121

Annual Report and Accounts 2014

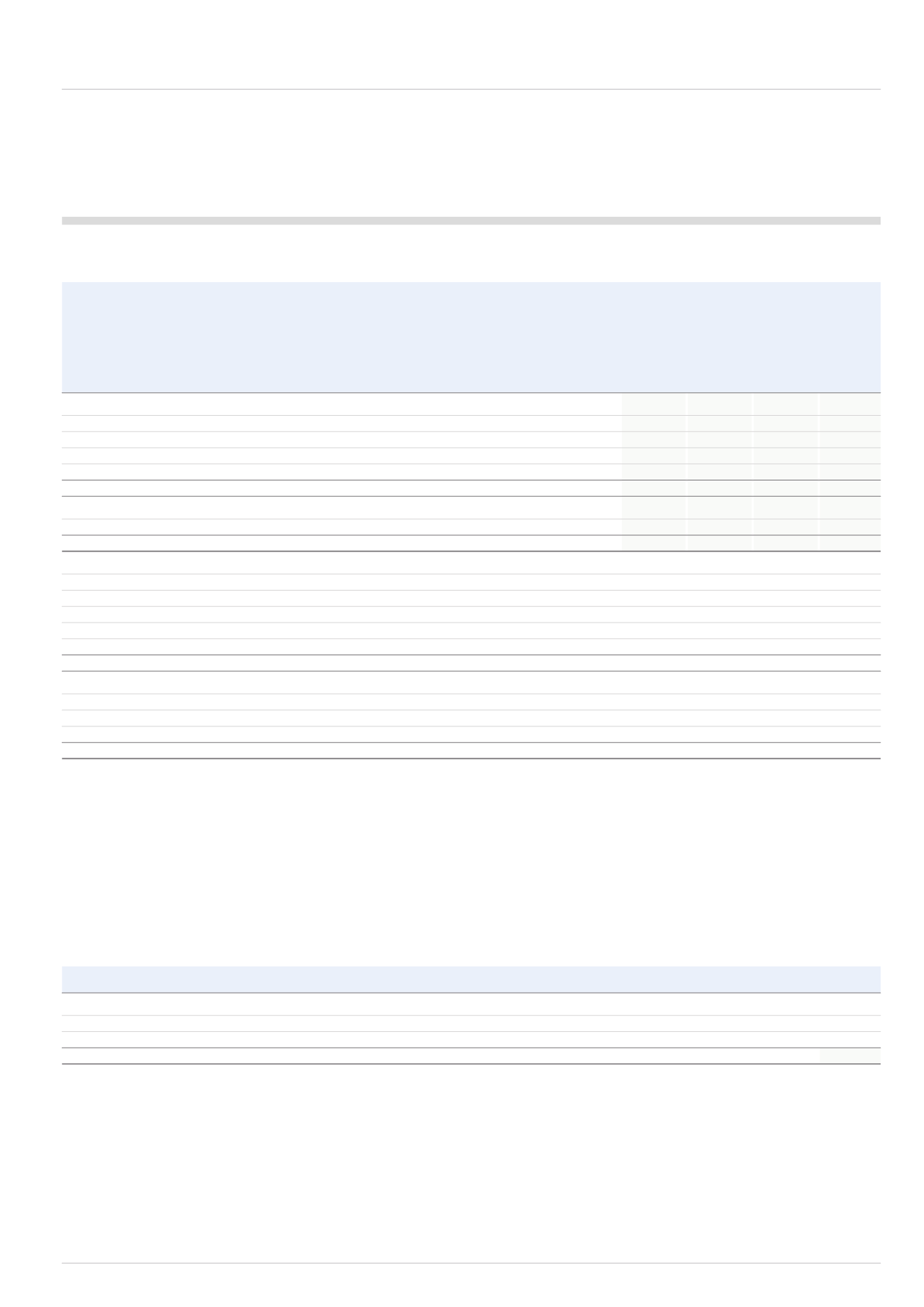

The following table shows the Group’s financial instruments held at fair value.

Quoted prices in

active markets

Significant

for identical

other

assets and

observable Unobservable

liabilities

inputs

inputs

Level 1

Level 2

Level 3

Total

£m

£m

£m

£m

As at 31 December 2014

Financial assets measured at fair value

Equity instruments*

19.0

19.0

Cash and cash equivalents

43.8

43.8

Foreign currency forward contracts

10.5

10.5

62.8

10.5

-

73.3

Financial liabilities measured at fair value

Foreign currency forward contracts

(9.2)

(9.2)

-

(9.2)

-

(9.2)

As at 31 December 2013

Financial assets measured at fair value

Equity instruments*

17.8

17.8

Cash and cash equivalents

99.9

99.9

Interest rate swaps

0.8

0.8

Foreign currency forward contracts

21.6

21.6

117.7

22.4

-

140.1

Financial liabilities measured at fair value

Debt instruments

(19.0)

(19.0)

Foreign currency forward contracts

(3.1)

(3.1)

Deferred consideration

(9.6)

(9.6)

-

(22.1)

(9.6)

(31.7)

* Equity instruments relate to investments in funds in order to satisfy long-term benefit arrangements.

