123

Annual Report and Accounts 2014

4.5 Retirement benefits

IMI offers a number of defined benefit arrangements to employees that will not be paid until more than a year after the period in which they are earned,

for example pension benefits, jubilee plans, post-employment and other long-term employee benefit arrangements.

There is a significant degree of estimation involved in predicting the ultimate benefits payable under these defined benefit arrangements in respect of which

the Group holds net liabilities on its balance sheet. This section explains how the value of these benefits payable and any assets funding the arrangements are

accounted for in the Group financial statements and gives details of the key assumptions upon which the estimations are based.

Assets and liabilities for defined contribution arrangements are minimal as they relate solely to short-term timing differences between the period during which

benefits have accrued and when contributions are paid into schemes.

Defined Contribution (‘DC’): Arrangements where the employer pays fixed contributions into an external fund on behalf of the employee (who is responsible for

making the investment decision and therefore assumes the risks and rewards of fund performance). Contributions to these arrangements are recognised in the

consolidated income statement as incurred.

Defined Benefit: A defined benefit pension plan is a pension arrangement in which the employer promises a specified annual benefit on retirement that is

predetermined by a formula based on the employee’s earnings history, tenure of service and age, rather than depending directly on individual investment returns.

In some cases, this benefit is paid as a lump sum on leaving the Company or while in the service of the Company rather than as a pension. The Group underwrites

one or more risks in meeting these obligations and therefore any net liability or surplus in these arrangements in shown on the Group balance sheet.

4.5.1 Summary information

Net pension deficit: £34.7m (2013: £157.9m)

The net pension deficit or ‘net liability for defined benefit obligations’ (‘DBO’) at 31 December 2014 was £34.7m (2013: £157.9m). A further £nil (2013: £0.8m)

was recognised in liabilities held for sale. The assets and liabilities of the schemes are aggregated, recognised in the consolidated balance sheet and shown

within non-current liabilities or in non-current assets if a scheme is in surplus and it is recoverable.

Number of Defined Benefit arrangements: 64 (2013: 74)

Ten schemes were divested on 1 January 2014, as part of the disposal of the Retail Dispense businesses. A further scheme in Sweden had its liabilities

bought-out on 1 September 2014 via an insurance contract. In the UK, the IMI Pension Fund commenced winding-up procedures and has been replaced

by two new Schemes (‘the UK Funds’).

The Group provides pension benefits through a mixture of funded and unfunded defined benefit and defined contribution (‘DC’) arrangements, although its

strategy is to move away from defined benefit arrangements towards defined contribution arrangements wherever possible to minimise the liability of the Group.

Assessments of the obligations of the defined benefit plans are carried out by independent actuaries, based on the projected unit credit method. An historical

