• Organic revenue growth

25% of each award was subject to the achievement of an

organic revenue growth measure, calculated as an average

annual growth rate, to encourage continued focus on organic

growth. Revenue is defined as segmental revenues before

exceptional items adjusted, at the Committee’s discretion,

to exclude the impact of material acquisitions and disposals

by the Company completed during the performance period

and to remove the impact of exchange rate movements.

Organic revenue growth of 2.7% per annum would trigger the

minimum level of vesting (25% of the organic revenue element)

increasing on a straight-line basis such that awards were

eligible to vest in full for growth of 8% per annum. Over the

period IMI delivered growth of 2.2%.

In aggregate, none of the initial number of shares awarded were

released to the executives and other participants.

All-employee share plans

Executive directors are entitled to participate in the all-employee share plans on the same terms as other eligible employees at

IMI. In 2014, Mark Selway, Douglas Hurt, Roy Twite and Martin Lamb all received free share awards under the Employee Share

Ownership Plan. Mark Selway and Douglas Hurt received SAYE awards in 2014 of 650 shares each.

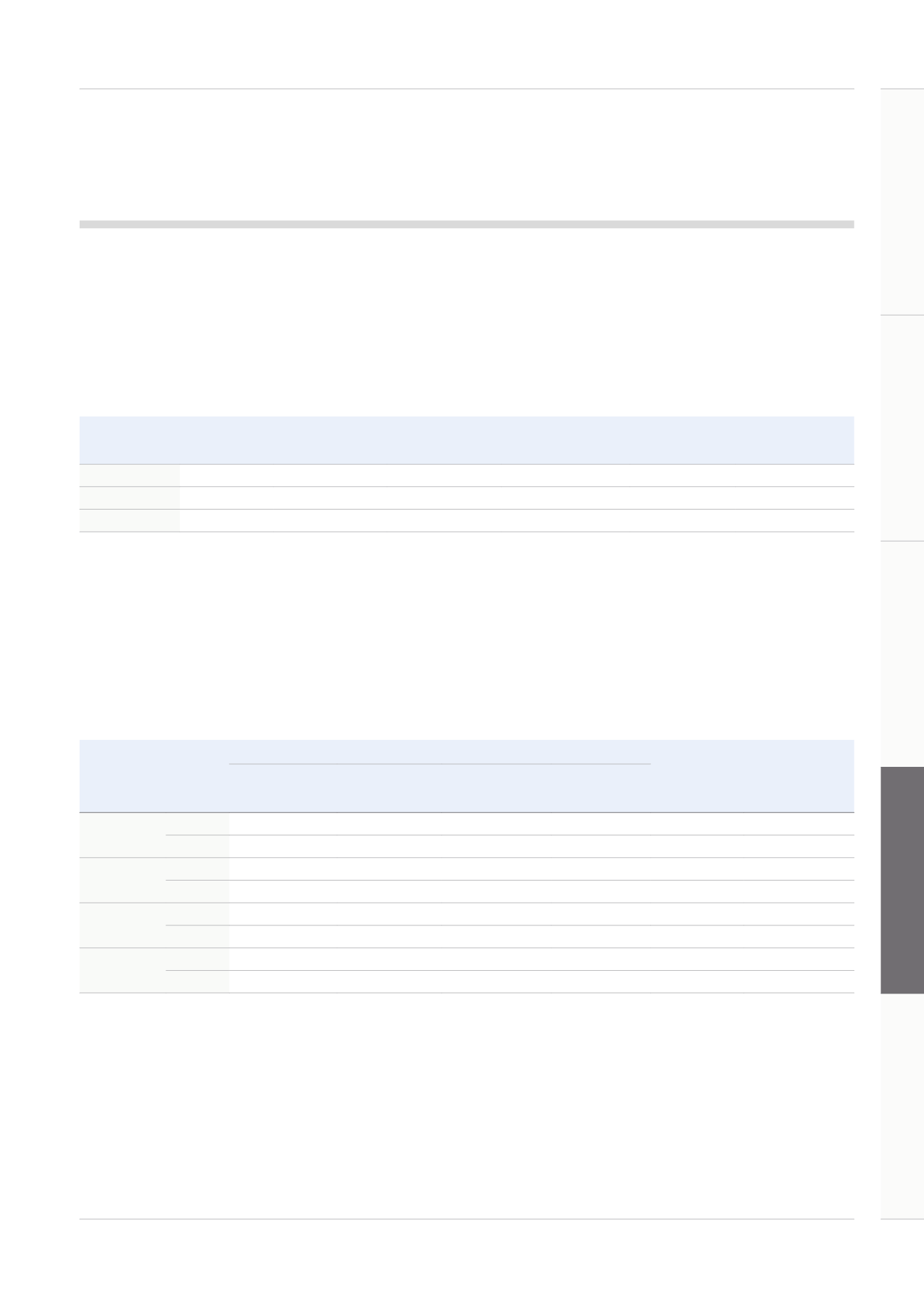

Initial award Value on date of

award

1

(£000)

Number of initial

shares vesting

Additional dividend

equivalent shares

Total shares

vesting

Value of shares on

vesting

(£000)

