102

IMI plc

SECTION 2 – RESULTS FOR THE YEAR

Continued

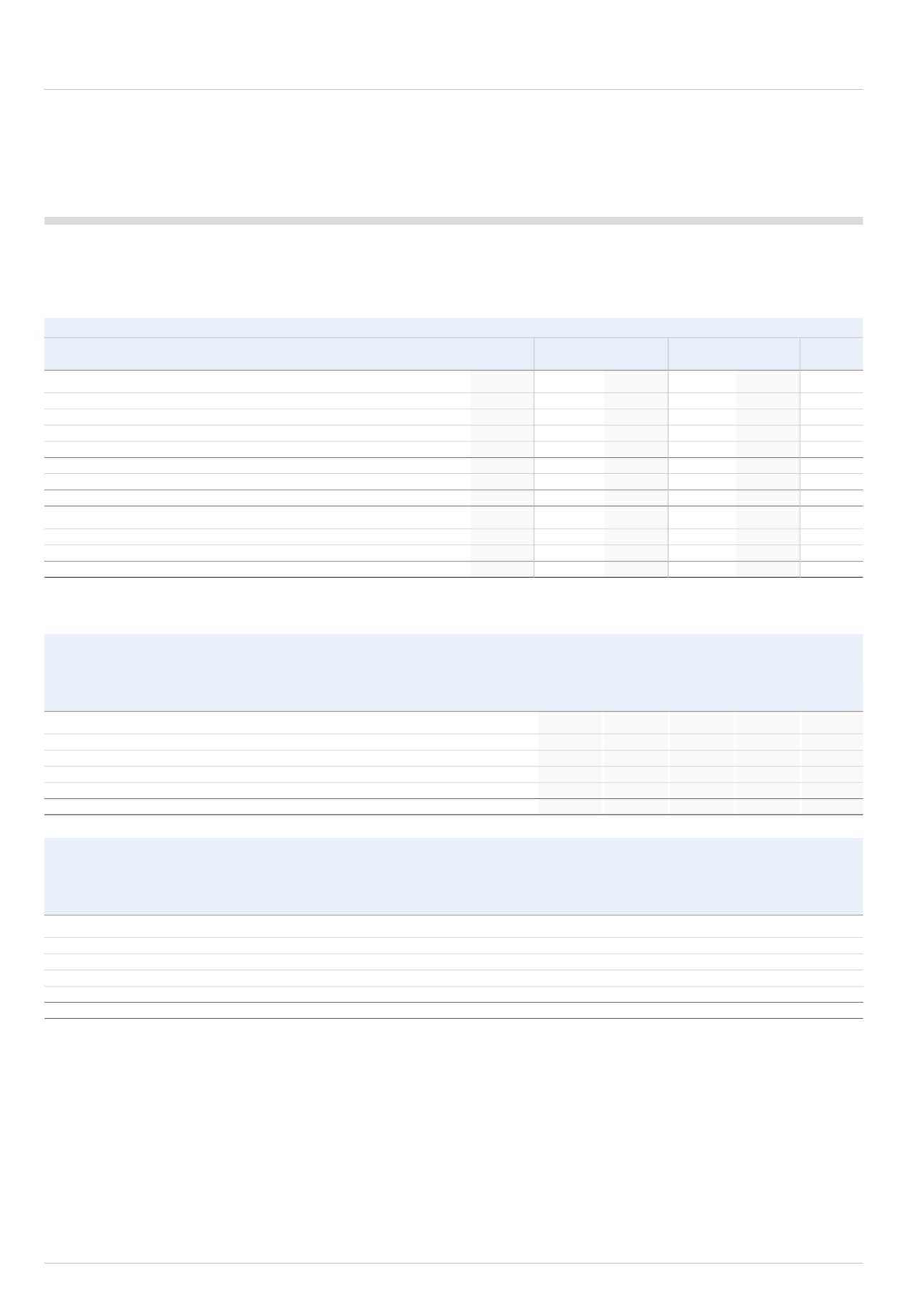

2.4.7 Recognised deferred tax assets and liabilities

Deferred taxes record the tax consequences of temporary differences between the accounting and taxation recognition of certain items, as explained below:

