The difference between those benefits and those automatically

provided under the Fund, the enhanced protection member

(EPM) benefits, is assessed as at 31 December each year to

determine if it was necessary to make a payment to the Fund

(to augment Fund benefits) or to make a payment in lieu of that

to Martin Lamb. EPM benefits were payable as at 31 December

2013 and Martin Lamb received an additional Fund pension of

£2,694 per annum in respect of these benefits. No EPM benefits

were payable as at 31 December 2012 or 31 December 2011.

EPM benefits were also payable at the date Martin Lamb retired

on 27 September 2014 and he received an additional Fund

pension of £3,558 per annum in respect of these benefits.

The Company and the Trustee of the Fund agreed to defer Martin

Lamb’s pension in the Fund so that payment commences on

7 January 2015 (the date he attains age 55) rather than on 27

September 2014.

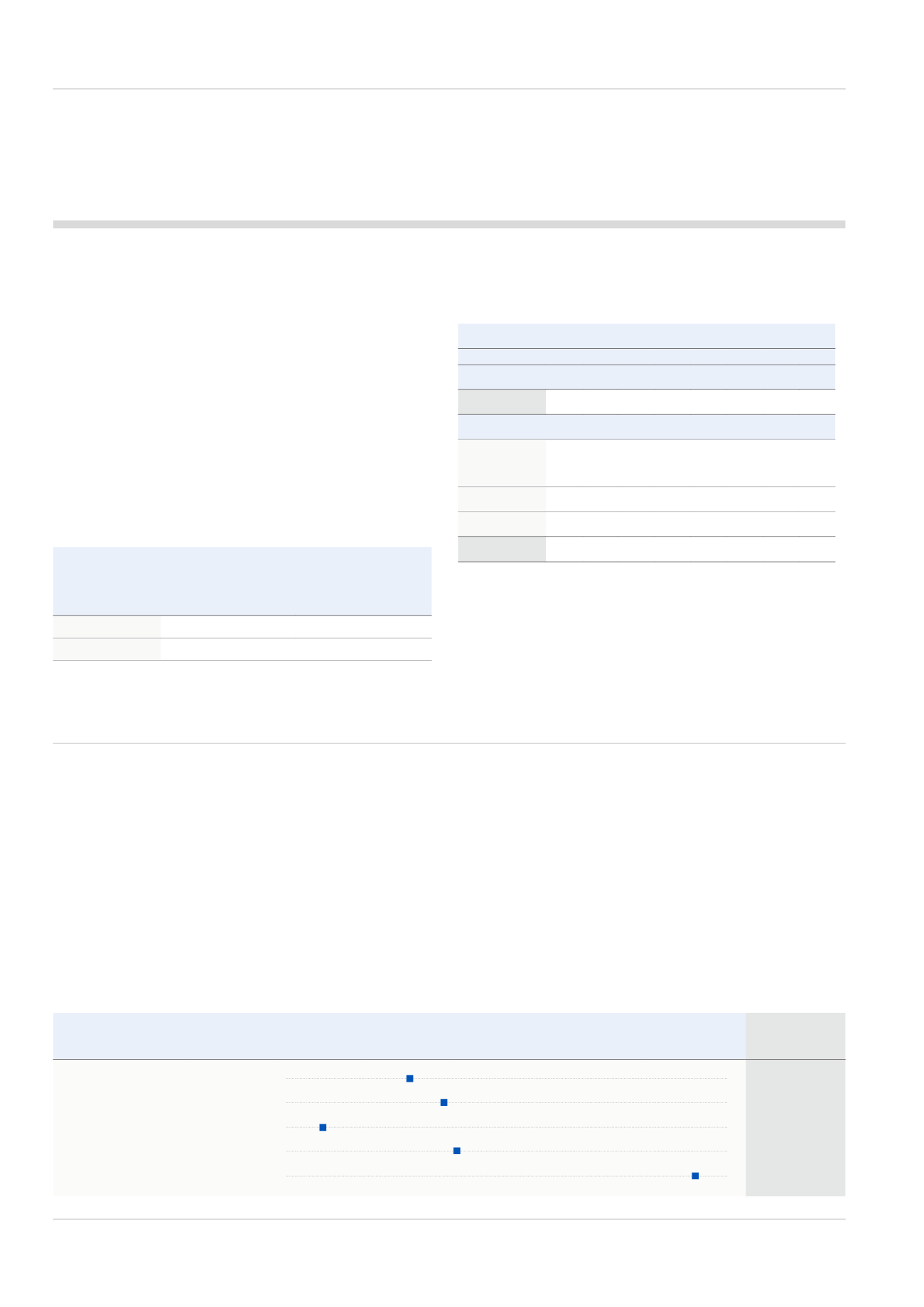

Benefits

During the year the executive directors received a number of

benefits. These are summarised below. Amounts less than

£10,000 pa are combined.

1

Benefits pro-rated to retirement from the Board on 8 May 2014.

In addition to the above benefits and allowances that are included

in the single figure (refer to table on page 69), the executive

directors are also beneficiaries of company policies that have

no taxable value, including directors’ insurance, death in service

cover, travel insurance, the use of a company driver and personal

accident cover.

