120

IMI plc

SECTION 4 – CAPITAL STRUCTURE AND FINANCING COSTS

Continued

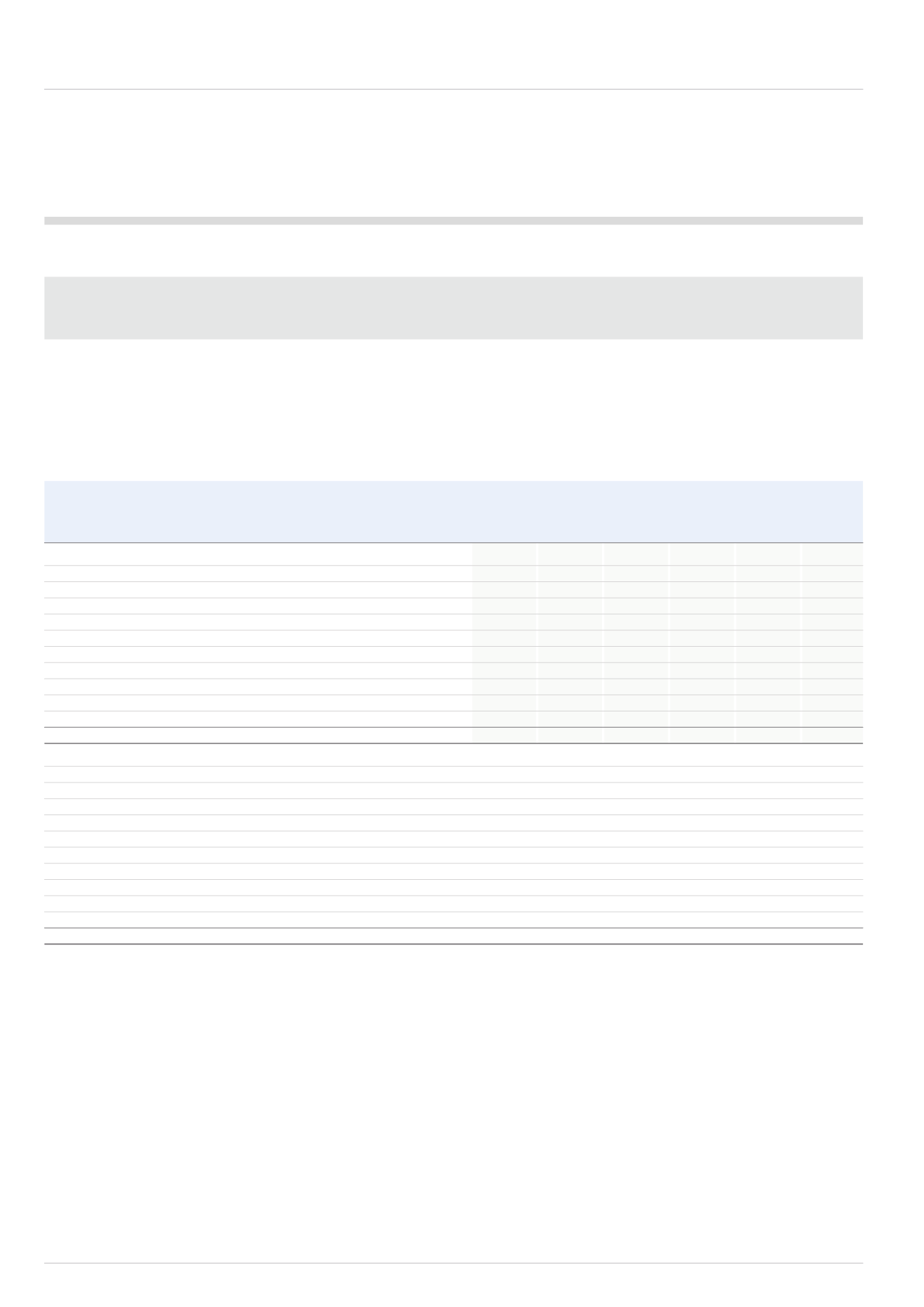

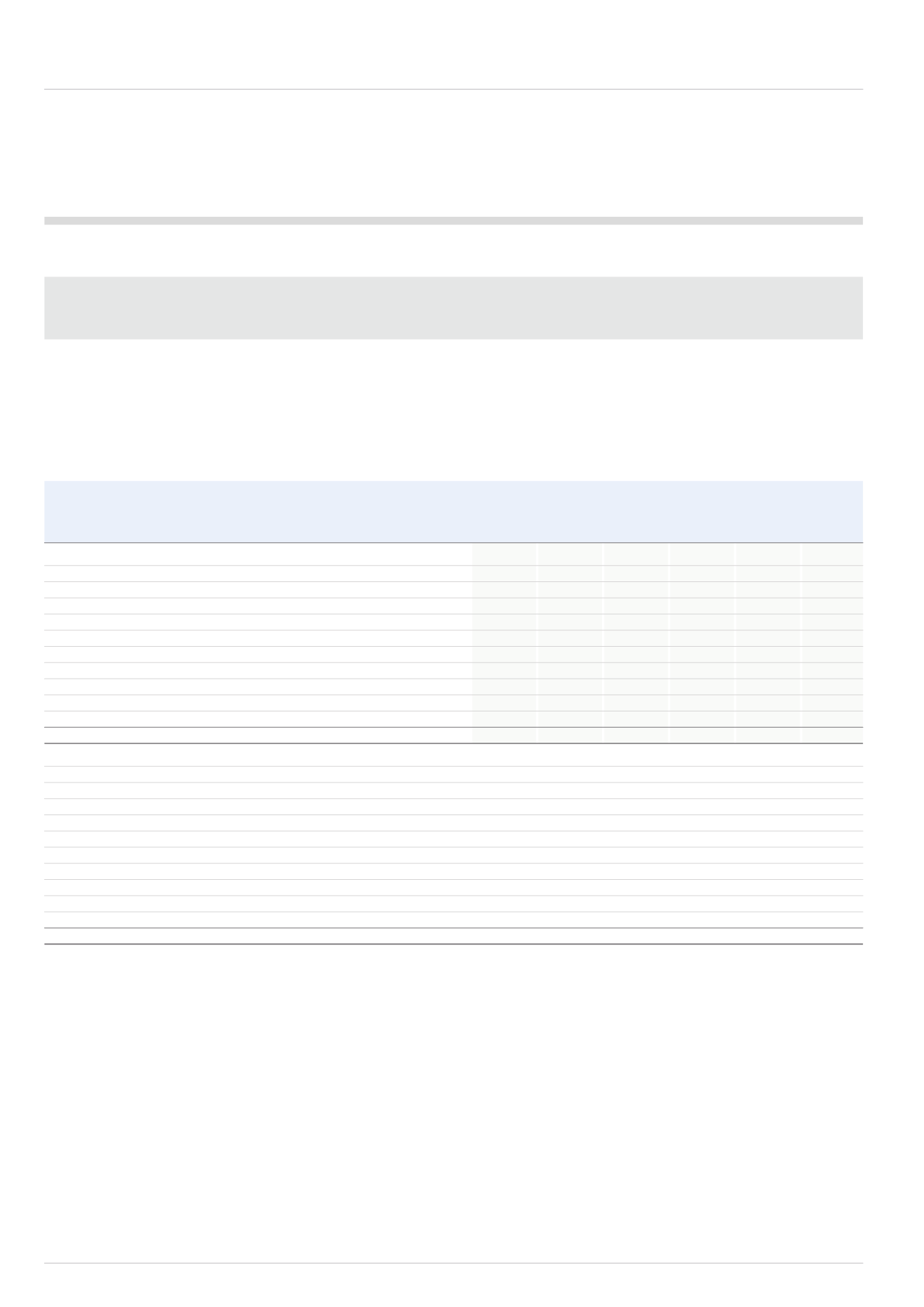

4.4.6 Fair value

Financial instruments included in financial statements are measured at either fair value or amortised cost. The measurement of this fair value can in some cases

be subjective, and can depend on the inputs used in the calculations. The Group generally calculates its own fair values using comparable observed market

prices and a valuation model using the respective and relevant market data for the instrument being valued.

4.4.6.1 Total financial assets and liabilities

The table below sets out the Group’s accounting classification of each class of financial assets and liabilities, and their fair values at 31 December 2014

and 31 December 2013. Under IAS39, all derivative financial instruments not in a hedge relationship are classified as derivatives at fair value through the

income statement. The Group does not use derivatives for speculative purposes and transacts all derivatives with suitable investment grade counterparties.

All transactions in derivative financial instruments are undertaken to manage the risks arising from underlying business activities.

Other Available for

At

Total

Designated derivatives sale assets amortised

carrying Fair value

at fair value at fair value at fair value

cost

value if different

£m

£m

£m

£m

£m

£m

2014

Cash and cash equivalents

43.8

43.8

Bank overdrafts

(23.0)

(23.0)

Borrowings due within one year

(2.0)

(2.0)

Borrowings due after one year

(218.8)

(218.8)

(248.7)

Trade and other payables*

(361.4)

(361.4)

Trade receivables

