For each of the performance measures, a target

performance level is established. In addition, a

minimum and maximum level is established. The

payout for a minimum result is one-half of the target

result, while the payout for a maximum result is two

times that of the target result. Typically, the target result

is equidistant between the minimum result and the

maximum result. Interpolation is used to calculate

incentive payouts for results between minimum and

target or target and maximum.

The Compensation Committee considers the probability

of attainment of each of the various measures.

Generally, it is expected that target performance will be

attained 50% to 60% of the time, minimum performance

attained at least 75% of the time, and maximum

performance attained not more than 25% of the time.

During its annual review in February, the Compensation

Committee reviews and approves or, if deemed

appropriate, modifies the annual incentive goals for that

year.

Importance of neutralizing foreign currency effects:

Since 1991, the Company has communicated external

earnings guidance that excludes foreign currency

effects because

of the importance of our Japanese

business

to our results and the fact that currency

changes are largely outside of management’s control.

However, reported earnings do reflect the impact of

foreign currency.

The reason the MIP objectives are set on a currency

neutral basis is that the Compensation Committee

strongly believes that in a period of yen strengthening,

which was experienced as recently as 2008 through

2012, the Company’s management should not be

rewarded with MIP payments that benefit from reported

results that were enhanced by currency changes.

Similarly, the Company’s management should not be

penalized in periods of yen weakening as has been

experienced in the last several years.

In addition to currency neutrality, the business

environment in which the Company operates is taken

into consideration when setting MIP objectives for each

metric, which resulted in lower targets for pretax

operating earnings in Japan. The MIP goals were then

approved by the Compensation Committee in February

2015.

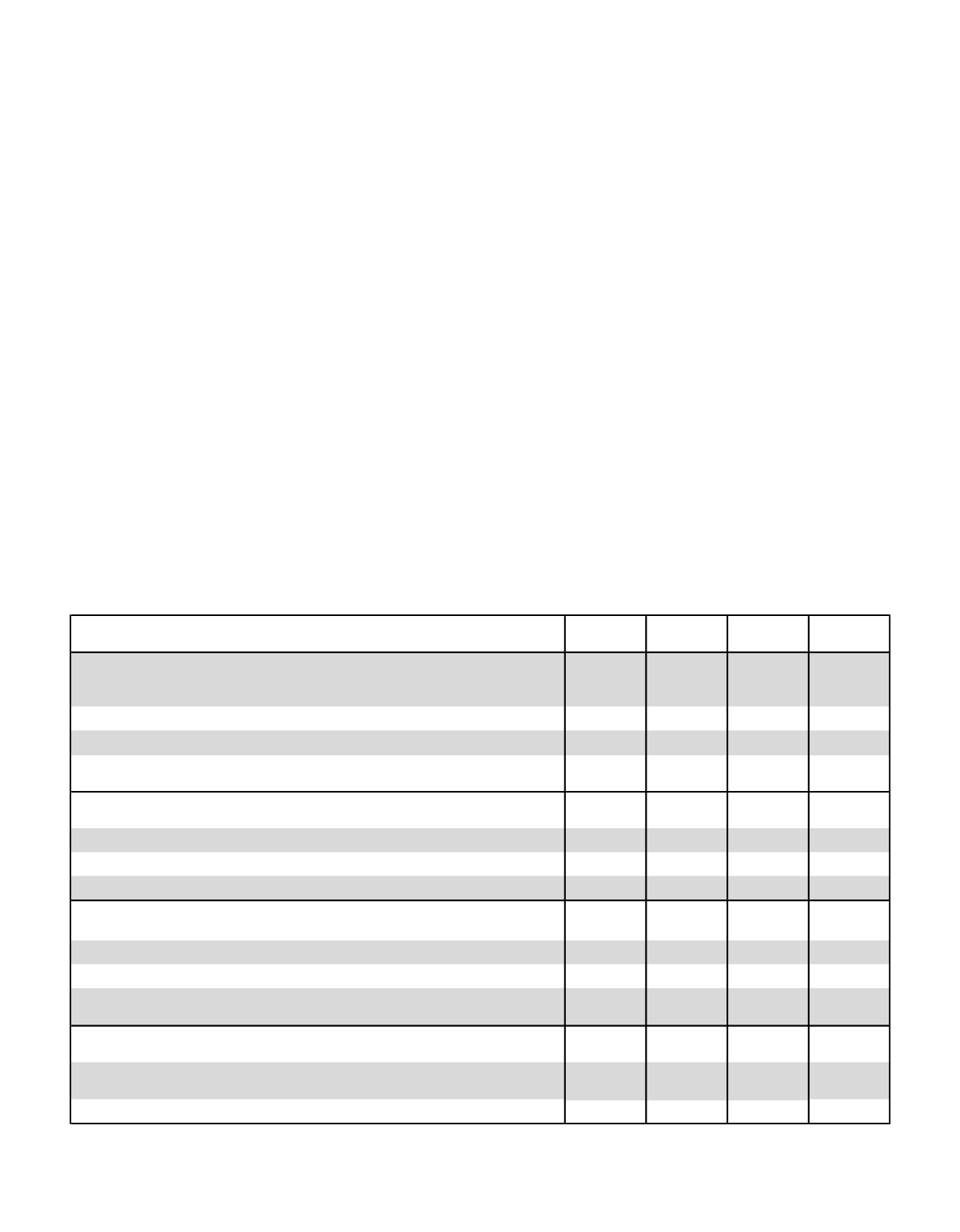

2015 MIP Targets and Actual Performance:

The following descriptions of the corporate and

business segment metrics and objectives for 2015 MIP

apply to the NEOs.

Corporate Metrics:

Minimum

Goal

Target

Goal

Maximum

Goal

2015 Actual

2% (or

$6.29 per

share)

3% (or

$6.35 per

share)

7% (or

$6.59 per

share)

7.5% (or

$6.62 per

share)

16% 20% 24% 20.2%

500% 600% 700% 828%

Grow th of operating earnings per diluted share on a consolidated basis for the

company (excluding foreign currency effect) froma

2014 base of $6.16 per share

Operating Return on Shareholder Equity (excluding foreign currency effect) (OROE)

Solvency Margin Ratio

Net Investment Income (Consolidated)

Budget

minus 2% Budget

Budget plus

2%

Budget plus

2.2%

3.00% 5.00% 7.00% 3.70%

2.00% 2.75% 3.50% 2.60%

U.S. Segment Metrics:

Increase in New Annualized Premiums

Increase in Direct Premiums

Increase in Pretax Operating Earnings

0.50% 1.50% 2.50% 2.70%

1.00% 3.00% 5.00% 13.38%

0.00% 0.75% 1.50% 1.38%

Japan Segment Metrics:

Increase in New Annualized Premiums (increase in third sector sales)

Increase in Direct Premiums

Increase in Pretax Operating Earnings before allocated expenses and foreign

currency change

-4.00% -3.00% -2.00% 0.42%

Global Investments Metrics (Eric M. Kirsch only):

Net Investment Income (Consolidated)-

-same as above

Budget

minus 2% Budget

Budget plus

2%

Budget plus

2.2%

Credit Losses/Impairments

(in millions)

($325)

($225)

($125)

$150

32