119

Annual Report and Accounts 2014

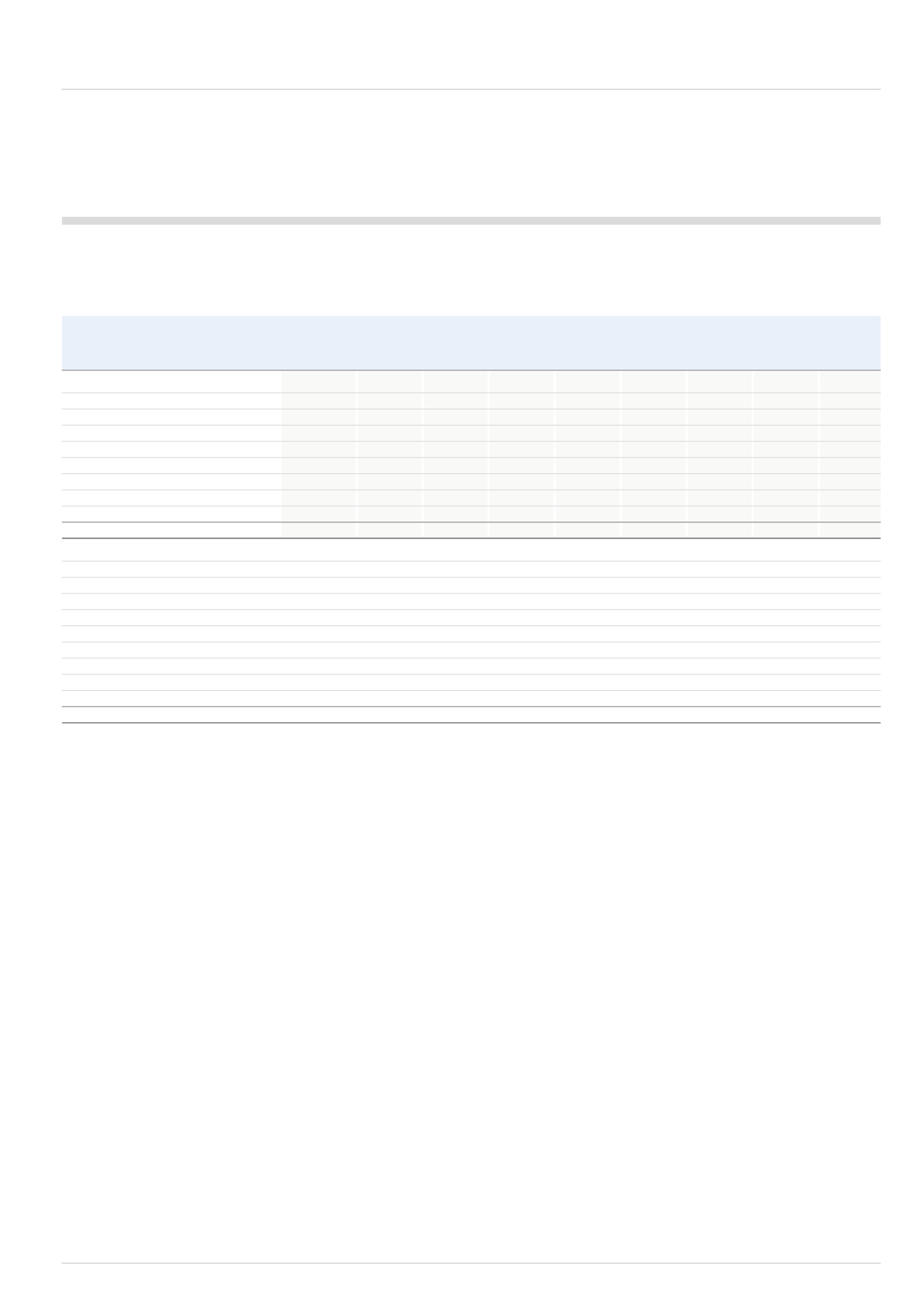

4.4.5.2 Terms and debt repayment schedule

The terms and conditions of cash and cash equivalents and outstanding loans were as follows:

Effective

Carrying Contractual

0 to

1 to

2 to

3 to

4 to

5 years

interest rate

value cash flows

<1 year

<2 years

<3 years

<4 years

<5 years

and over

%

£m

£m

£m

£m

£m

£m

£m

£m

2014

Cash and cash equivalents

Floating

43.8

43.8

43.8

US loan notes 2022

7.17% (9.6)

(15.1)

(0.7)

(0.7)

(0.7)

(0.7)

(0.7)

(11.6)

US loan notes 2016

7.26% (48.1)

(53.6)

(3.5)

(50.1)

US loan notes 2018

5.98% (96.2)

(114.4)

(5.8)

(5.8)

(5.8)

(97.0)

US loan notes 2019

7.61% (64.1)

(86.5)

(4.9)

(4.9)

(4.9)

(4.9)

(66.9)

Finance leases

Various

(1.3)

(1.3)

(0.6)

(0.4)

(0.2)

(0.1)

Bank overdrafts

Floating

(23.0)

(23.0)

(23.0)

Unsecured bank loans

Floating

(1.5)

(1.8)

(1.4)

(0.2)

(0.1)

(0.1)

Total

(200.0)

(251.9)

3.9

(62.1)