318.0

318.0

Investments

19.0

7.9

26.9

Other current financial assets/(liabilities)

Derivative assets**

8.1

2.4

10.5

Derivative liabilities***

(9.2)

(9.2)

Total

8.1

(6.8)

62.8

(279.3)

(215.2)

2013

Cash and cash equivalents

99.9

99.9

Bank overdrafts

(9.6)

(9.6)

Borrowings due within one year

(19.0)

(61.8)

(80.8)

(80.4)

Borrowings due after one year

(208.9)

(208.9)

(238.3)

Trade and other payables*

(353.6)

(353.6)

Trade receivables

293.6

293.6

Investments

20.2

20.2

Other current financial assets/(liabilities)

Derivative assets**

16.5

5.9

22.4

Derivative liabilities***

(3.1)

(3.1)

Total

(2.5)

2.8

120.1

(340.3)

(219.9)

* Trade and other payables exclude corporation tax and other tax liabilities and include liabilities of £15.4m (2013: £24.2m) falling due after more than one year;

£10.2m in 1-2 years, £2.0m in 2-3 years, £2.0m in 3-4 years, £1.2m in 4-5 years (2013: £10.1m in 1-2 years, £2.8m in 2-3 years, £2.0m in 3-4 years, £9.3m

in 4-5 years)

** Includes £nil (2013: £0.2m) falling due after more than one year.

*** Derivative liabilities include liabilities of £0.4m (2013: £0.3m) falling due after more than one year: £nil in 1-2 years and £nil in 2-3 years (2013: £nil in 1-2 yrs

and £0.3m in 2-3 yrs). Derivative liabilities designated at fair value represent the fair value of net investment hedge derivatives. The increase in value of net

investment hedge derivatives in the year of £3.6m (2013: £3.4m) is shown in the consolidated statement of comprehensive income.

There are no other financial liabilities included within payables disclosed above and finance leases disclosed in section 4.4.5.2.