Accrued pension in

the Fund as at 31

December 2014

£000pa

Accrued pension in

the Fund as at 31

December 2013

£000pa

M J Lamb

334

331

R M Twite

67

65

M W Selway

D M Hurt

R M Twite

M J Lamb

1

2014 2013 2014 2013 2014 2013 2014 2013

Non-cash benefits (£000)

Total

1

-

1

1

2

2

1

3

Cash benefits and taxable allowances (£000)

Company

car and fuel

allowance

19

2 17 17 17 17

7 20

Relocation

-

100

-

-

-

-

-

-

Other

25

7

3

2

-

-

3

4

Total

45 109 21 20 19 19 11 27

Directors’ Remuneration Report (cont’d)

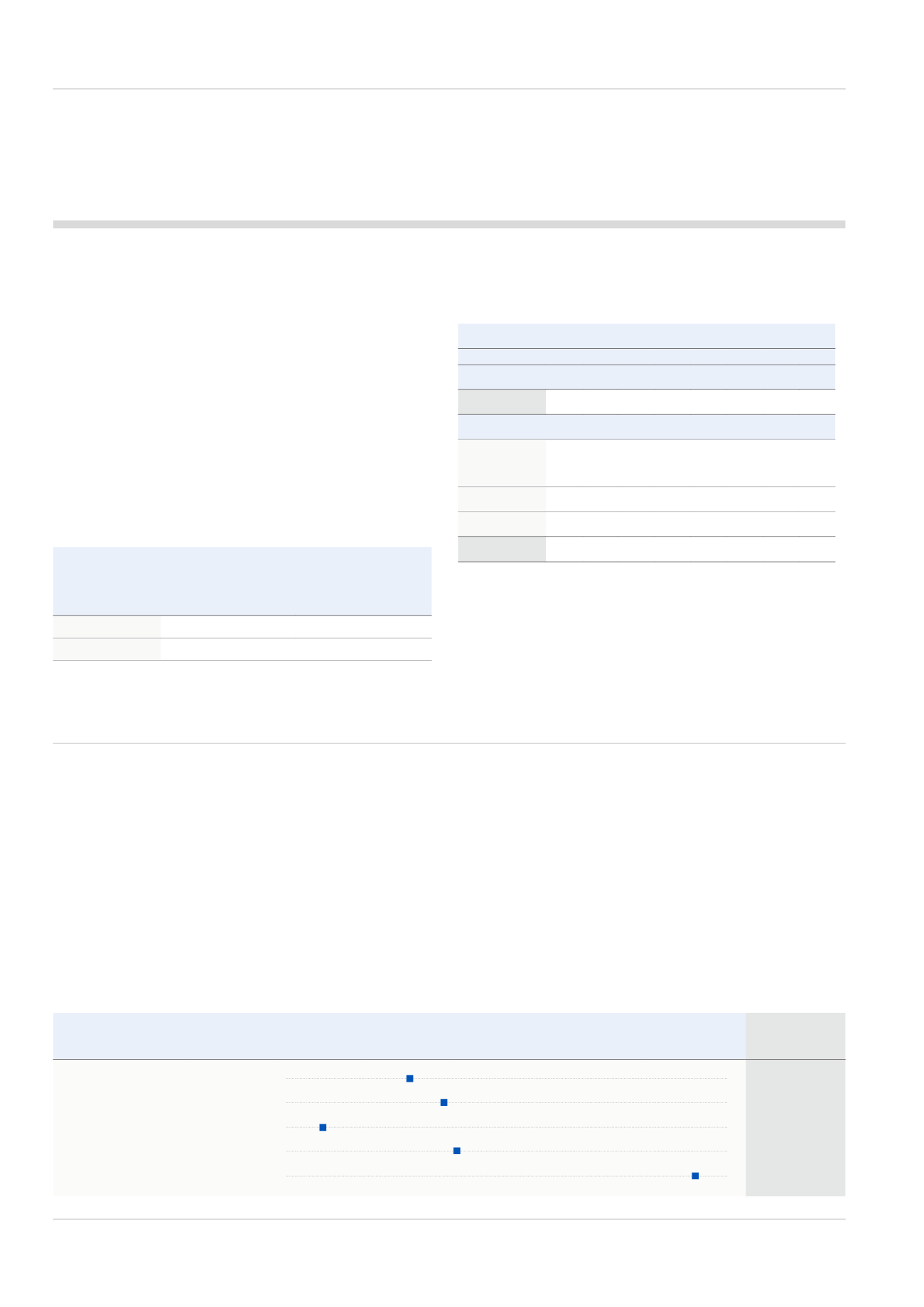

Annual incentive bonus

The 2014 bonus plan focused on the financial performance

of IMI during the year considering Group profit before tax and

exceptional items (‘Group PBT’) (35%); Group adjusted earnings

per share (‘EPS’) (15%); organic revenue growth (15%); cash

conversion (15%); health, safety and environment (5%); and

personal non-financial objectives (15%).

Progress was made on a number of fronts and we continued

to deliver positive results for our shareholders. In particular:

• the total dividend for the year increased by 6.5% compared

to 2013;

• Group adjusted basic earnings per share increased by 7%

compared to 2013;

• organic revenue growth was 2% in 2014, an improvement

on the 1% delivered in 2013; and

• very strong performance again for Health and Safety.

It is the opinion of the Committee that detailed disclosure,

either on a forward looking or retrospective basis of financial

and operational bonus targets is commercially sensitive. This

position will be kept under review. However, to give shareholders

a sense of delivered performance in the context of the ranges

set at the start of the financial year, the following graph illustrates

actual outcomes relative to the ranges set:

Weighting

1

Below

Threshold

Threshold

Target

Maximum

Above

Maximum

Bonus Earned

(% of bonus

opportunity)

Profit before tax

35%

4.7%

Earnings per share

15%

5.7%

Organic revenue growth

15%

0.0%

Cash conversion

15%

6.2%

Health & Safety

5%

5.0%

1

Total is out of 100%. Note that personal objectives account for 15%.

72

IMI plc