118

IMI plc

SECTION 4 – CAPITAL STRUCTURE AND FINANCING COSTS

Continued

4.4.4.1

Overview

The Board monitors the geographical spread of its shareholders and

employees are encouraged to hold shares in the Company. The underlying

capital base of the Group includes total equity and reserves and net debt.

Employee benefit obligations net of deferred tax form part of the extended

capital base. Management of this element of the capital base is discussed

further in section 4.5 of the financial statements. Undrawn committed funding

facilities are maintained as described in section 4.4.5.1 to provide additional

capital for growth (including acquisitions and organic investments) and liquidity

requirements as discussed above.

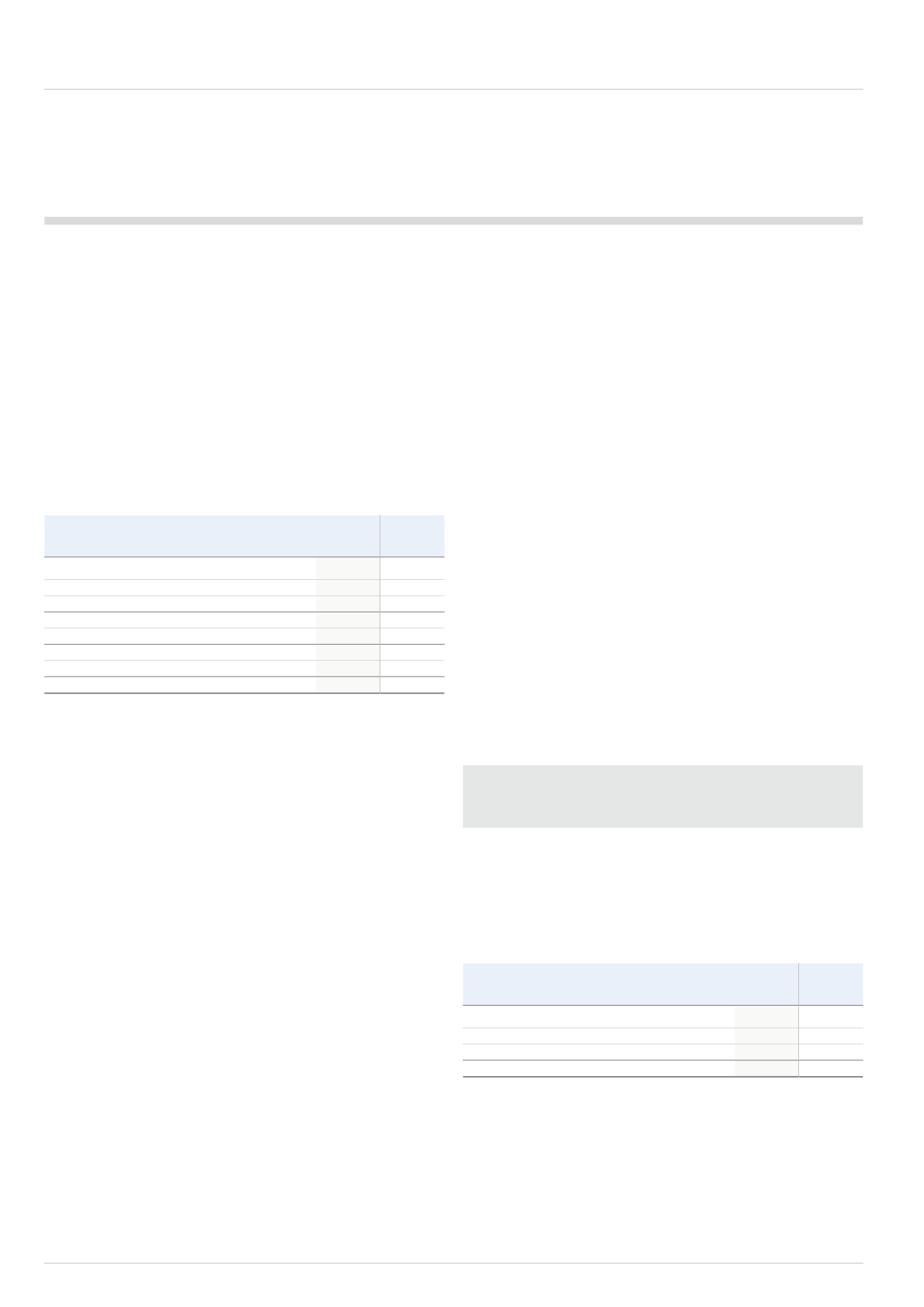

4.4.4.2

Capital base

2014

2013

£m

£m

Total equity

554

648

Gross debt including overdrafts

244

299

Gross cash

(44)

(100)

Capital base

754

847

Employee benefits and deferred tax assets

13

131

Extended capital base

767

978

Undrawn funding facilities

272

215

Available capital base

1,039

1,193

Part of the capital base is held in currencies to broadly match the currency base

of the assets being funded as described in the asset translation risk section.

4.4.4.3

Debt or equity

The balance between debt and equity in the capital base of the Company is

considered regularly by the Board in the light of market conditions, business

forecasts, growth opportunities and the ratio of net debt to EBITDA. Funding

covenants currently limit net debt to a maximum of three times EBITDA. The

net debt to EBITDA ratio at the end of 2014 was 0.5 times (2013: 0.5 times)

and was 0.6 times excluding disposal gains and one-off pension gains from

the continuing EBITDA. Through the life of our five year plan, the Board would

consider appropriate acquisitions which might take net debt to EBITDA to

an internal limit of up to two and half times EBITDA on acquisition, with an

expectation to fall to no more than two times EBITDA within two years of the

acquisition, as long as prevailing market conditions and the outlook for our

