98

IMI plc

2.2 Exceptional items

The Group uses the exceptional items category in the income statement to

classify separately items of both income and expense which are sufficiently

large, volatile or one-off in nature to assist the reader of the financial statements

to gain a better understanding of the underlying performance of the Group.

The following items are considered to be exceptional in these

financial statements.

2.2.1 Reversal of net economic hedge

contract losses/gains

For segmental reporting purposes, changes in the fair value of economic

hedges which are not designated as hedges for accounting purposes, together

with the gains and losses on their settlement, are included in the segmental

revenues and operating profit of the relevant business segment. The exceptional

items at the operating level reverse this treatment. The financing exceptional

items reflect the change in value or settlement of these contracts with the

financial institutions with whom they were transacted. The former comprised

a reversal of a loss of £3.9m (2013: reversal of gain of £5.1m) and the latter

amounted to a loss of £6.7m (2013: gain of £2.7m).

2.2.2 Restructuring costs

The restructuring costs treated as exceptional of £8.6m (2013: £14.2m) include

£4.2m costs for the closure of IMI Components, announced in August 2014

and £4.4m on the completion of the IMI Norgren UK factory move. Other

restructuring costs of £2.6m have been charged below segmental operating

profit and included in the underlying operating profit as, based on their

quantum, they do not meet our definition of exceptional items.

2.2.3 Gains on special pension events

As described on page 125, the UK Fund was split into two newly formed

schemes one for pensioners and one for deferred members resulting in a

one-off settlement gain of £3.5m. In addition, the insurance buy-out of one

of our Swedish schemes resulted in a further settlement gain of £3.5m.

Both of these gains have been treated as exceptional items.

2.2.4 Impairment losses and acquired

intangible amortisation

As reported at the half-year and prior to its disposal in October 2014 (see 3.5),

due to reduced expectations for the future performance of AFP, the Group

carried out a review of the recoverable amount of the business. Alongside

this, we also reassessed the amounts to be paid based on the business’s

performance in the three to five years following the acquisition. This review

led to the recognition of an exceptional net impairment loss of £10.8m,

partially offset by a deferred tax credit of £3.8m.

As reported on page 106, following completion of the Group’s annual

impairment review an exceptional impairment loss has been recorded for

£26.9m reflecting a deterioration in the current trading base of Remosa.

Additional exceptional impairment losses were recognised of £1.1m on

announcement of the proposed closure of IMI Components and £2.0m for

the impairment of legacy IT software as Hydronic Engineering implements

a new ERP system.

An analysis by segment of acquired intangible amortisation is included in

section 2.1.1.

2.2.5 Gain on disposal of subsidiaries

Gains on the disposals of Eley and AFP are discussed in section 3.5.

2.2.6 Acquisition and disposal costs

Acquisition and disposal costs comprise £2.2m of fees associated with the

acquisition of Bopp & Reuther which were incurred in the year and a net release

of £0.4m relating to deferred remuneration included within the post-employment

contracts of the vendors for the AFP and NPSL acquisitions (2013: charge of £1.9m).

Preparatory costs for the sale of the Retail Dispense businesses in the prior year

amounted to £8.0m and principally represented costs payable to the legal and

financial advisors assisting with the origination and completion of the transaction,

in addition to the advisory costs borne in 2013 relating to the return of cash.

2.2.7 Taxation

The tax effects of the above items are included in the exceptional column

of the income statement. In addition, during the year the Group incurred

a one-off charge of £2.8m in respect of a prior year tax audit. In 2013,

exceptional tax charges of £14.7m were incurred in association with the

pre-sale restructuring of certain of the Retail Dispense businesses and

were included in discontinued operations.