D M Hurt

41,250

392

-

-

-

-

R M Twite

41,250

392

-

-

-

-

M J Lamb

2

75,450

716

-

-

-

-

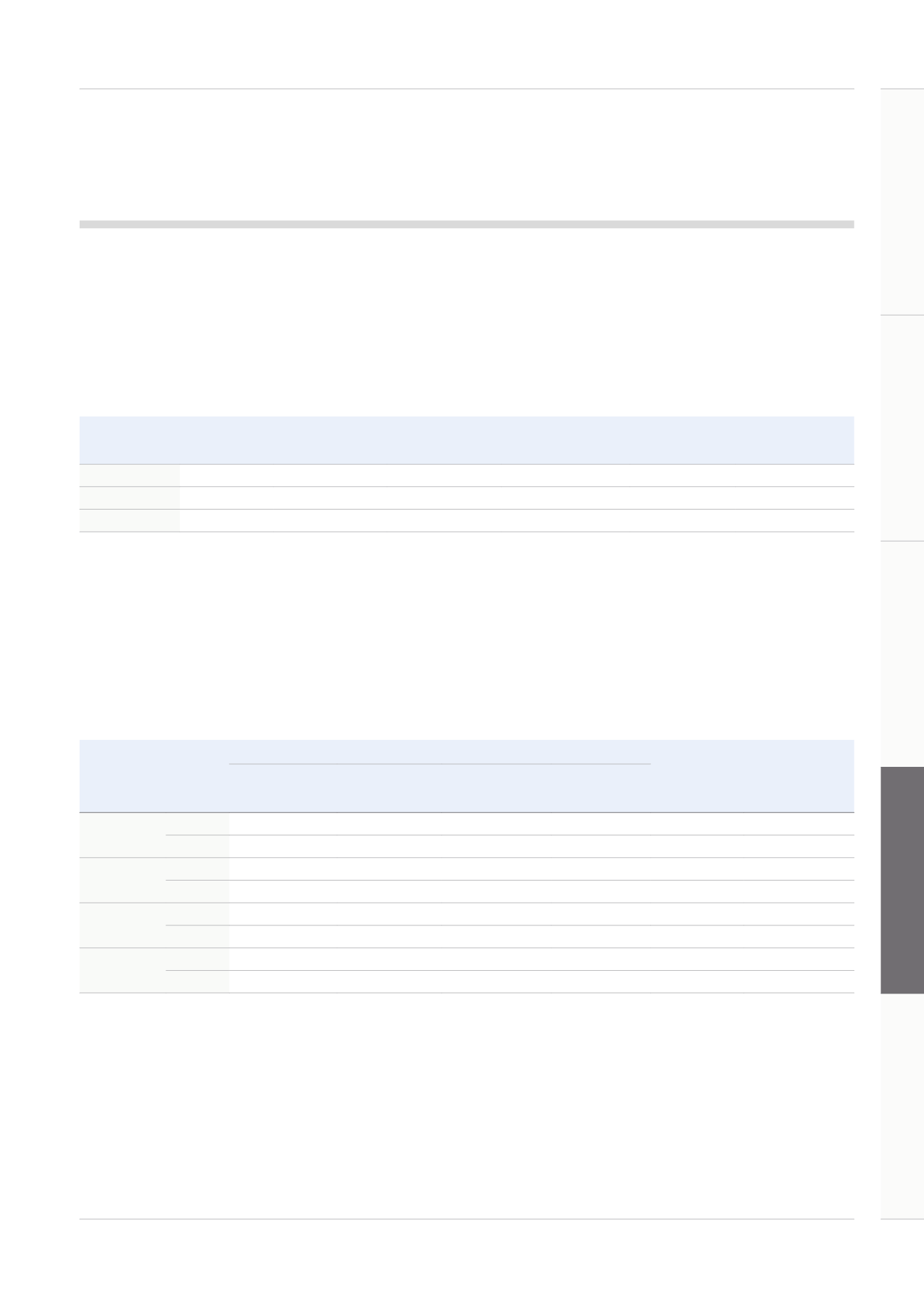

Share Incentive Plan

SAYE

Dividends

(£000)

Total value under

the all-employee

share plans (£000)

Number of shares

awarded

Value of free

share award

1

(£000)

Number of options

awarded

Value of SAYE

options

2

(£000)

M W Selway

2014

73

1

650

1

-

2

2013

-

-

-

-

-

-

D M Hurt

2014

196

3

650

1

-

4

2013

240

3

-

-

-

3

R M Twite

2014

196

3

-

-

-

3

2013

240

3

-

-

-

3

M J Lamb

2014

196

3

-

-

-

3

2013

240

3

-

-

2

5

1

The mid-market price on the date of award was 949.50 pence.

2

Under the terms of Martin Lamb’s retirement, his 2012 award of 75,450 shares was not time pro-rated.

1

In 2014 free shares were awarded at a share price of 1,526.00 pence (1,249.33 pence in 2013).

2

In 2014 SAYE awards were made at a 10% discount and the value shown is the intrinsic gain at the date of grant, calculated in accordance with the single figure

requirements (on page 69).

75

Strategic Review

Performance Review

Corporate Governance

Financial Statements

Introduction

Annual Report and Accounts 2014