117

Annual Report and Accounts 2014

4.4.3.3

Commodity risk

The commodity inputs to the Group’s production process typically consist

of base metals. Commodity risk for the Group is the risk that the prices of

these inputs could rise, thus reducing Group profits.

a) Overview

Including the discontinued businesses, the Group’s operating companies

purchase metal and metal components with an annual base metal material

value of approximately £31m (2013: £35m).

b) Management of commodity risk

The Group manages this exposure through a centralised process hedging

copper, zinc and aluminium using a combination of financial contracts and local

supply agreements designed to minimise the volatility of short-term margins.

4.4.3.4

Liquidity risk

Liquidity risk is the risk that the Group will not be able to meet its financial

obligations as they fall due.

a) Management of liquidity risk

The Group’s approach to managing liquidity is to ensure, as far as possible,

that it will always have adequate resources to meet its liabilities when they

fall due, with sufficient headroom to cope with abnormal market conditions.

This position is reviewed on a quarterly basis.

Funding for the Group is co-ordinated centrally by the treasury function and

comprises committed bilateral facilities with a core group of banks, and a series

of US loan note issues. The level of facilities is maintained such that facilities

and term loans exceed the forecast peak gross debt of the Group over a rolling

12 month view by an appropriate amount taking into account market conditions

and corporate activity, including acquisitions, organic growth plans and share

buybacks. In addition, we undertake rigorous and regular covenant compliance

reviews to ensure that we remain fully within those covenant limits. At the end

of 2014 the Group had undrawn committed facilities totalling £272m (2013:

£215m) and was holding cash and cash equivalents of £44m (2013: £100m).

There are no significant seasonal funding requirements or capital intensive

investment areas for the Group.

4.4.4

Capital management

Capital management concerns the decision as to how the Group’s activities

are financed and specifically, how much of the Group capital is provided by

borrowings (or debt) and how much of it is financed with equity raised from

the issue of share capital.

The Board’s policy is to maintain a balance sheet with a broad capital

base and the strength to sustain the future development of the business

including acquisitions. This section discusses how the Board views the

capital base of the Group and the impact on leverage, distribution policy

and investment policy.

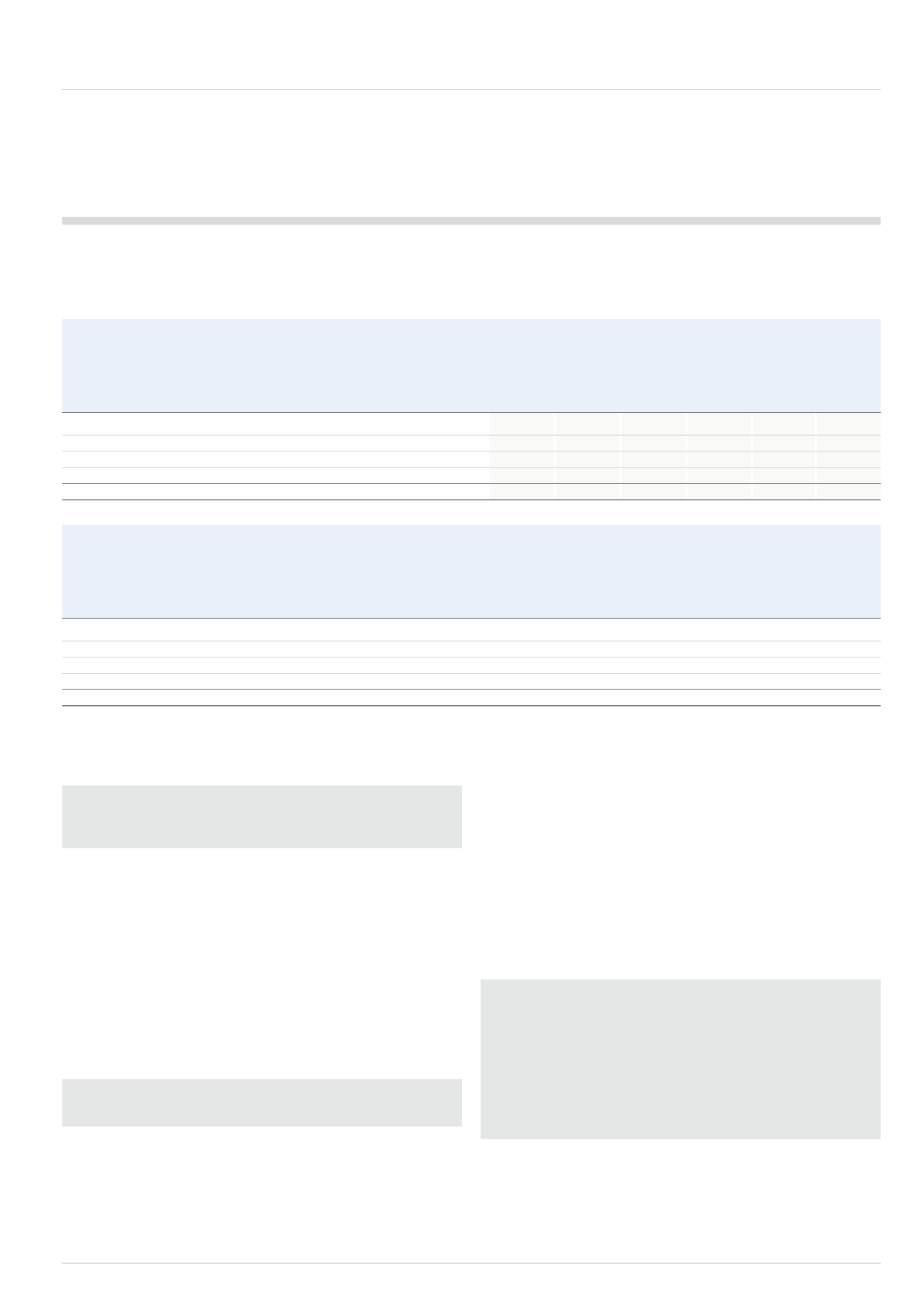

b) Interest rate risk profile

The following table shows how much of our cash, interest-bearing liabilities and exchange contracts attract both fixed and floating rate interest charges,

and how this is analysed between currencies:

