100

IMI plc

SECTION 2 – RESULTS FOR THE YEAR

Continued

2.4

Taxation

IMI operates through subsidiary companies all around the world that pay many

different taxes such as corporate income taxes, VAT, payroll withholdings, social

security contributions, customs import and excise duties. This note aggregates

only those corporate income taxes that are or will be levied on the individual

profits of IMI plc and its subsidiary companies for periods leading up to and

including the accounting date. The profits of each company are subject to

certain tax adjustments as specified by applicable tax laws in each country to

arrive at the tax liability that is expected to result on their tax returns. Where

these tax adjustments cause future tax differences then deferred taxes may

also be recorded.

2.4.1

Governance and strategy

IMI seeks to effectively manage its taxation obligations worldwide in compliance

with all applicable tax laws and regulations. Therefore, the Group monitors

the tax contribution by the individual businesses to ensure it meets local tax

requirements, that available global tax incentives and allowances are recognised,

and any material tax risks are properly and promptly addressed, as well as

appropriately provided and disclosed in the Group’s accounts and tax returns.

IMI aims to build positive working relationships with tax authorities around the

world by fully co-operating in an open, constructive and timely manner. As tax

laws are often complex and sometimes ambiguous, tax outcomes are inherently

uncertain. Accordingly, it is recognised that there will be areas of differing legal

interpretation with tax authorities and where this occurs IMI will engage

in proactive discussion to obtain early resolution and seek to remove

uncertainty and controversy.

IMI Tax Policy requires compliance, fairness, value and transparency in the

management of the Company’s tax affairs, in accordance with the principles

of The IMI Way. This approach has been approved by the Board, fully

communicated to subsidiary businesses and is regularly reviewed to

ensure responsible business practices across the Group are maintained.

2.4.2

UK corporation tax

The average weighted rate of corporation tax in the UK for the 2014 calendar

year was 21.5% (2013: 23.25%). Changes enacted in previous Finance Acts

revise the main rate of UK corporation tax to 20% from 1 April 2015. UK

deferred tax assets and liabilities have therefore been calculated using a rate

of 20% (2013: 20%). The current tax charge for UK companies was £2.0m

(2013: £7.1m). During the year the Company made significant additional

payments to its UK defined benefit pension schemes, which has had the

effect of reducing the Group’s UK corporation tax liability for the year.

2.4.3

Tax payments

During the year, the Group made payments of corporate income tax of £67.2m

(2013: £41.7m), principally arising in the USA, UK, Italy, Switzerland, Sweden,

Japan and Germany. There is normally an element of volatility in the annual

payments of corporate income taxes due to the timing of assessments,

acquisitions and disposals, exceptional items and payments on account

in the many countries in which the Group operates. In addition, the Group

makes substantial other tax payments relating to employment, consumption,

procurement and investment to local authorities around the world.

