Directors’ Remuneration Report (cont’d)

1

The mid-market price on the date of award was 922.00 pence.

2

Awards will vest on 10 May 2015. The value of shares on vesting is estimated

using the average price over the last quarter of 2014 (1,204.86 pence). Awards

take the form of nil-cost options and can be exercised over a period of up to

seven years following vesting, unless reduced under the terms of an

individual’s departure.

3

Under the terms of Martin Lamb’s retirement his 2012 award of 289,850 shares

was not time pro-rated.

4

Adjusted for the February 2014 share consolidation.

Awards vesting under the Performance Share Plan

In May 2012, awards were also made to executive directors

under the Performance Share Plan (‘PSP’). The vesting of the

awards was subject to the achievement of three independent

performance conditions, measured over the three-years ending

31 December 2014. The 2012 PSP award will vest at 0%.

• EPS growth

Half of each award was subject to the achievement of an EPS

growth performance measure. Under the PSP, EPS is defined

as adjusted basic earnings per share before the post-tax

impact of any reported exceptional items, which may include

impairment losses, profit/ loss on disposal of a subsidiary,

rationalisation costs, acquired intangible amortisation and

IAS39 charges or credits for changes in the fair value of financial

instruments. EPS was chosen as an appropriate measure

because it rewards absolute growth in underlying earnings

and because the Committee believed it worked well

in combination with TSR which is an external, relative

measure of performance.

Growth of 6% per annum would trigger the minimum level of

vesting (25% of the EPS element), increasing on a straight-line

basis such that awards were eligible to vest in full for EPS growth

of 15% per annum. Over the period IMI delivered EPS growth of

2.7% per annum, increasing EPS from 64.5 pence in 2011 to

a comparable 69.8 pence at the end of 2014.

• Relative TSR

25% of each award was subject to the achievement of a

relative TSR performance measure. TSR is defined as the

movement in share price during the performance period,

measured in local currency, with adjustments to take account of

changes in capital structure and dividends, which are assumed

to be reinvested in shares on the ex-dividend date. TSR was

chosen as a measure as it is an external, relative benchmark for

performance that aligns executives’ rewards with the creation of

shareholder value.

At the end of the three-year performance period, the Company

ranked 21 in the peer group. The Committee was in agreement

that the outcome under the TSR measure was reflective of the

general underlying financial performance of the Company.

