2015 Financial Performance Ranking Matrix

Aflac Incorporated Relative Ranking Among Peer Group

Aflac

Incorporated

Revenue

1-Year

Growth

Net

Income

1-Year

Growth

Premium

Income

1-Year

Growth

EPS

1-Year

Growth

Return on

Revenues

2015

Return on

Average

Equity

2015

Return on

Average

Assets

2015

1Yr

Indexed

TSR

(12/31/14-

12/31/15)

3Yr

Indexed

TSR

(12/31/12-

12/31/15)

Composite

Score

Performance

Rank

Relative

Ranking

(out of 18

companies)

12

12

13

12

3

3

8

10

17

—

—

Weightings

1

1

1

1

2

2

2

4

4

—

—

Totals

12

12

13

12

6

6

16

40

68

185

10

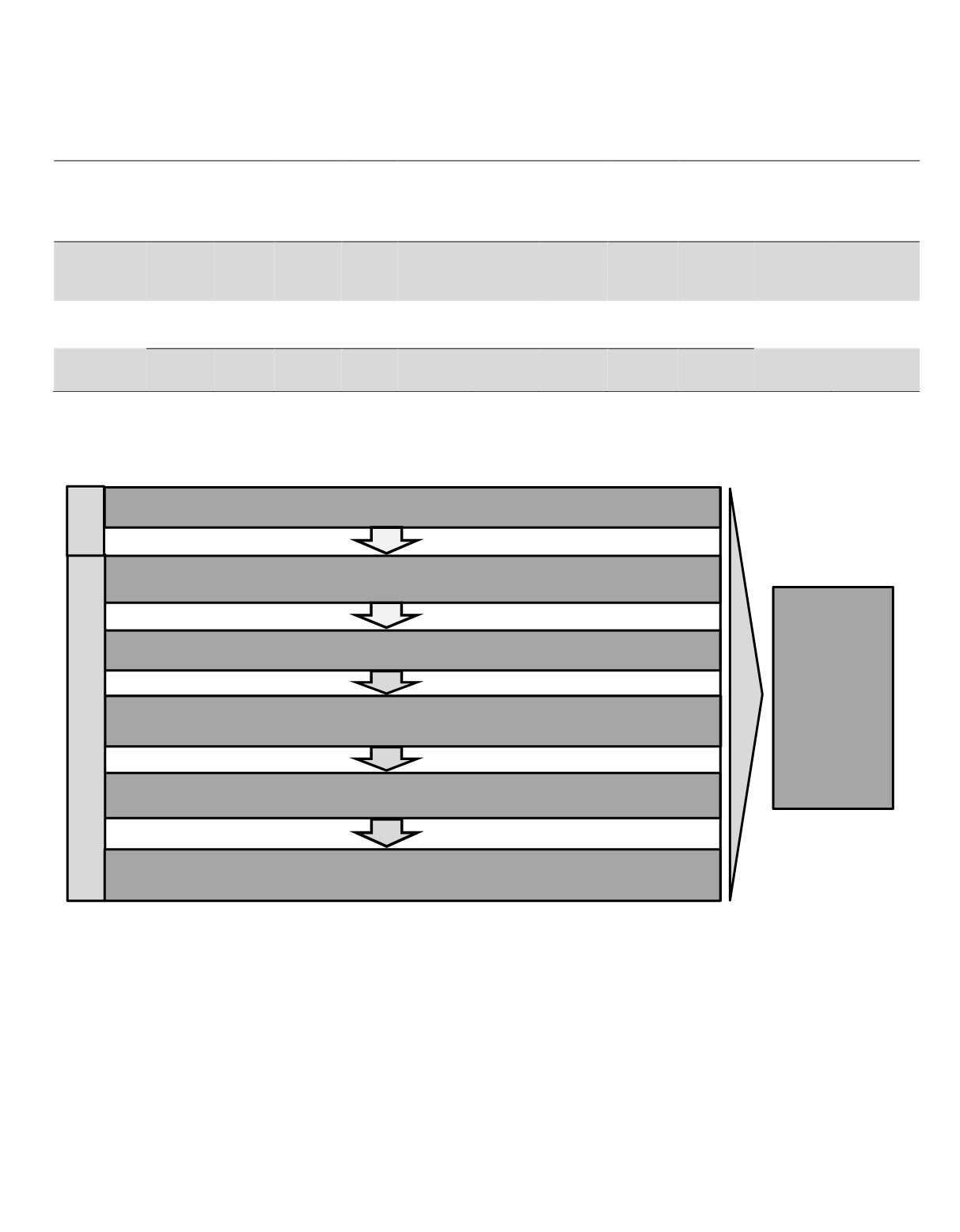

The CEO’s and President’s PBRS grant processes are summarized below:

For 2015, the above-described process resulted in the CEO receiving 78,548 PBRS, and the President receiving 49,101

PBRS. See “2015 Grants of Plan-based Awards” table for additional information.

Step 2: Determine the Company’s relative financial and TSR performance against its peers

Step 3: Assess CEO TDC at peers

Step 4: Calculate TDC amount for the CEO based upon the Company’s performance

percentile ranking versus peers

Step 5: Determine CEO’s final PBRS grant based on prior steps—adjust contingent PBRS

grant from February to reflect actual relative performance ranking

December

ecember

Step 1: Contingent PBRS grant issued based on prior year’s performance

February

Grant

received

contingent on

performance

over next

three years;

thus, CEO and

President

have to earn

award twice

Step 6: Determine President’s final PBRS grant—adjust contingent PBRS grant from

February so that TDC equates to 55% of CEO’s TDC

39