SECTION 2 – RESULTS FOR THE YEAR

Continued

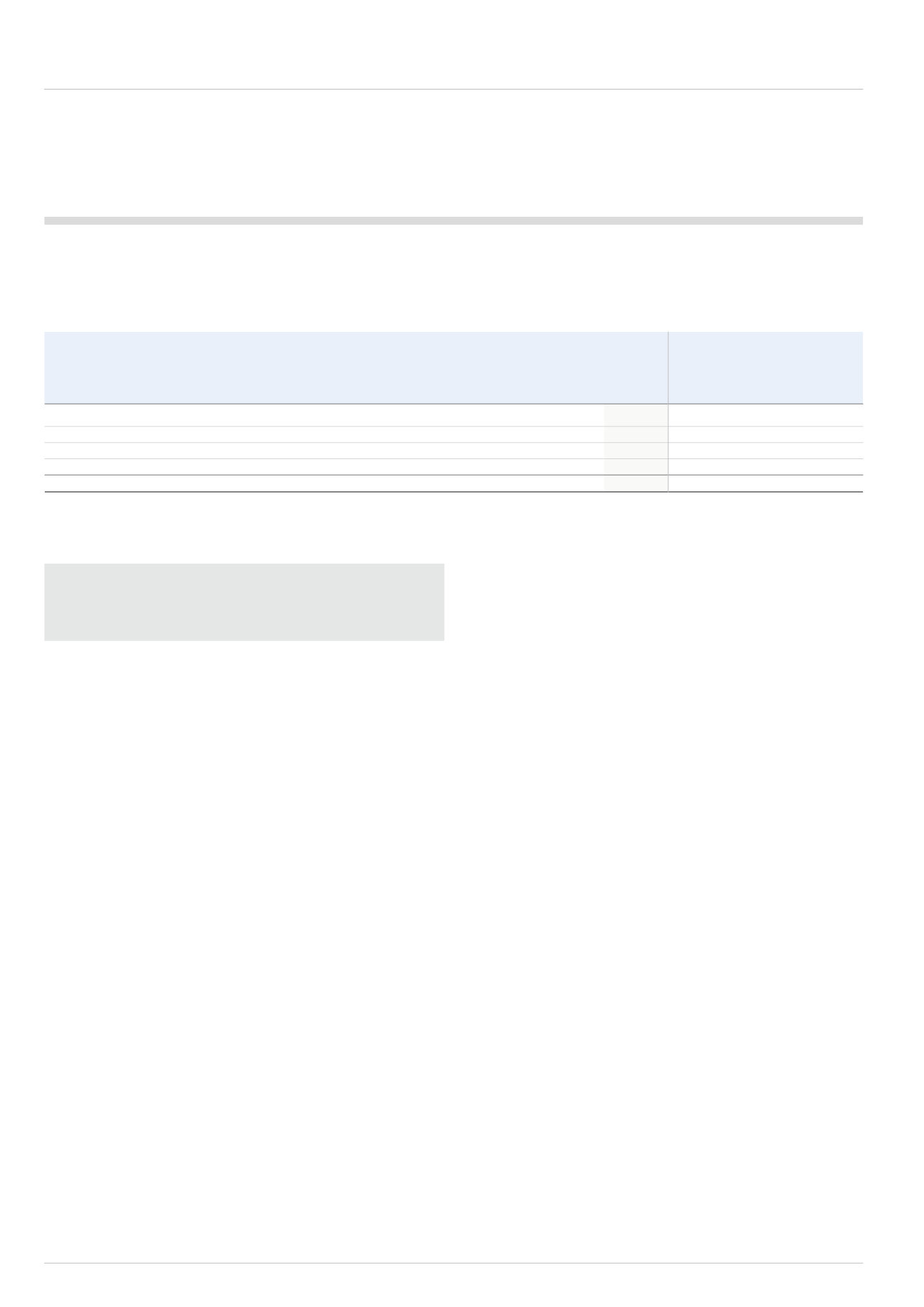

2.1.3.5 Audit Fees

The Group engages its auditor, EY, to perform assignments in addition to their statutory audit duties where their expertise, experience and knowledge of the

Group should enable them to perform these assignments more efficiently than other similar service providers.

The Group’s policy on such assignments is set out in the Audit Committee Report on page 53. Fees earned by EY and its associates during the year are set out below:

2014

2013

Continuing

Continuing Discontinued

Business

Business

Business

Total

£m

£m

£m

£m

Fees earned by the Company’s auditor for the audit of the Company’s annual accounts

0.2

0.2

-

0.2

The audit of the Company’s subsidiaries, pursuant to legislation

2.5

2.6

0.5

3.1

Tax compliance services

0.3

0.1

-

0.1

Other assurance services

-

0.1

-

0.1

Total

3.0

3.0

0.5

3.5