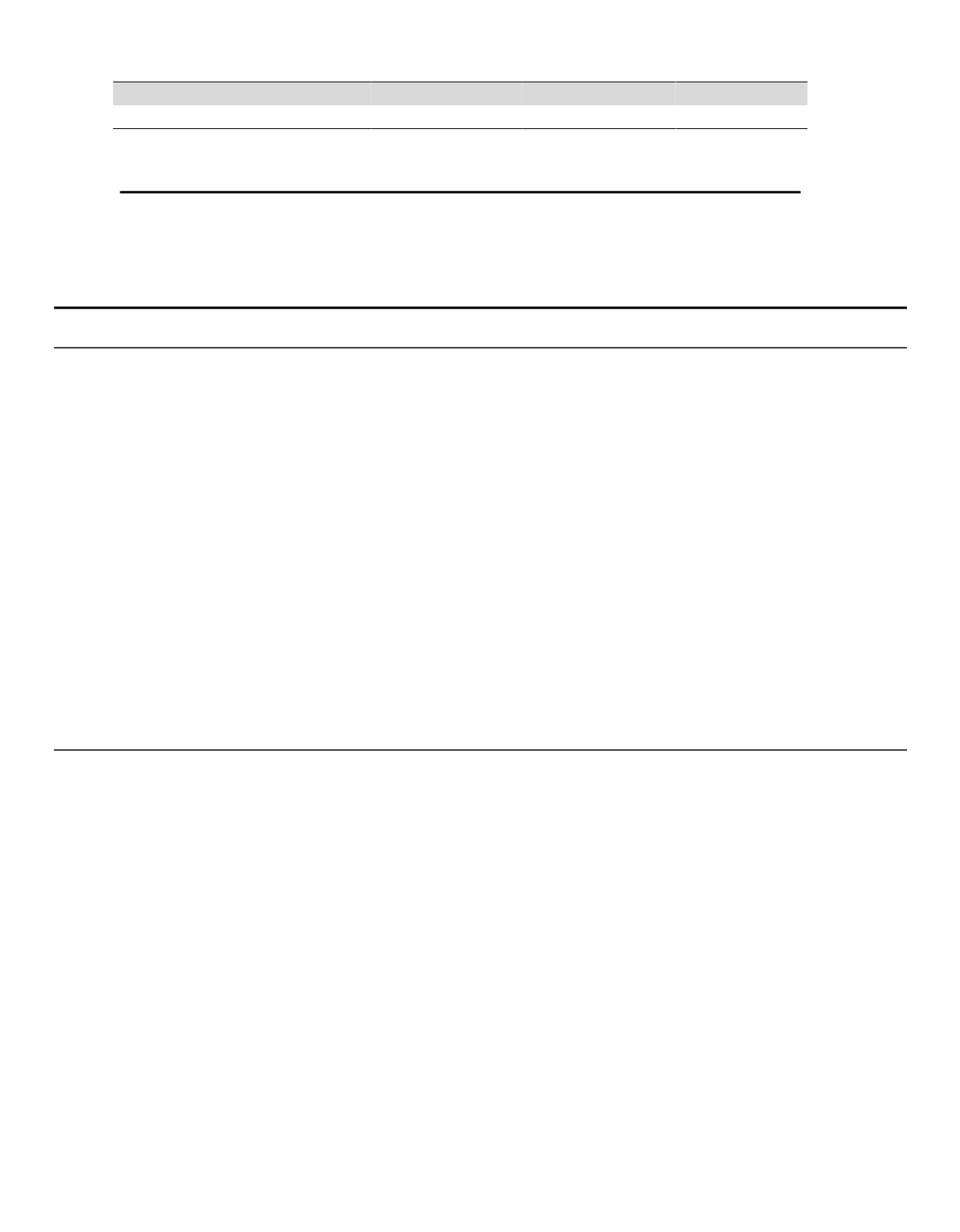

(in millions)

Revenue

(1)

Total Assets

(2)

Market Value

(3)

Aflac Incorporated

$23,181

(4)

$124,381

(4)

$25,562

Peer Median

$20,609

$102,110

$24,048

(1)

For the trailing 12 months ending September 30, 2015

(2)

As of September 30, 2015

(3)

As of December 31, 2015 when data was compiled for the performance review by the Compensation Committee

(4)

Figures are net of foreign currency effect

The assessment of the Company’s 2015 performance relative to the peer group can be found below in the “CEO and

President Compensation and Pay-for Performance” section of this CD&A.

ELEMENTS OF EXECUTIVE COMPENSATION PROGRAM

Base Salary

The primary purpose of the base salary component of

our executive compensation program is to provide the

recipient with a steady stream of income consistent with

his or her level of responsibility, qualifications and

contribution over time. The Consultant annually gathers

comparative market data on salaries for (i) the

Compensation Committee to use in reviewing and

determining the CEO’s salary and (ii) the CEO to use in

making recommendations for the salaries of all other

executive officers.

In the aggregate, the total base salaries of all of the

Company’s executive officers are near the 50

th

percentile of the survey results for these same positions

at peer group companies. Virtually all executive officers,

including NEOs, receive salaries that are within a plus

or minus range of 20% from the survey median for their

positions. Only Mr. Cloninger’s salary is above this

range, which we consider appropriate given his tenure

with the Company, his current important role of

President, as well as his experience gained through

serving in other executive level roles while with the

Company (e.g., CFO and Treasurer). In general,

executive officers who are new to their role are likely to

be below the median and executive officers who have

been in their jobs for extended periods are more likely

to be above the median.

In 2015, Messrs. Daniel P. Amos and Cloninger did not

receive salary increases; Mr. Daniel P. Amos has not

received a salary increase in the last four years. Mr.

Crawford was hired in 2015 and his base salary was set

at an annualized level of $700,000 upon his hiring.

Messrs. Paul S. Amos and Kirsch received

approximately a 1.5% base salary increase for 2015.

Management Incentive Plan (MIP)

All of the NEOs are eligible to participate in an annual

non-equity incentive plan sponsored by the Company,

referred to as the MIP, which was submitted to and

approved by shareholders in 2012 (the Amended and

Restated 2013 Management Incentive Plan).

The Board of Directors believes that it is important for

the Company to manage the business for the long-term

value of its shareholders. Therefore, performance

goals are tailored to metrics that drive shareholder

returns such as sales growth, earnings growth, and

return on equity.

The MIP payout is entirely dependent upon the level of

achievement of performance goals. This methodology

for setting MIP goals has been consistent for many

years:

MIP segment metrics for Aflac U.S. and Aflac

Japan are consistent with assumptions used in

developing segment financial projections

(described below) based on the Company’s

best estimates for the coming year.

The segment projections are then consolidated

into the corporate financial projection used to

develop earnings per share guidance.

The Company’s CEO, President, and CFO recommend

to the Compensation Committee the specific Company

performance objectives and their ranges. In

recommending the incentive performance objectives to

the Compensation Committee, the Company’s CEO,

President, and CFO take into consideration past

performance results and scenario tests of the

Company’s financial outlook as projected by a complex

financial model. The model projects the impact on

various financial measures using different levels of total

new annualized premium sales, investment returns,

budgeted expenses, morbidity, and persistency. This

enables the Company to set ranges around most

performance objectives.

31