existing businesses supported such a move. It is expected that at these levels

our debt would still be perceived as investment grade. The potential benefits

to equity shareholders of greater leverage are offset by higher risk and the cost

and availability of funding. The Board will consider raising additional equity in

the event that it is required to support the capital base of the Group.

4.4.4.4

Dividend policy and share buybacks

As part of the capital management process, the Group ensures that adequate

reserves are available in IMI plc in order to meet proposed shareholder

dividends, the purchase of shares for employee share scheme incentives

and any on-market share buyback programme.

The Board supports a progressive dividend policy with an aim that the dividend

should be covered by at least two times underlying earnings. In the event that

the Board cannot identify sufficient investment opportunities through capital

expenditure, organic growth initiatives and acquisitions, the return of funds to

shareholders through share buybacks or special dividends will be considered.

It should be noted that a number of shares are regularly bought in the market

by an employee benefit trust in order to hedge the exposure under certain

management incentive plans. Details of these purchases are shown in section

4.6.2 to the financial statements.

4.4.4.5

Weighted average cost of capital

The Group currently uses a post-tax Weighted Average Cost of Capital

(‘WACC’) of 9% (2013: 8%) as a benchmark for investment returns. This is

reviewed regularly in the light of changes in market rates. The Board tracks

the Group’s return on invested capital and seeks to ensure that it consistently

delivers returns in excess of the WACC. Consistent with this objective the

growth in Economic Value Added (EVA) was used as a metric in the Group’s

long-term incentive programmes.

4.4.5

Debt and credit facilities

This section provides details regarding the specific borrowings that the

Group has in place to satisfy the debt elements of the capital management

policy discussed above.