2.4.4

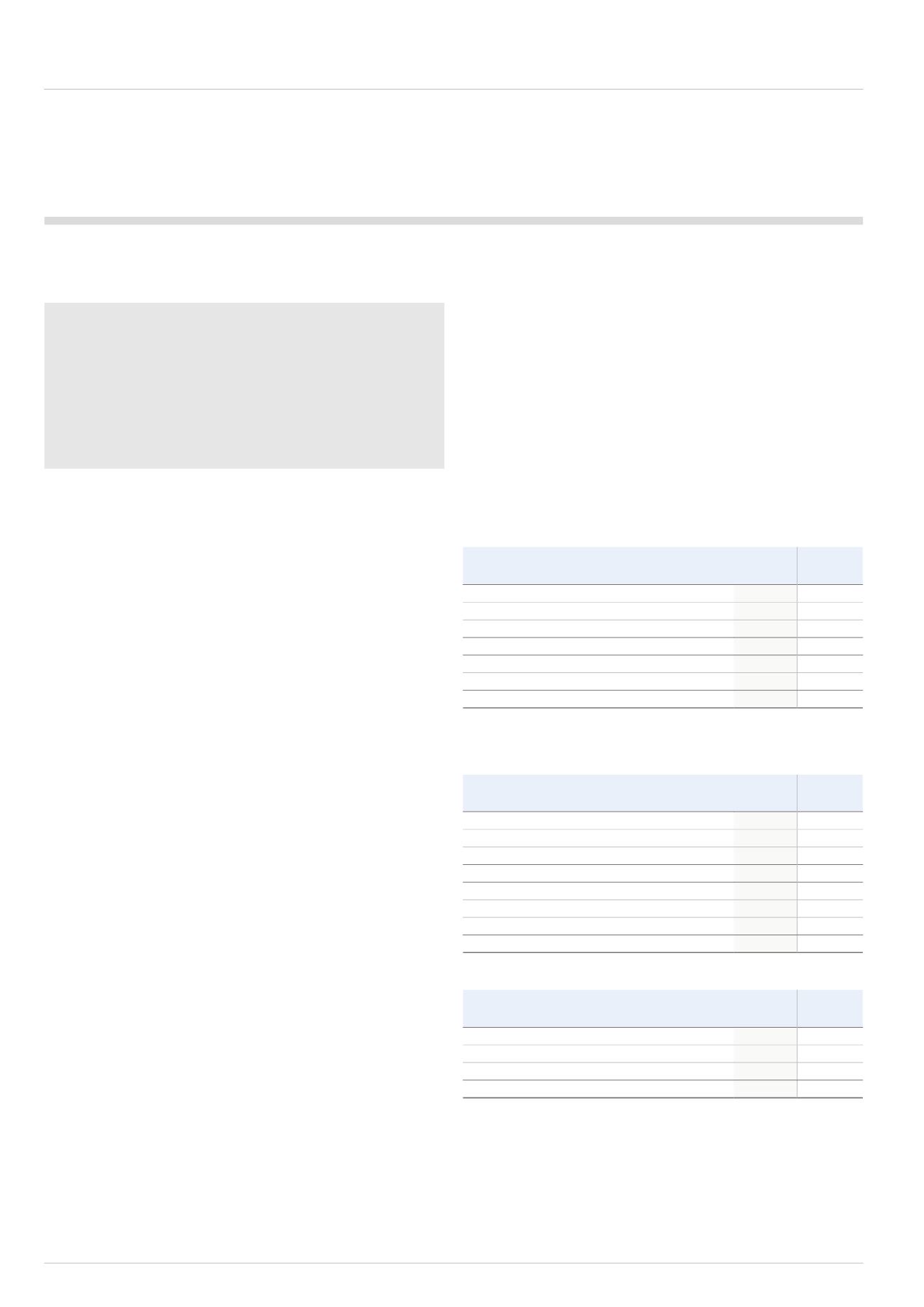

Recognised in the income statement

This section sets out the current and deferred tax charges, which together

comprise the total tax charge in the income statement.

2014

£m

2013

£m

Current tax charge

Current tax charge

46.3

98.4

Adjustments in respect of prior years

(3.4)

(1.4)

42.9

97.0

Deferred taxation

Origination and reversal of temporary differences

12.5

(2.3)

Total income tax charge

55.4

94.7

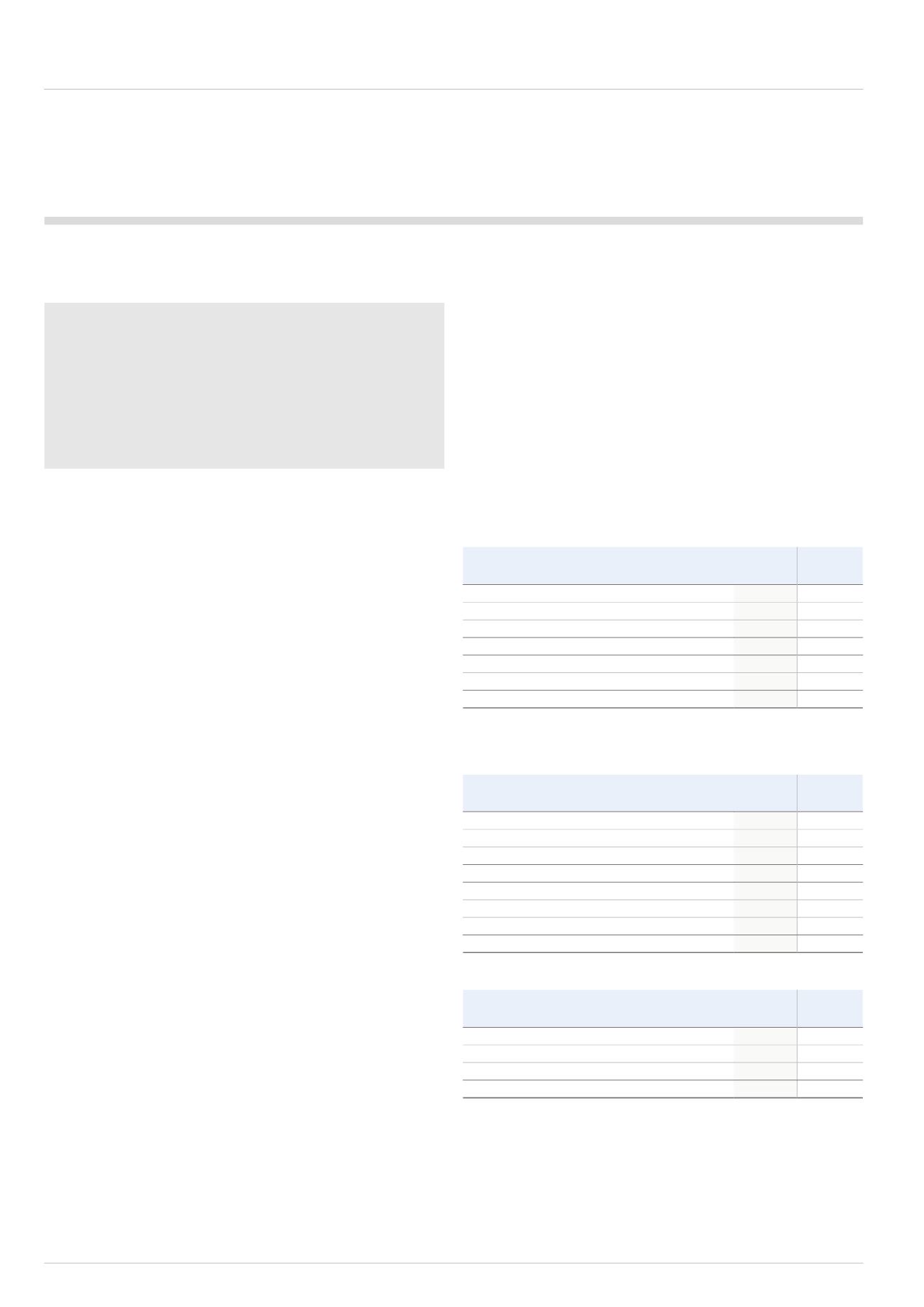

The above income tax charge is apportioned between continuing and

discontinued operations in the income statement as follows:

2014

£m

2013

£m

Current tax charge

Continuing operations

39.9

59.6

Discontinued operations

3.0

37.4

42.9

97.0

Deferred tax charge/(credit)

Continuing operations

13.0

(3.9)

Discontinued operations

(0.5)

1.6

12.5

(2.3)

2014

£m

2013

£m

Total income tax charge

Continuing operations

52.9

55.7

Discontinued operations

2.5

39.0

55.4

94.7