Weighted

Debt and Cash and

Weighted average

exchange exchange

Floating

Fixed average

period

contracts contracts

rate

rate

fixed for which

2014

2014

2014

2014 interest rate rate is fixed

£m

£m

£m

£m

% years

Sterling

-

343

343

-

US Dollar

(218)

106

106

(218)

6.8

3.4

Euro

(303)

6

(297)

-

Other

(172)

38

(134)

-

Total

(693)

493

18

(218)

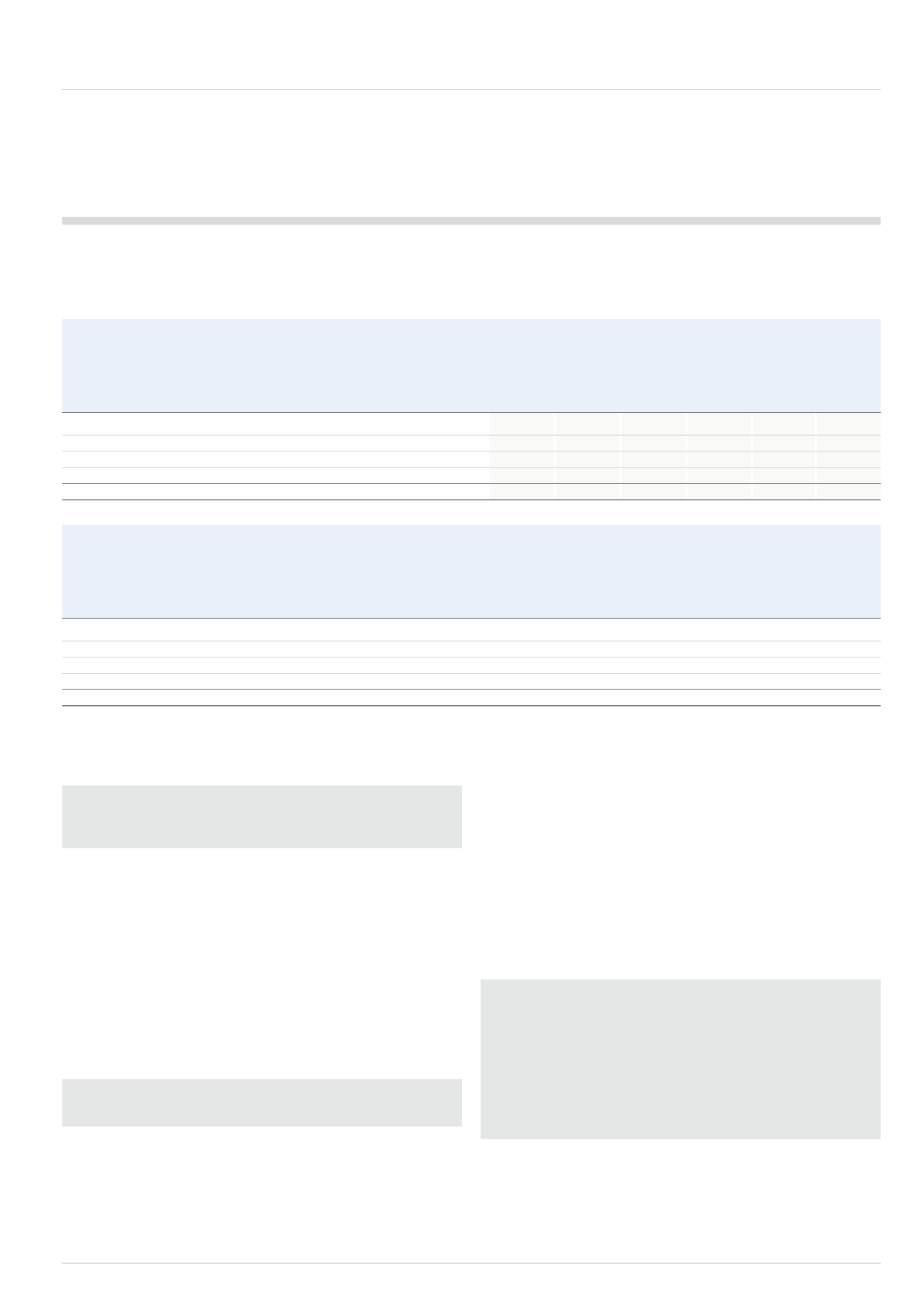

Weighted

Debt and Cash and

Weighted

average

exchange exchange

Floating

Fixed

average

period

contracts

contracts

rate

rate

fixed for which

2013

2013

2013

2013 interest rate rate is fixed

£m

£m

£m

£m

% years

Sterling

(60)

515

455

-

US Dollar

(243)

3

(34)

(206)

6.8

4.4

Euro

(327)

16

(311)

-

Other

(164)

61

(103)

-

Total

(794)

595

7

(206)