101

Annual Report and Accounts 2014

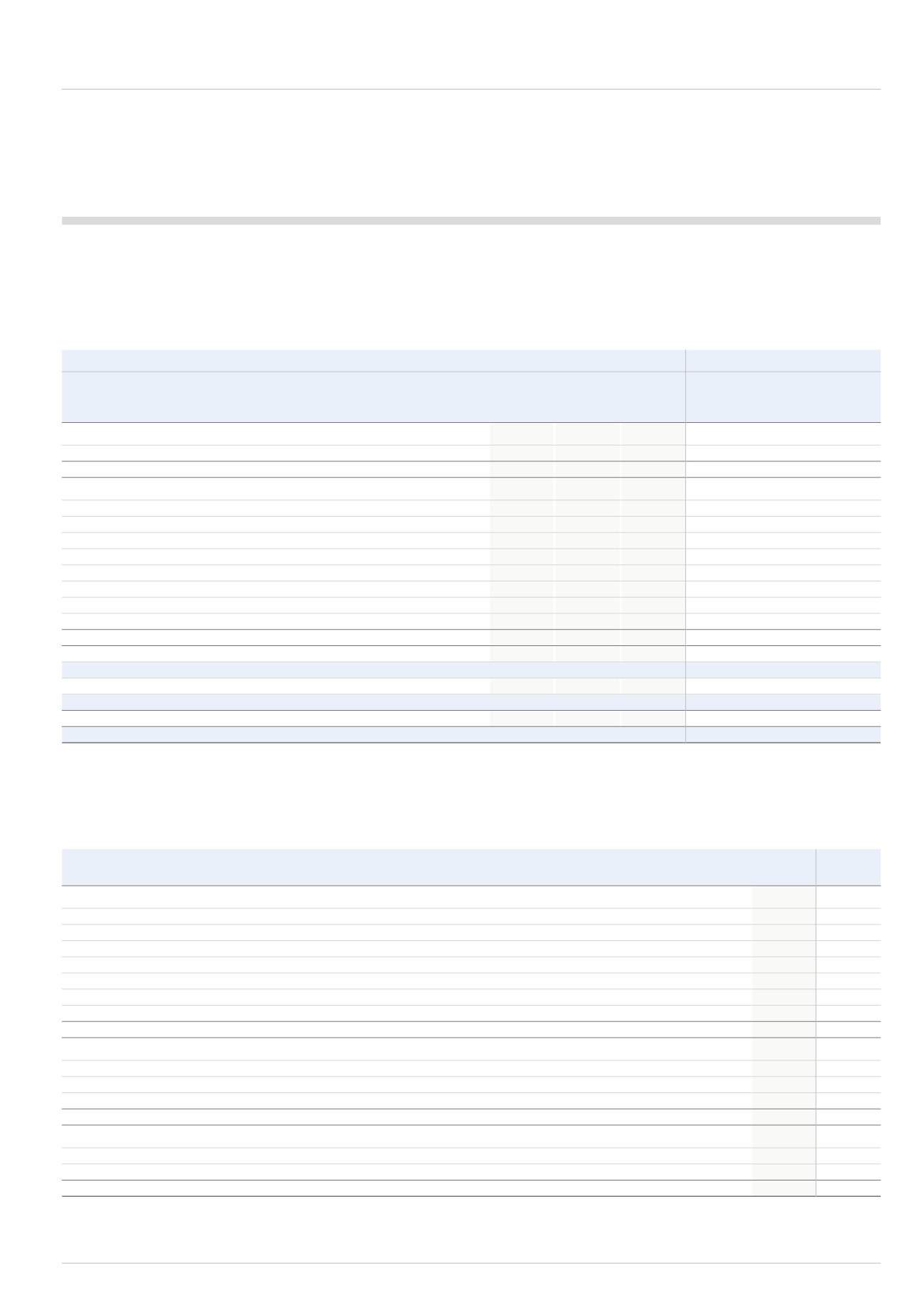

2.4.5 Reconciliation of effective tax rate

As IMI’s head office and parent company is domiciled in the UK, the Group references its effective tax rate to the UK corporation tax rate, despite only a small proportion

of the Group’s business being in the UK. Therefore, the following tax reconciliation applies the UK corporation tax rate for the year to profit before tax, both before and

after exceptional items. This resulting tax charge is reconciled to the actual tax charge for the Group, by taking account of specific tax adjustments as follows:

2014

2013

Before Exceptional

Before Exceptional

exceptionals

items

Total

exceptionals

items

Total

£m

£m

£m

£m

£m

£m

Profit before tax from continuing operations

278.1

(32.4)

245.7

297.7

(48.4)

249.3

Profit before tax from discontinued operations (section 2.5)

-

481.0

481.0

80.4

(8.0)

72.4

Profit before tax

278.1

448.6

726.7

378.1

(56.4)

321.7

Income tax using the Company’s domestic rate of tax of 21.5% (2013: 23.25%)

59.8

96.4

156.2

87.9

(13.1)

74.8

Effects of:

Non-deductible items

2.9

4.7

7.6

4.3

2.1

6.4

Exceptional tax charge on restructuring

-

-

-

-

17.1

17.1

Non-taxable profit on disposal of businesses

-

(108.0)

(108.0)

-

-

-

Utilisation of tax losses

-

-

-

(1.4)

-

(1.4)

Current year losses for which no deferred tax asset has been recognised

1.3

-

1.3

1.3

-

1.3

Differing tax rates

0.8

(1.7)

(0.9)

(0.1)

(2.1)

(2.2)

Over/(under) provided in prior years

(3.6)

2.8

(0.8)