Assets

Liabilities

Net

2014

2013

2014

2013

2014

2013

£m

£m

£m

£m

£m

£m

Non-current assets

3.7

6.1

(40.8)

(59.6)

(37.1)

(53.5)

Inventories

3.5

5.6

(4.1)

(5.5)

(0.6)

0.1

On revaluation of derivatives

1.9

0.5

(2.4)

(2.3)

(0.5)

(1.8)

Employee benefits and provisions

35.2

58.9

(5.4)

(4.3)

29.8

54.6

Other tax assets

2.5

4.0

-

-

2.5

4.0

46.8

75.1

(52.7)

(71.7)

(5.9)

3.4

Set off of tax

(25.5)

(27.4)

25.5

27.4

-

-

Total deferred tax assets and liabilities

21.3

47.7

(27.2)

(44.3)

(5.9)

3.4

Reflected in the balance sheet as follows:

Deferred taxation asset/(liability)

21.3

43.9

(27.2)

(34.3)

(5.9)

9.6

Asset/(liability) held for sale (Section 2.5)

-

3.8

-

(10.0)

-

(6.2)

Total deferred tax assets and liabilities

21.3

47.7

(27.2)

(44.3)

(5.9)

3.4

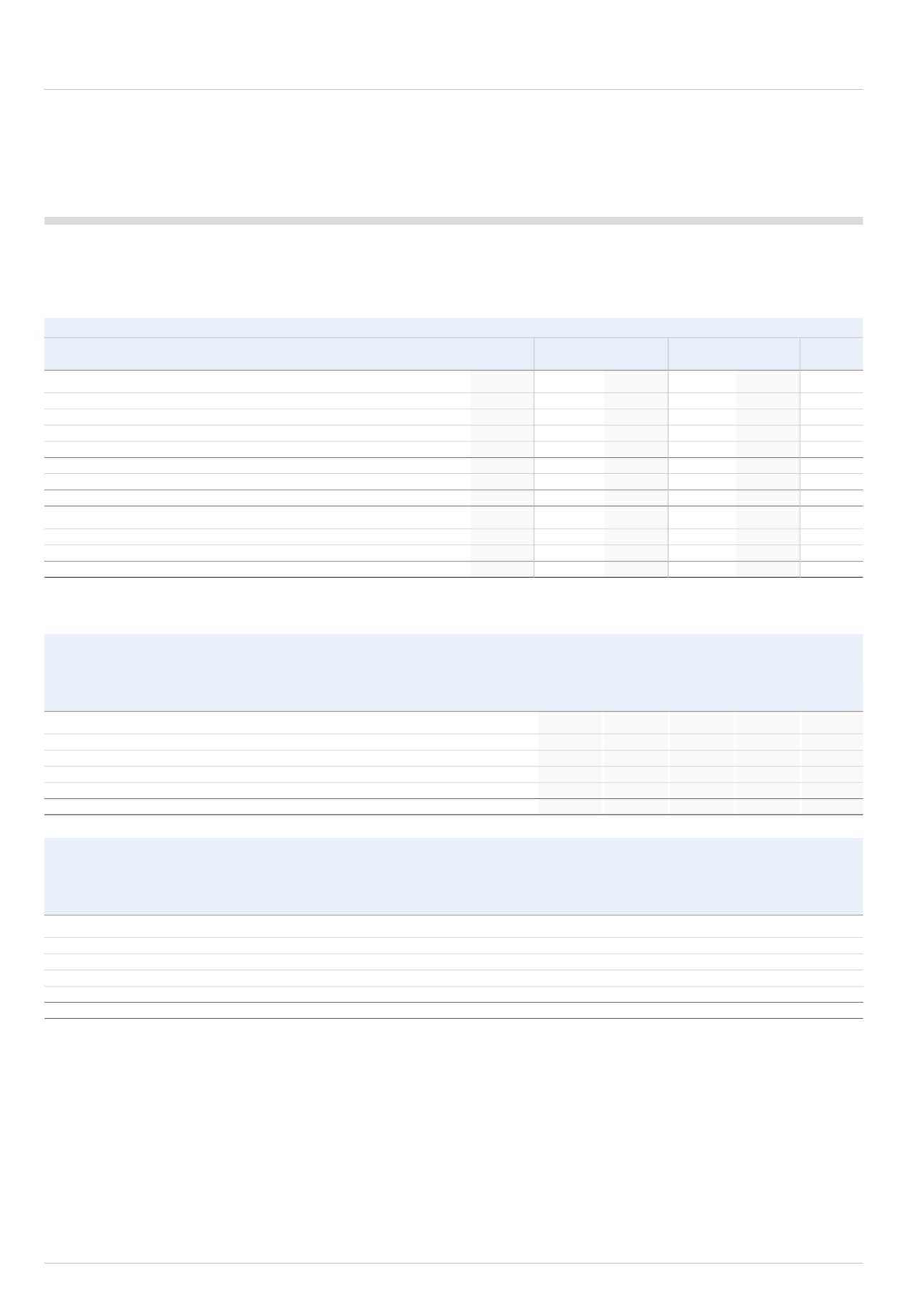

The movement in the net deferred tax balances has been recognised in the financial statements as analysed below:

Recognised Recognised

in the outside the

Balance at

income

income

Balance at

1 Jan 14

statement

statement

Exchange Acquisitions 31 Dec 14

£m

£m

£m

£m

£m

£m

Non-current assets

(53.5)

7.1

-

(0.2)

9.5

(37.1)

Inventories

0.1

(2.4)

-

(0.2)

1.9

(0.6)

On revaluation of derivatives

(1.8)

(0.9)

2.3

(0.1)

-

(0.5)

Employee benefits and provisions

54.6

(15.8)

(4.8)

-

(4.2)

29.8

Other tax assets

4.0

(0.5)

-

(0.3)

(0.7)

2.5

Net deferred tax asset/(liability)

3.4

(12.5)

(2.5)

(0.8)

6.5

(5.9)

Recognised Recognised

in the outside the

Balance at

income