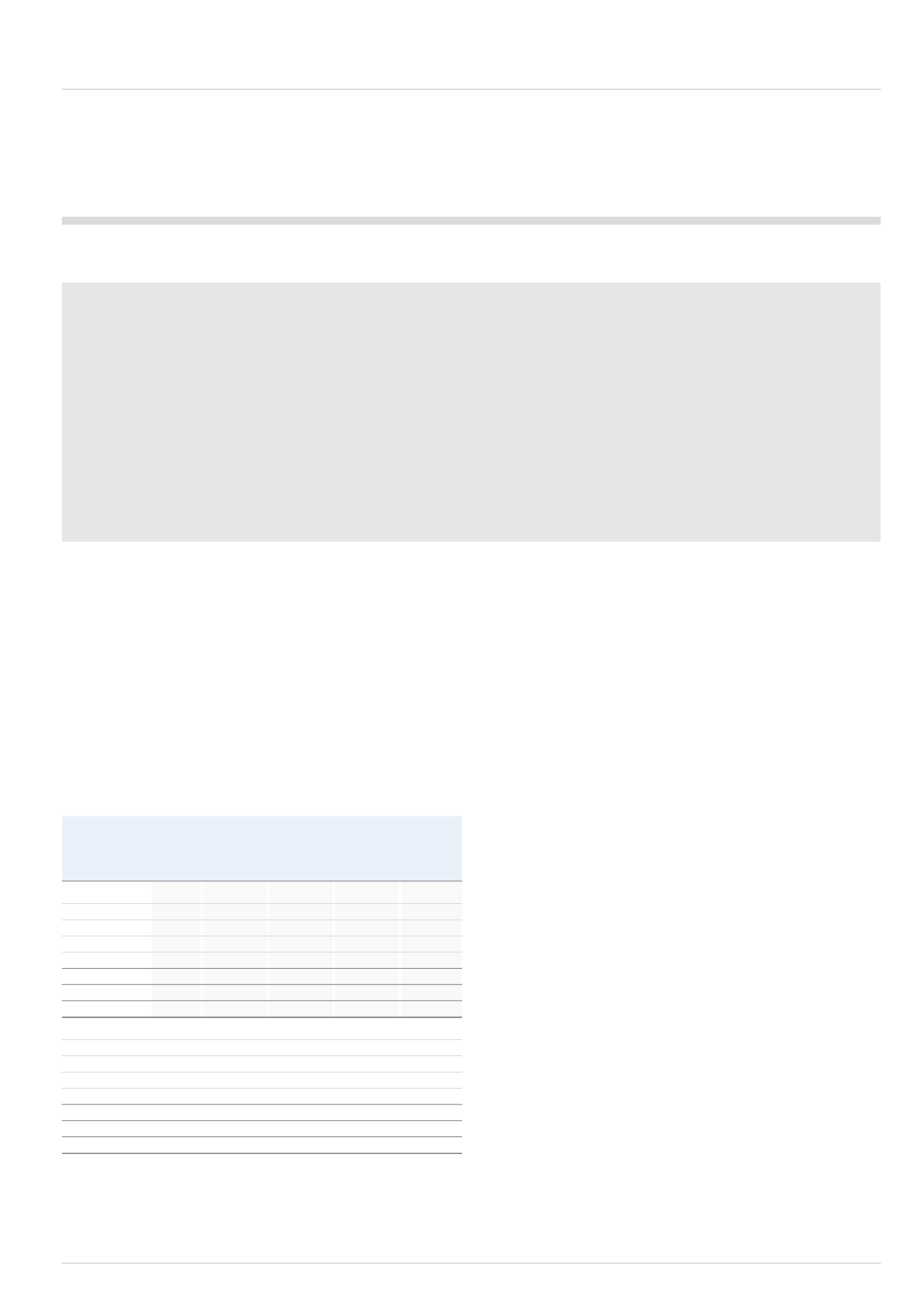

split of the types of defined benefit schemes in operation is as follows:

Defined

% benefit

%

Qty

Assets

of total

obligation

of total

Type of scheme

No.

£m assets

£m liabilities

2014

Final salary*

23

1,369.8

93% (1,362.7)

90%

Cash balance**

12

101.0

7% (127.4)

9%

Jubilee***

11

-

0% (2.0)

0%

Other

18

5.0

0% (18.3)

1%

Total

64

1,475.8

100% (1,510.4)

100%

Asset ceiling

(0.1)

Revised assets

1,475.7

2013

Final salary*

28

1,189.1

92% (1,321.2)

91%

Cash balance**

13

99.4

8% (112.1)

8%

Jubilee***

13

-

0% (2.1)

0%

Other

20

5.1

0% (16.6)

1%

Total

74

1,293.6

100% (1,452.0)

100%

Asset Ceiling

(0.3)

Revised assets

1,293.3

* Final Salary scheme:

The pension available to a member in a final salary

arrangement will be a proportion of the member’s salary at or around their

retirement date. This proportion will be determined by the member’s length of

pensionable service, their accrual rate and any particular circumstances under

which the member retires (for example early ill-health retirement).

** Cash Balance:

A cash balance scheme is a form of defined benefit pension

under which the member has the right to a defined lump sum on retirement

rather than a defined amount of pension receivable. For example a cash

balance plan may have minimum or guaranteed rates of return on pension

contributions. The amount of pension to which that lump sum may be converted

is determined by the annuity rates prevailing at the time of conversion.

*** Jubilee:

Jubilee plans provide for cash award payments which are based on

completed lengths of service. These payments are often made on cessation of

service with the Company, subject to a minimum period of service.