97

Annual Report and Accounts 2014

2.1.2

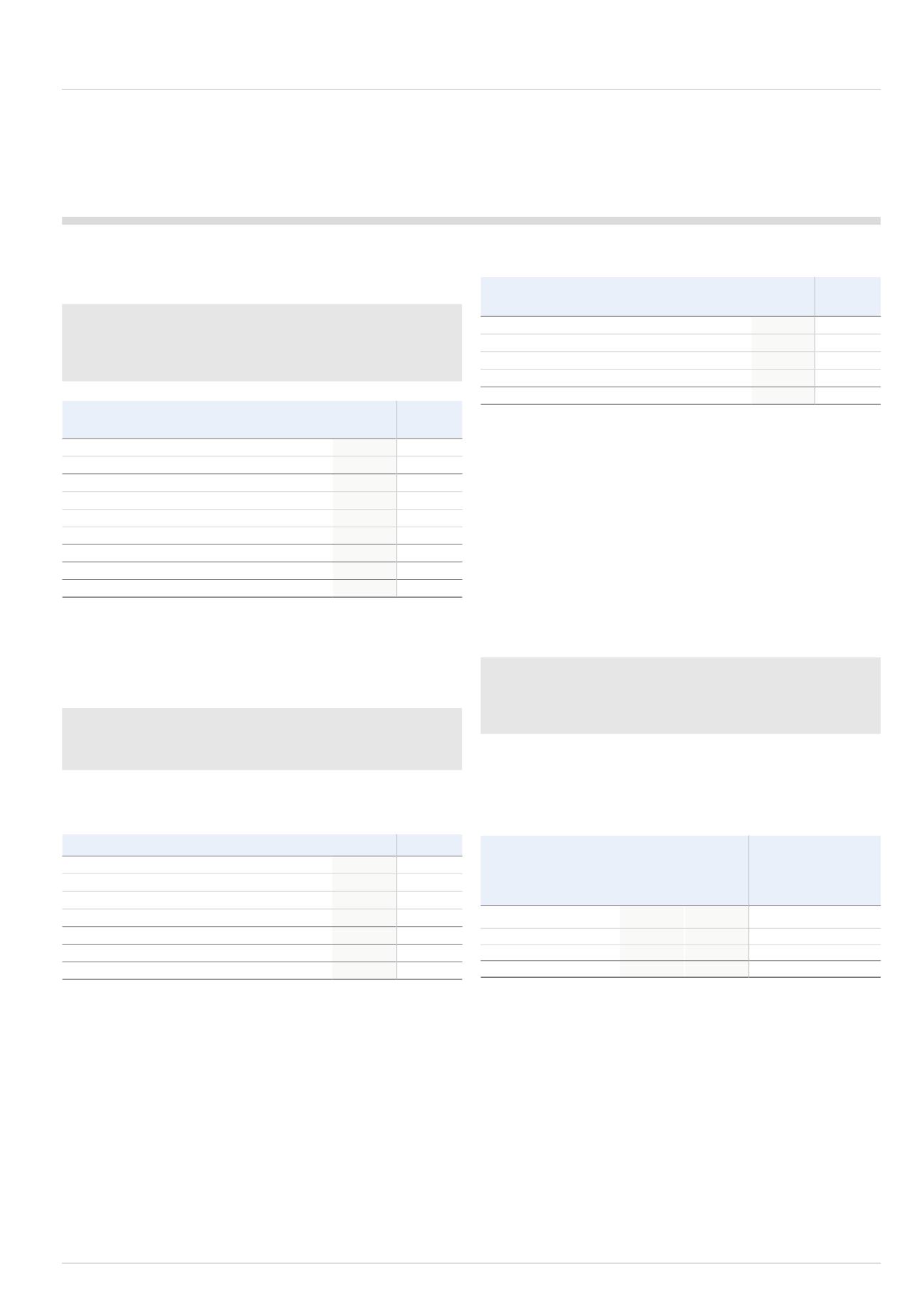

Operating costs by function

The following table is included to show how much of the operating costs

deducted from revenue to arrive at the Group’s post-exceptional operating

profit, relate to cost of sales, selling and distribution costs, administrative

expenses and exceptional items.

2014

£m

2013

£m

Segmental revenue

1,686.0

1,744.0

Cost of sales

(919.6)

(948.8)

Segmental gross profit

766.4

795.2

Selling and distribution costs

(211.5)

(220.0)

Administrative expenses

(256.8)

(253.6)

Restructuring costs

(2.6)

-

Operating profit before exceptional items

295.5

321.6

Exceptional items*

(25.7)

(51.1)

Operating profit

269.8

270.5

* The exceptional costs are analysed in detail in section 2.2.

2.1.3

Specific elements of operating costs

Certain specific items of operating expenses are disclosed to provide the

reader of financial statements with more information regarding these costs.

This section provides this analysis.

