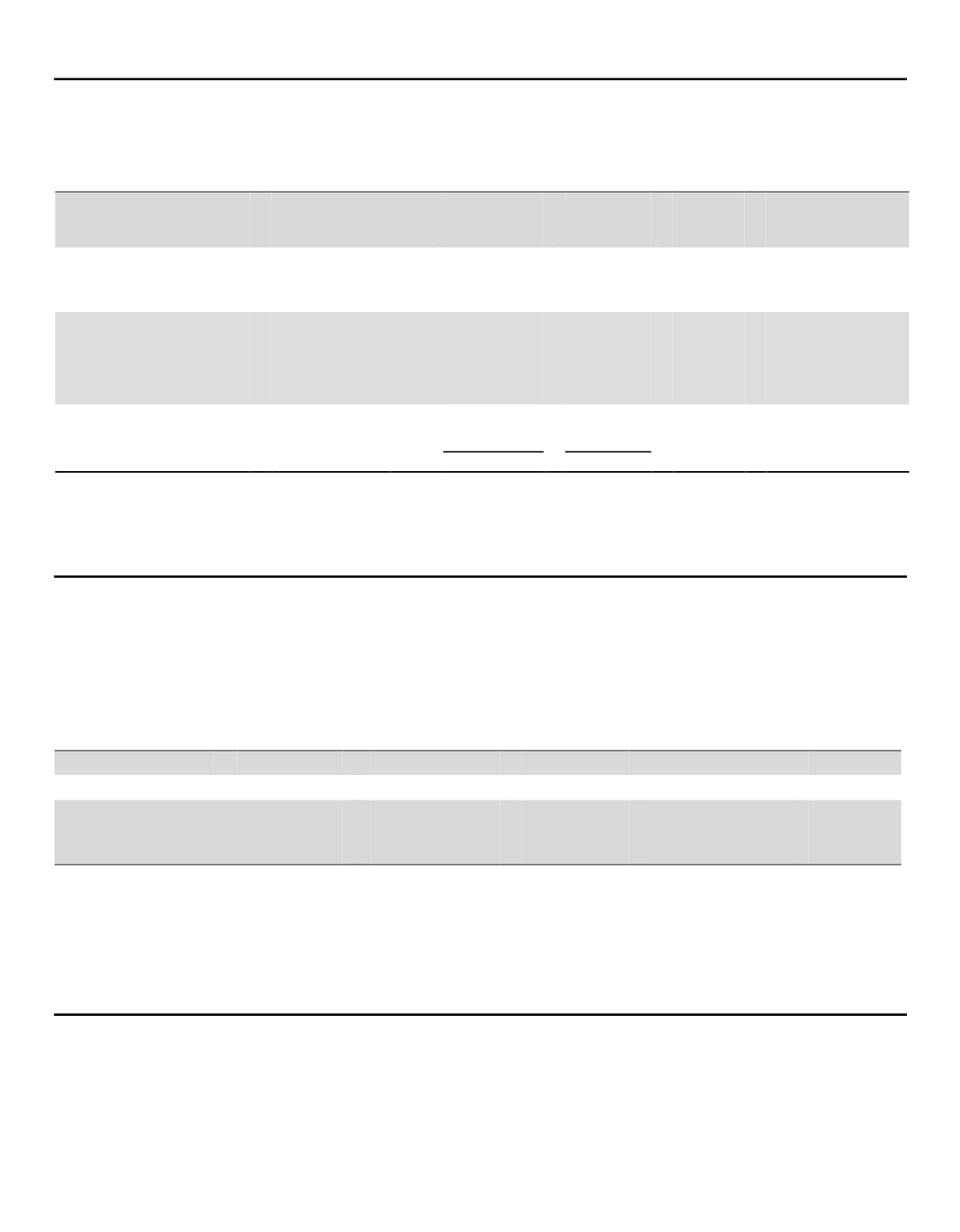

Principal Shareholders

No person, as of February 24, 2016, was the owner of record or, to the knowledge of the Company, beneficial owner of

more than 5% of the outstanding shares of Common Stock or of the available votes of the Company other than as

shown below:

Name and Address

of Beneficial

Owner

Title of Class

Amount of

Beneficial Ownership

Percent

of

Class

Percent of

Available

Votes

Common Stock

Shares

Votes

1 Vote Per Share

21,878,030

21,878,030

5.2

3.1

BlackRock Inc.

(1)

55

East 52

nd

Street

New York, NY 10055

The Vanguard Group

(1)

100 Vanguard Boulevard

Malvern, PA 19355

1 Vote Per Share

26,629,832

26,629,832

6.4

3.8

Norges Bank

(1)

(The Central Bank of Norway)

Bankplassen2

PO Box 1179 Sentrum

NO 0107 Oslo

Norway

1 Vote Per Share

27,149,212

27,149,212

6.5

3.9

Daniel P. Amos

(2)

1932 Wynnton Road

Columbus, GA 31999

10 Votes Per Share

4,662,960

46,629,600

1.2

6.5

1 Vote Per Share

373,289

373,289

5,036,249

47,002,889

(1)

The above information is derived from Schedule 13Gs filed with the Securities and Exchange Commission, dated February 9, 2016 by

BlackRock Inc., dated February 10, 2016 by The Vanguard Group, and dated February 11, 2016 by Norges Bank. According to the Schedule

13G filings, BlackRock Inc., The Vanguard Group, and Norges Bank have sole voting and dispositive power with respect to these shares.

(2)

See footnote (1) on page 2

4

.

Security Ownership of Management

The following table sets forth, as of February 24, 2016, the number of shares and percentage of outstanding shares of

Common Stock beneficially owned by: (i) our named executive officers, comprising our CEO, CFO, and the three other

most highly compensated executive officers as listed in the 2015 Summary Compensation Table (collectively, the

“NEOs”) whose information was not provided under the heading “Election of Directors,” and (ii) all Directors and

executive officers as a group.

Common Stock Beneficially Owned and Approximate Percentage of Class as of February 24, 2016

Name

Shares

(1)

Percent of

Shares

Votes

Percent of

Votes

Frederick J. Crawford

33,095

*

33,095

*

Eric M. Kirsch

93,500

*

93,500

*

All Directors, nominees, and executive

officers as a group

(24 persons)

16,266,532

3.9

149,855,588

20.5

* Percentage not listed if less than .1%.

(1)

Includes options to purchase shares, which are exercisable within 60 days for Eric M. Kirsch of 19,080 and all Directors and executive officers

as a group, 3,147,736. Also includes shares of restricted stock awarded under the 2004 Long-Term Incentive Plan; in 2015 and 2016 for

Frederick J. Crawford of 32,917; in 2014, 2015 and 2016 for Eric M. Kirsch of 50,727; and all Directors and executive officers as a group

900,569 which they have the right to vote, but they may not transfer until the shares have vested. Includes 47,814 shares pledged for all

Director nominees and executive officers as a group. For information on the Company’s pledging policy, please see “Stock Ownership

Guidelines; Hedging and Pledging Restrictions” on page 41.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), executive officers,

Directors, and holders of more than 10% of the Common Stock are required to file reports of their trading in Company

equity securities with the SEC. Mr. Thomas J. Kenny, a Director, did not timely report the receipt of a 10,000 stock

option award on February 10, 2015. A Form 4 for this transaction was filed on February 19, 2015.

Based solely on its review of the copies of such reports received by the Company, or written representations from

certain reporting persons, the Company believes that all other filings required to be made by its reporting persons

complied with all applicable Section 16 filing requirements during the last fiscal year.

26