(1.3)

-

(1.3)

Total tax in income statement (section 2.4)

61.2

(5.8)

55.4

90.7

4.0

94.7

Income tax expense reported in the consolidated income statement

61.2

(8.3)

52.9

65.5

(9.8)

55.7

Effective rate of tax:

22.0%

21.5%

22.0%

22.3%

Income tax attributable to discontinued operations (section 2.5)

-

2.5

2.5

25.2

13.8

39.0

Effective rate of tax:

0.5%

31.3%

53.9%

Total tax in income statement (section 2.4)

61.2

(5.8)

55.4

90.7

4.0

94.7

Effective rate of tax:

22.0%

7.6%

24.0%

29.4%

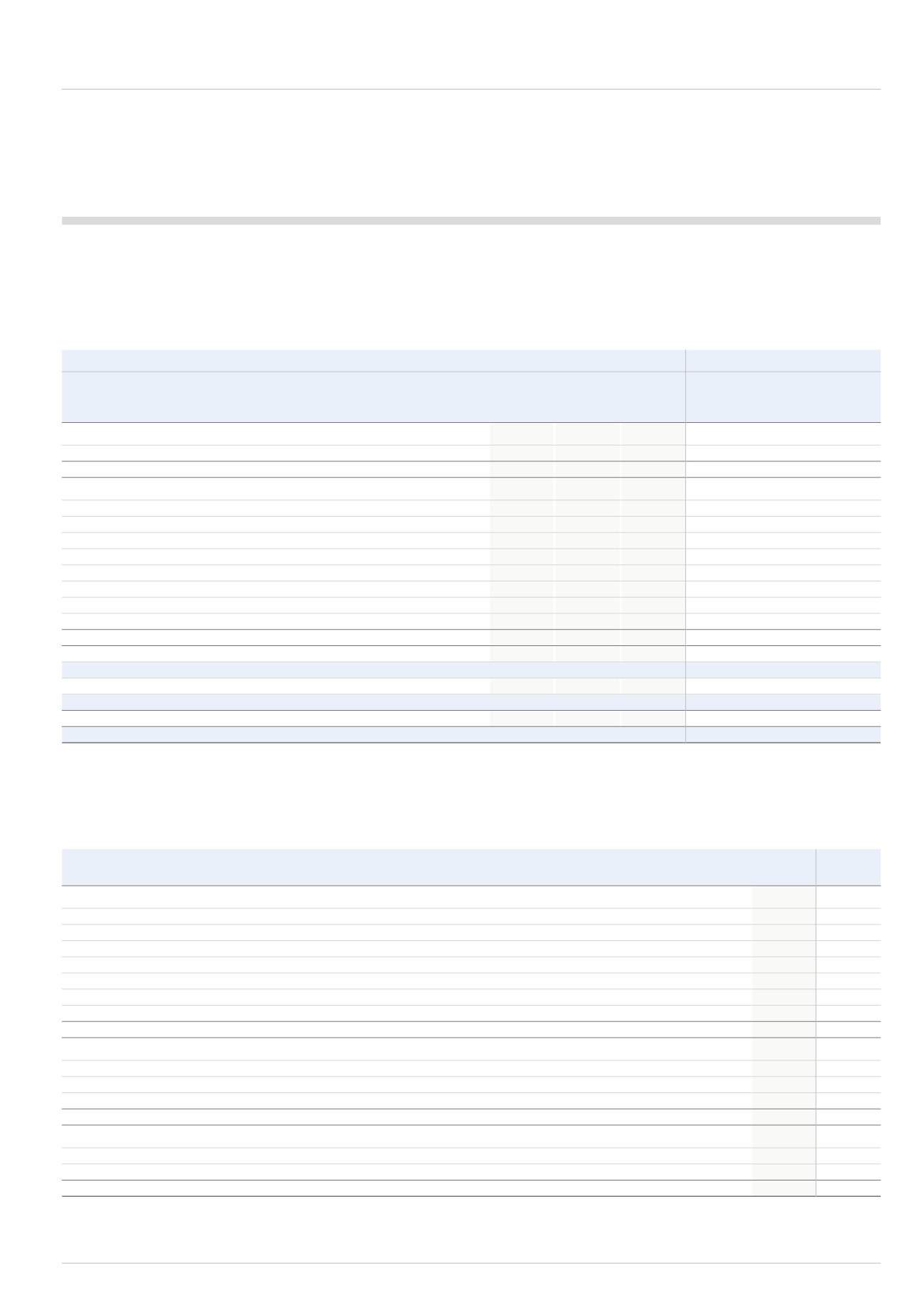

2.4.6 Recognised outside of the income statement

In addition to amounts charged to the income statement, some current tax and deferred tax is charged/(credited) directly to equity or through other

comprehensive income, which can be analysed as follows:

2014

2013

£m

£m

Deferred tax:

On equity-settled transactions

5.2

(0.3)

On change in value of effective net investment hedge derivatives

0.7

0.7

On available for sale financial assets

0.4

(0.2)

On fair value gain on deal-contingent forward relating to disposal proceeds

(3.0)

3.0

On re-measurement gains and on defined benefit plans

2.2

21.3

On pension restructuring

(3.0)

-

On foreign currency translation differences

-

(1.0)

2.5

23.5

Current tax:

On pension restructuring

9.6

-

On foreign currency translation differences

(1.5)

-

On equity-settled transactions

(4.0)

(5.3)

6.6

18.2

Of which the following amounts are charged/(credited):

to the statement of comprehensive income

5.4

23.8

to the statement of changes in equity

1.2

(5.6)

6.6

18.2