Long-term Equity Incentive (LTI) Award

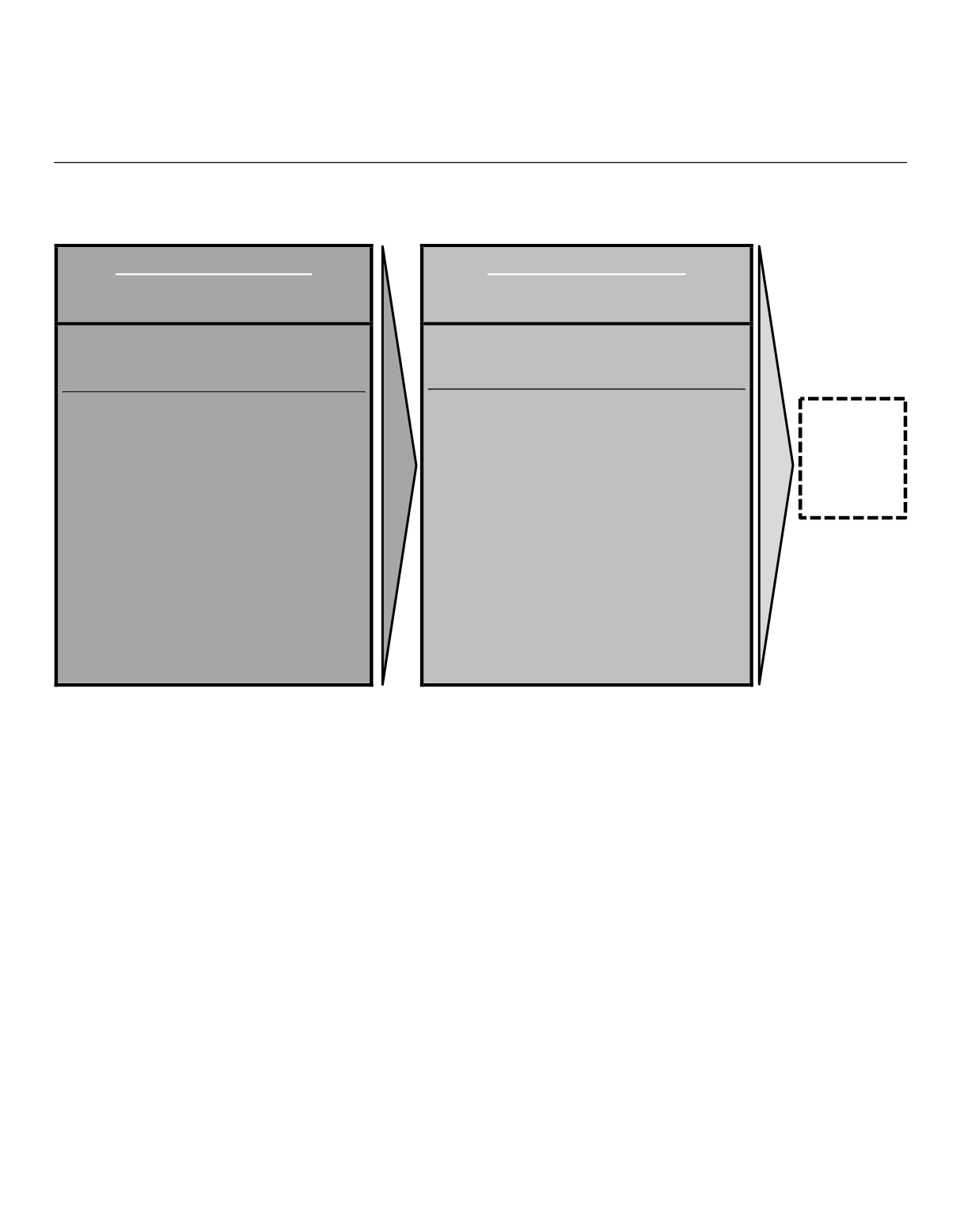

A summary of the determination of the size and final realized LTI award for the CEO and President is shown below, with

further details provided in the narrative following the illustration:

1

ST

PERFORMANCE TEST

Determines Maximum LTI Award

(There is NO Targeted LTI Award)

2

ND

PERFORMANCE TEST

Determines Ultimate Value of LTI Award

at End of Vesting Period

PBRS grant amount is determined

based on Aflac Incorporated’s relative

financial and TSR performance

Relative financial performance

(weighted 54%) is measured by:

Revenue growth

Net income growth

Premium income growth

EPS growth

Return on revenues

Return on average equity

Return on average assets

Relative TSR performance (weighted

46%) is measured by:

1-year TSR

3-year TSR

PBRS award value is determined by

achievement of our core capital adequacy

ratio over a three-year period

Performance is measured by RBC:

Measures capital adequacy by

quantifying insurance risk,

business risk, and interest rate

risk of the consolidated

insurance operations of Aflac

Japan and Aflac U.S.

Similar to the PBRS awards granted to our other NEOs,

the CEO’s and President’s 2015 LTI awards were made

in 100% PBRS contingent upon the Company’s RBC

performance over the three-year period spanning 2015

to 2017. The RBC metric selected for the PBRS awards

to the CEO and President is the same as that disclosed

previously in the section titled

“

Long-term Equity

Incentives” beginning on page 35.

Consistent with prior years, the size of the CEO’s 2015

LTI award was based upon the Company’s relative

performance against its peers across the metrics shown

in the following table. Relative financial performance

carries an overall weighting of 54% and is measured by

revenue growth, net income growth, premium income

growth, earnings per share (“EPS”) growth, return on

revenues, return on average equity, and return on

average assets. Relative total shareholder return

(“TSR”) performance carries an overall 46% weighting

and is measured by 1-year TSR and 3-year TSR. The

performance period for all non-TSR metrics was the

trailing twelve month period ending September 30,

2015; and for the two TSR metrics, the Company’s TSR

was compared against the peers as of December 31,

2015. As summarized below, the contingent grant to

the CEO and President in February 2015 was trued-up

on December 31, 2015. This program design helps

align the LTI award for the CEO and President with our

relative performance for the current year (i.e., 2015).

As mentioned previously, the President was placed on

a performance-based program similar to the CEO’s

starting in 2015.

Based upon an analysis of the Company’s relative

financial performance and TSR, the Company ranked

10 out of 18 companies (17 peers plus the Company);

the lower the total weighted composite score, the higher

a company’s overall ranking (rankings on each metric

are out of 18 companies):

Realized

Value of

PBRS

Award

38