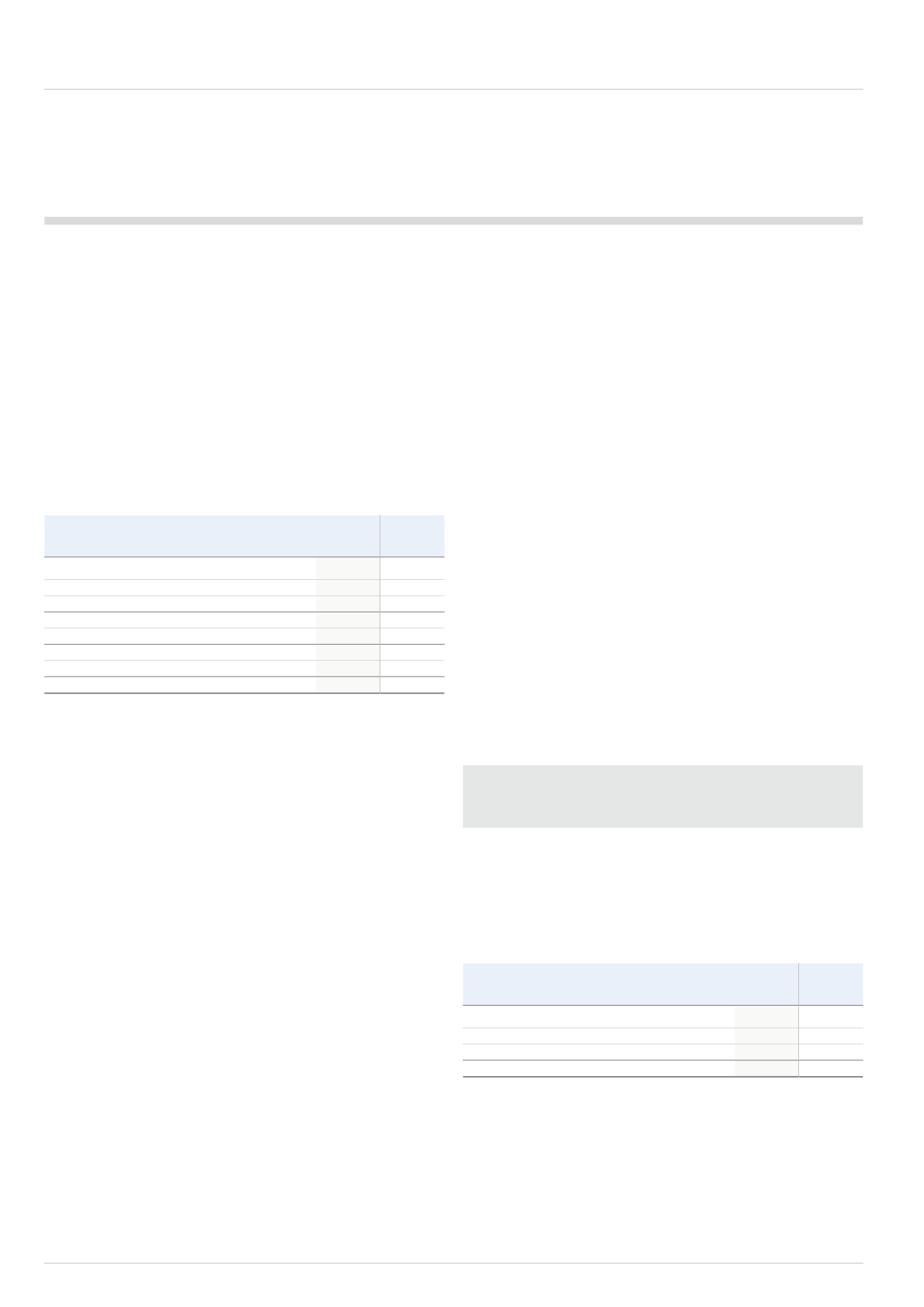

4.4.5.1

Undrawn committed facilities

The Group has various undrawn committed borrowing facilities. The facilities

available at 31 December in respect of which all conditions precedent had

been met were as follows:

2014

2013

£m

£m

Expiring within one year

48

140

Expiring between one and two years

24

50

Expiring after more than two years

200

25

272

215

The weighted average life of these facilities is 2.9 years (2013: 1.1 years).