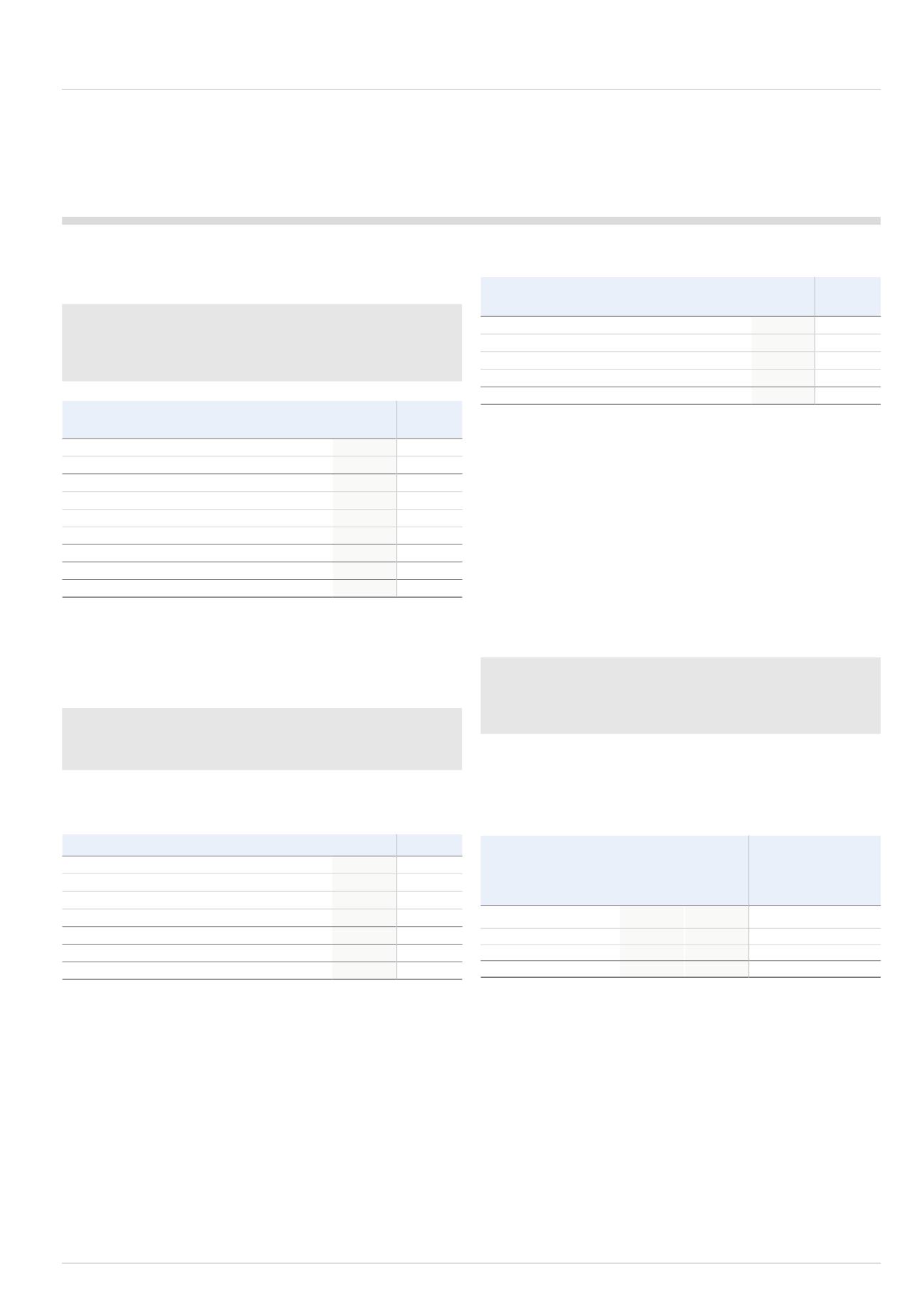

2.1.3.1 Employee information

The average number of people employed by the Group during the year was:

2014

2013

IMI Critical Engineering

3,971

3,845

IMI Precision Engineering

5,748

5,760

IMI Hydronic Engineering

1,878

1,926

Corporate

151

176

Total continuing

11,748

11,707

Retail Dispense

-

2,759

Total Group

11,748

14,466

The aggregate employment cost charged to operating profit for the year was:

2014

£m

2013

£m

Wages and salaries*

436.7

514.8

Share based payments

4.4

11.2

Social security costs

84.3

88.0

Pension costs**

10.1

16.1

Total

535.5

630.1

* Wages and salaries include £nil (2013: £1.0m) for contingent consideration

payments to the vendors of AFP and NPSL.

** In 2014, pension costs above include the £3.5m gain on settlement of one of

our Swedish pension schemes but exclude the gain of £3.5m arising from the

split of the UK Pension Fund as this amount is in respect of former employees.

Both items were disclosed as exceptional items, see section 2.2.3.

The aggregate gains made by directors on the exercise of share options was

£10.6m (2013: £13.4m). The remuneration, as defined in the Companies Act

2006 Schedule 5, for the executive directors’ comprises fixed and annual

variable pay as set out in the table on page 69 of the Remuneration Report.

For details of the non-executive directors’ remuneration please refer to

page 77 of the Remuneration Report.

2.1.3.2 Operating lease charges and operating lease commitments

The Group enters into leases for property, plant and equipment assets when

doing so represents a more cost-effective or lower risk option than purchasing

them. This leads to an income statement charge for the year and future

commitments for the Group in respect of these leases.

Continuing operating costs include a charge of £14.4m (2013: £14.3m)

relating to the lease of properties and a charge of £7.8m (2013: £7.1m) relating

to the lease of plant and machinery. The continuing commitments in respect

of non-cancellable operating leases in place are shown in the following table

by time period:

2014

2013

Land and

Land and

buildings

Others

buildings

Others

£m

£m

£m

£m

Within one year

13.4

7.5

14.3

6.7

In the second to fifth year

41.3

10.8

41.6

11.1

After five years

35.0

1.5

34.0

2.0

89.7

19.8

89.9

19.8

The comparative disclosures above exclude commitments for the Retail

Dispense businesses, which the Group disposed of on 1 January 2014.

2.1.3.3 Research and development expenditure

The continuing cost of research and development expenditure charged directly

to the income statement was £45.4m (2013: £50.0m). In addition, amortisation

of capitalised intangible development costs amounted to £2.3m (2013: £2.1m)

and across the Group a further £6.4m (2013: £3.3m) was capitalised.

2.1.3.4 Exchange gains on operating activities net of

hedging arrangements

The transactional foreign exchange losses in the Group were £1.8m

(2013: gains of £0.6m).