COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (“CD&A”) section provides a detailed description of our executive

compensation philosophy and programs, the compensation decisions made by the Compensation Committee related to

those programs, and the factors considered in making those decisions. This CD&A focuses on our named executive

officers (“NEOs”) for 2015, who were:

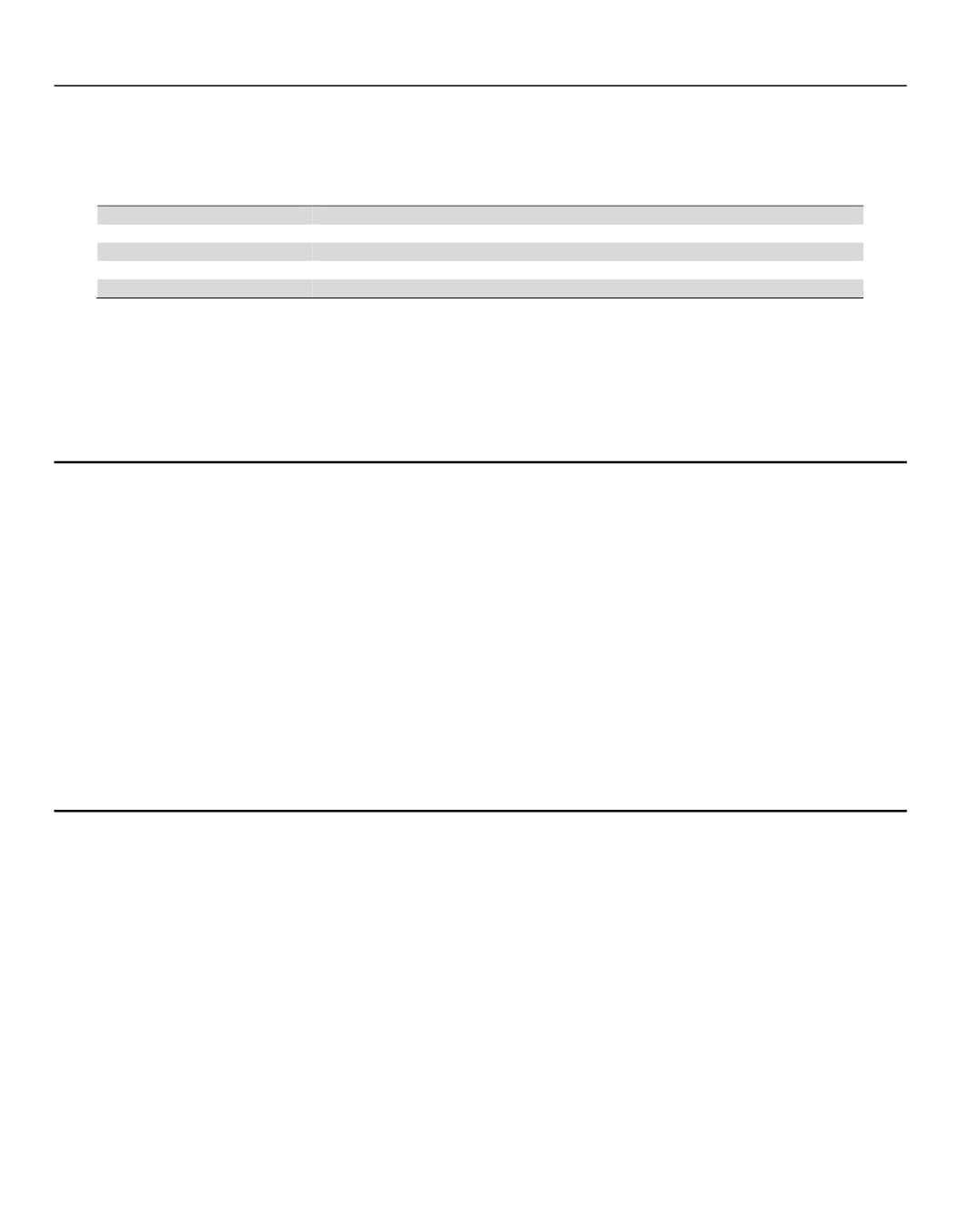

Named Executive Officer

Title

Daniel P. Amos

Chairman & Chief Executive Officer

Frederick J. Crawford

Executive Vice President, Chief Financial Officer (effective June 30, 2015)

Kriss Cloninger III

President

Paul S. Amos II

President, Aflac

Eric M. Kirsch

Executive Vice President, Global Chief Investment Officer, Aflac

Successful 2015 Leadership Transition

In 2015, the Company underwent a successful leadership transition. Mr. Crawford joined the Company as the Executive

Vice President, Chief Financial Officer effective June 30, 2015, replacing Mr. Cloninger as Chief Financial Officer

effective as of that date. Mr. Cloninger remains President with a particular emphasis on capital and strategic planning,

as well as helping the Company grow while ensuring solid profitability.

Overview

The Company’s compensation philosophy is to provide

pay-for-performance that is directly linked to the

Company’s results. We believe this is the most effective

method for creating shareholder value, and that it has

played a significant role in making the Company an

industry leader. Importantly, the performance-based

elements of our compensation programs apply to all

levels of Company management, not just the executive

officers. In fact, pay-for-performance components

permeate every employee level at the Company. The

result is that we are able to attract, retain, motivate and

reward talented individuals who have the necessary

skills to manage our growing global business on a day-

to-day basis, as well as for the future.

Our executive compensation program is designed to

drive shareholder value via the following guiding

principles:

a

pay-for-performance

philosophy

and

compensation program structure that directly

incentivizes our executives to achieve our

annual and long-term strategic and operational

goals;

compensation elements that help us attract and

retain high-caliber talent to lead the Company in

its execution of its business plan; and

best practices with respect to corporate

governance policies, such as stock ownership

guidelines, clawback provisions, and no

change-in-control excise tax gross-ups.

Summary of 2015 Results

The Company delivered strong financial and operating

results in 2015. Notable achievements that contributed

to shareholder value creation included:

growing total operating revenues, excluding foreign

currency effect, by 1.3% to $22.8 billion;

meeting our operating earnings objective for the 2

6

th

consecutive year as operating earnings per diluted

share increased by 7.5% (excluding impact from

foreign currency);

generating $2.5 billion in total combined new

annualized premium sales in the United States and

Japan driven by a 13.4% increase in third sector

sales (cancer and medical) in Japan and 3.7%

increase in U.S. sales;

increasing the quarterly dividend by 5.1% to $.41

per quarter and the annual dividend by 5.3% to

$1.58, marking the 33

rd

consecutive year in which

the dividend has been increased;

generating an industry-leading return on equity of

14.1%; additionally, our operating return on

shareholders’ equity excluding foreign currency

effect (“OROE”) for the full year was 20.2%;

our capital ratios, as of December 31, 2015 remain

strong:

o

Risk-based capital (“RBC”) ratio was 933%;

o

Solvency margin ratio (“SMR”), the principal

capital adequacy measure in Japan, was 828%;

and

repurchasing $1.3 billion (21.2 million) of the

Company’s shares as part of a balanced capital

allocation program, made possible due to the

strength of our capital ratios and liquidity position.

27