income

Balance at

1 Jan 13 statement

statement

Exchange Acquisitiions 31 Dec 13

£m

£m

£m

£m

£m

£m

Non-current assets

(55.4)

6.3

-

1.0

(5.4)

(53.5)

Inventories

(0.8)

1.0

-

(0.1)

-

0.1

On revaluation of derivatives

0.2

0.8

(2.7)

(0.1)

-

(1.8)

Employee benefits and provisions

80.5

(5.3)

(20.8)

0.2

-

54.6

Other tax assets

4.4

(0.5)

-

0.1

-

4.0

Net deferred tax asset

28.9

2.3

(23.5)

1.1

(5.4)

3.4

All exchange movements are taken through the translation reserve.

2.4.8 Unrecognised deferred tax assets and liabilities

Deferred tax assets of £39.8m (2013: £29.0m) have not been recognised in respect of tax losses of £16.1m (2013: £12.4m), interest of £40.4m (2013: £30.6m)

and capital losses of £113.3m (2013: £83.2m). The majority of the tax losses have no expiry date. No deferred tax asset has been recognised for these temporary

differences due to uncertainty over their offset against future taxable profits and therefore their recoverability.

It is likely that the majority of unremitted earnings of overseas subsidiaries would qualify for the UK dividend exemption. However £81.7m (2013: £78.0m) of those

earnings may still result in a tax liability principally as a result of withholding taxes levied by the overseas jurisdictions in which those subsidiaries operate. These tax

liabilities are not expected to exceed £8.1m (2013: £7.9m), of which only £2.0m (2013: £1.5m) has been provided as the Group is able to control the timing of the

dividends. It is not expected that further amounts will crystallise in the foreseeable future.