Valuation techniques for level 2 inputs

Derivative assets and liabilities of £10.5m and £9.2m respectively are valued by level 2 techniques. The valuations are derived from discounted contractual cash

flows using observable, and directly relevant, market interest rates and foreign exchange rates from market data providers.

Valuation techniques for level 3 inputs

Deferred consideration, being contingent consideration of £nil (2013: £8.7m) and amounts payable to employees of £nil (2013: £0.9m) were previously measured

at fair value using significant unobservable (level 3) inputs.

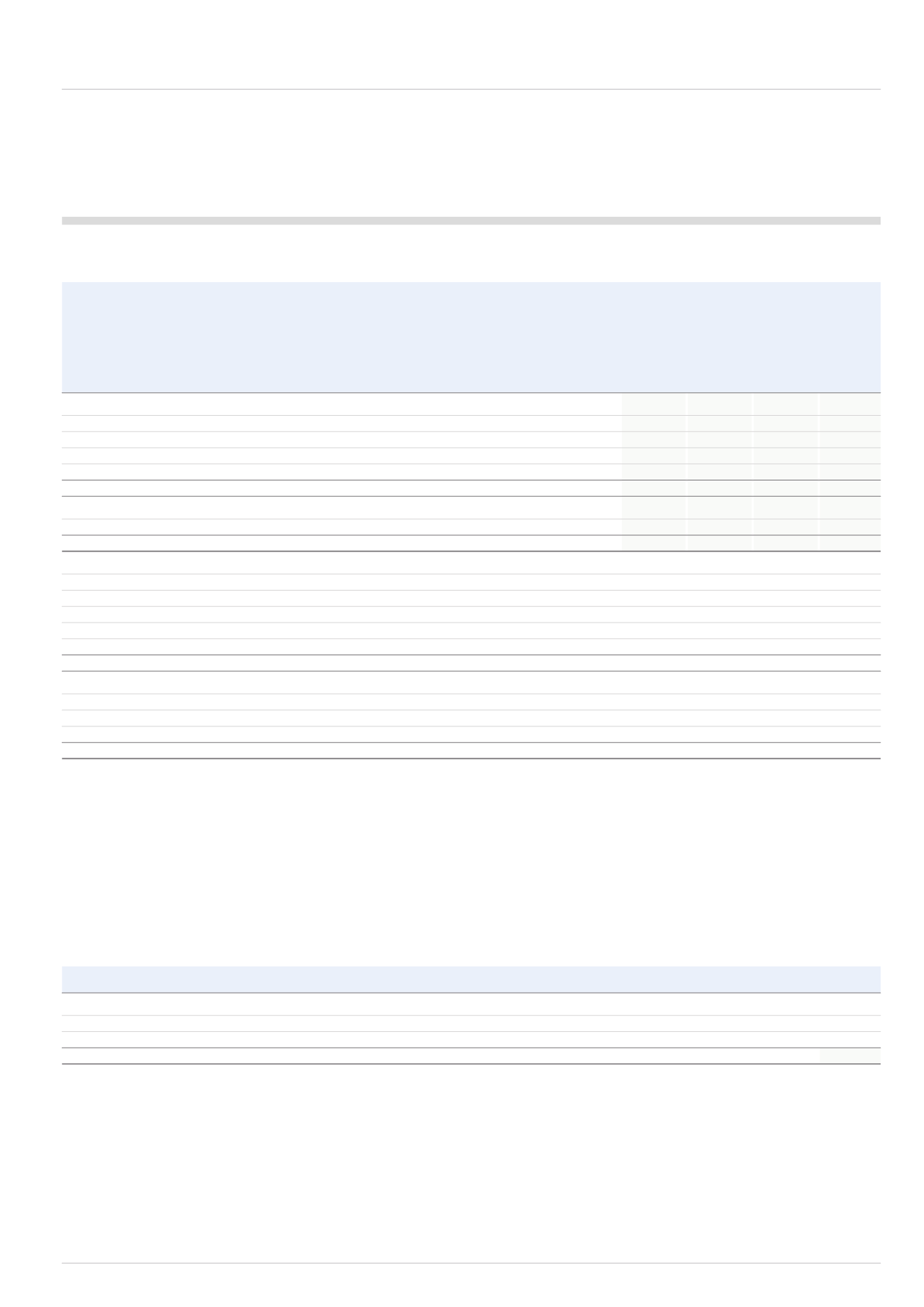

Deferred consideration reconciliation

£m

As at 1 January 2014

9.6

Arising in the year

(9.3)

Exchange adjustment

(0.3)

As at 31 December 2014

-