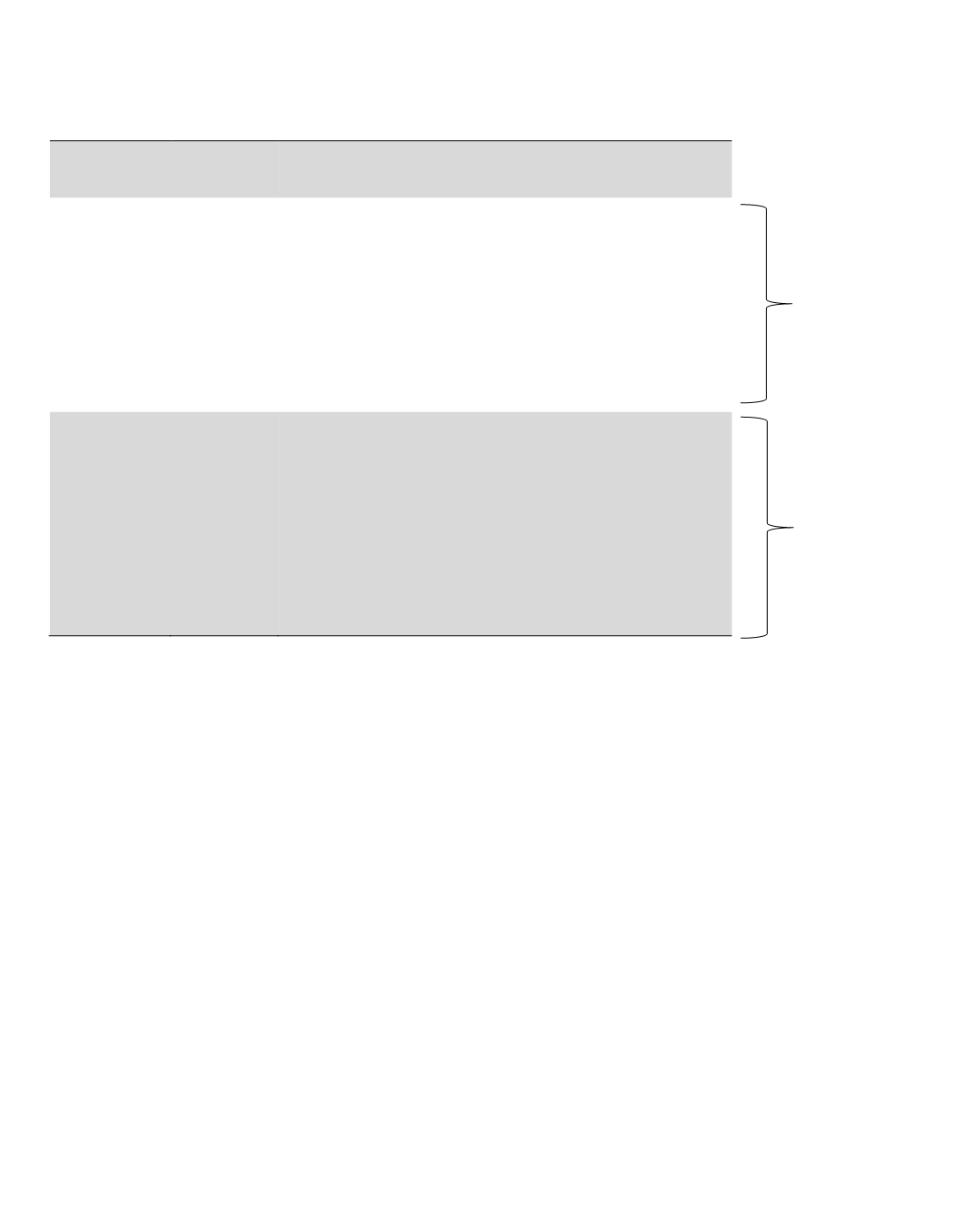

The key elements of our executive compensation programs directly link compensation incentives with our business

goals and shareholder interests:

Element

Vehicle

Performance Link

Base Salary

Cash

Set at competitive levels to attract and retain key

talent

MIP

Cash

Annual incentive award performance metrics

align with our business strategy, geographic

goals, and key value drivers of our Company

•

Corporate Goals:

EPS, OROE, SMR, Net

Investment Income

•

U.S. Goals:

increase in new annualized

premiums, increase in premium income,

increase in pretax operating earnings

•

Japan Goals:

increase in new annualized

premiums, increase in premium income,

increase in pretax operating earnings

Metrics are

rigorous and

set with the

intention of

achieving

target

performance

50%-60% of

the time

LTI

PBRS and

Stock

Options

PBRS (100% of LTI for CEO and President; 80% of

LTI for other NEOs)

• RBC ratio metric represents key industry

performance measures that align with long-

term value creation

Stock Options (0% of CEO and President LTI; 20%

of other NEOs)

• Align executive’s interests with shareholder

interests; only provides value if share price

increases

PBRS vest on

three-year

financial

performance

Options cliff

vest after

three years

Peer Group

Each year, the Compensation Committee reviews the

composition of the peer group against which the

Company’s executive compensation programs and

financial performance are benchmarked. Key factors

the Compensation Committee considers during its

annual review of companies in the peer group include

the following: operating characteristics, revenue size,

asset size, profitability, market value, and total number

of employees. Based on the annual review, a peer

group is selected among companies that are engaged

in businesses similar to that of the Company, are of size

similar to that of the Company, and compete against the

Company for talent. The following 17 companies, which

were unchanged since 2013, were selected to comprise

the 2015 peer group:

Aetna Inc.

Lincoln National Corporation

The Allstate Corporation

Manulife Financial Corporation

Assurant, Inc.

MetLife, Inc.

The Chubb Corporation

Principal Financial Group, Inc.

CIGNA Corporation

The Progressive Corporation

CNO Financial Group, Inc.

Prudential Financial, Inc.

Genworth Financial, Inc.

The Travelers Companies, Inc.

The Hartford Financial Services Group, Inc.

Unum Group

Humana Inc.

Overall, the Company’s revenues and total assets were

somewhat higher than the median of the peers, and our

market value was slightly higher than the peer group

median. The data shown below reflect those metrics

relevant at the time of the peer group review:

30