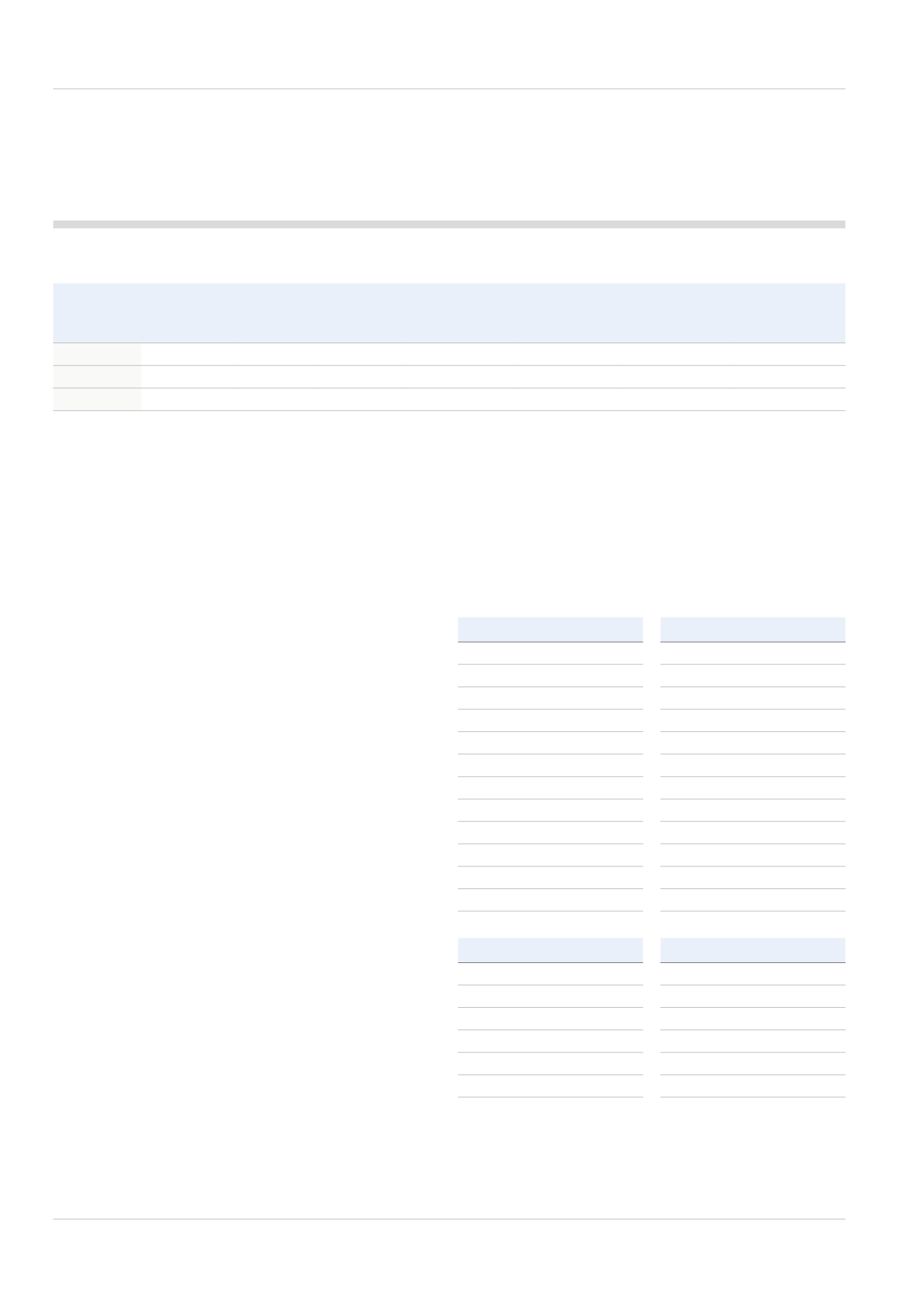

UK

BBA Aviation

Bodycote

Cobham

GKN

Halma

Johnson Matthey

Meggitt

Rotork

Spectris

Spirax-Sarco Engineering

Vesuvius

Weir Group

USA

Borgwarner

Eaton

Emerson Electric

Flowserve Corp

Honeywell

IDEX

Illinois Tool Works

Ingersoll-Rand

Manitowoc

Parker-Hannifin

Pentair

Tyco International

Japan

Amada

Fanuc

NSK

SMC

THK

Yaskawa Electric

Continental Europe

Atlas Copco

Heidelberg Druckmaschinen

Metso Corporation

Sandvik

SKF B

Sulzer AG

The 2012 peer group comprised the following companies,

adjusted to take account of merger and acquisition activity

during the performance period in line with the Committee’s

established guidelines:

Over the period IMI delivered compound annual EVA growth of 12.6% based on three-year EVA from 2012 to 2014 of £593.6m

compared to three-year EVA from 2009 to 2011 of £415.8m. The total awards vesting in March 2015 will be:

Shares

invested by the

executive

4

Initial

matching

award

Value on date

of award

1

(£000)

Number of

matching shares

vesting

Additional

dividend

equivalent

shares

Total matching

shares vesting

Value of matching

shares on vesting

2

(£000)

D M Hurt

27,827

132,512

1,222

92,758

8,022

100,780

1,214

R M Twite

25,600

121,908

1,124

85,335

7,380

92,715

1,117

M J Lamb

3

60,868

289,850

2,672

202,895

17,548

220,443

2,656

74

IMI plc