(11.7)

(102.8)

(67.6)

(11.6)

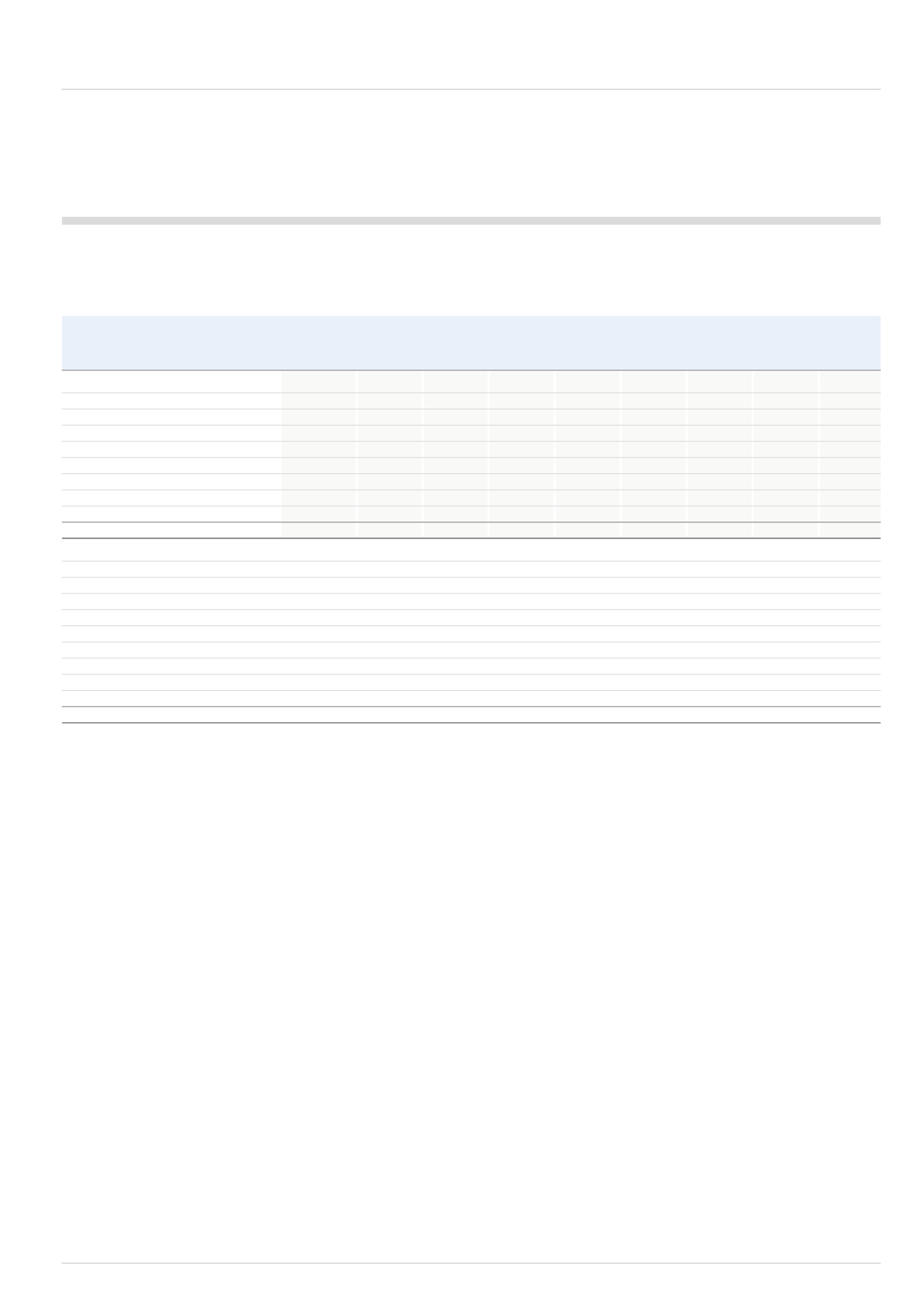

2013

Cash and cash equivalents

Floating

99.9

99.9

99.9

US loan notes 2022

7.17% (9.1)

(14.9)

(0.7)

(0.7)

(0.7)

(0.7)

(0.7)

(11.4)

US loan notes 2014

Floating

(19.0)

(19.1)

(19.1)

US loan notes 2016

7.26% (45.5)

(54.0)

(3.3)

(3.3)

(47.4)

US loan notes 2018

5.98% (90.9)

(113.4)

(5.4)

(5.4)

(5.4)

(5.4)

(91.8)

US loan notes 2019

7.61% (60.6)

(86.3)

(4.6)

(4.6)

(4.6)

(4.6)

(4.6)

(63.3)

Finance leases

Various

(1.6)

(1.9)

(0.8)

(0.6)

(0.3)

(0.2)

Bank overdrafts

Floating

(9.6)

(9.6)

(9.6)

Unsecured bank loans

Floating

(63.0)

(63.2)

(61.0)

(1.0)

(0.3)

(0.3)

(0.3)

(0.3)

Total

(199.4)

(262.5)

(4.6)

(15.6)

(58.7)

(11.2)

(97.4)

(75.0)

Contractual cash flows include undiscounted committed interest cash flows and, where the amount payable is not fixed, the amount disclosed is determined by

reference to the conditions existing at the reporting date.