103

Annual Report and Accounts 2014

2.5

Discontinued operations and non-current

assets and liabilities held for sale

When the Group has assets and liabilities that are likely to be sold rather than

being held for continuing use and when accounting standards require, these

assets and liabilities are included in current assets and liabilities and denoted

‘held for sale’ rather than in their usual categories.

If they represent a significant enough proportion of the Group, they are also

treated as discontinued operations. This means that their trading performance,

i.e. their revenues, costs and other items of income and expense, are no longer

reported within the headline figures in the income statement and are instead

reported in a separate line, net of tax, called ‘discontinued operations’. These

amounts no longer form part of continuing earnings per share. Comparative

figures are restated to be shown on the same basis.

This enables the income statement for the current and prior year to be

presented on a consistent basis and to convey a more forward-looking

version of the results for the year.

On 15 October 2013, the Board approved the sale of the Retail Dispense

businesses, which subsequently completed on 1 January 2014. The disposal

group represented a major class of business as defined by IFRS5

‘Non-current

assets held for sale and discontinued operations’

and it was determined that this

disposal group met the criteria to be disclosed as a discontinued operation in

the income statement. The Retail Dispense businesses were therefore classified

as held for sale following the agreement for the sale of these businesses to the

Marmon Group, a Berkshire Hathaway Company.

The disposal proceeds were used to return £620.3m of cash to shareholders and

invest £70.0m into the UK Pension Fund.

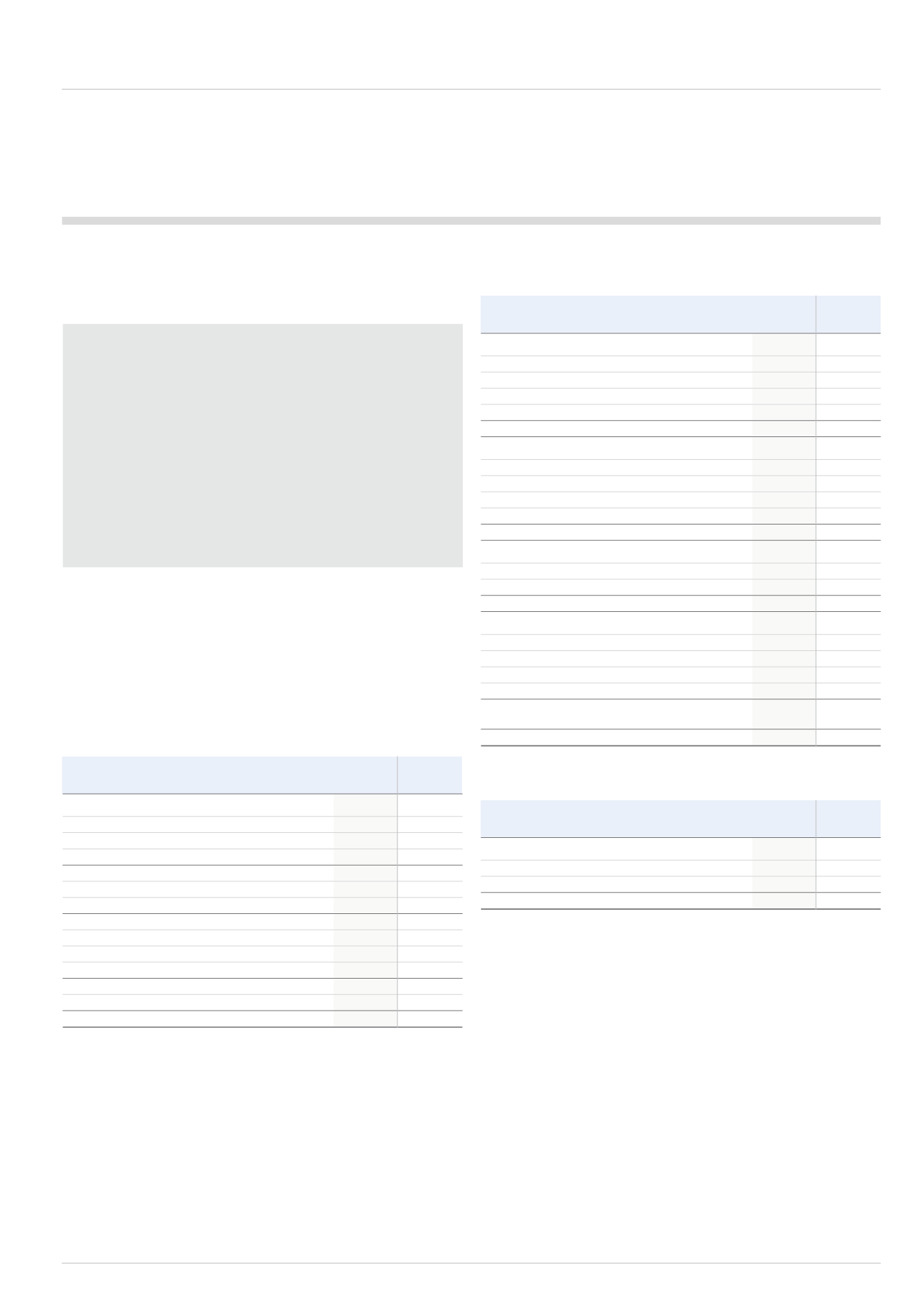

2014

2013

£m

£m

Revenue

-

511

Depreciation

-

(3.9)

Amortisation

-

(1.3)

Other operating expenses

-

(424.8)

Segmental operating profit

-

81.0

Restructuring costs

-

(3.0)

Gain on disposal of operations (see Section 3.5)

480.0

-

Operating profit

480.0

78.0

Financial income

-

0.2

Financial expense

-

(0.4)

Net finance expense related to pension schemes

-

(0.4)

Profit before tax

480.0

77.4

Taxation

(2.5)

(39.0)

Profit after tax

477.5

38.4

The results of the Retail Dispense businesses and the associated profit on

disposal are presented above, in addition to which, a pre-tax and post-tax gain

of £1.0m (2013: loss of £5.0m) relating to other discontinued operations have

also been included in this line in the income statement.

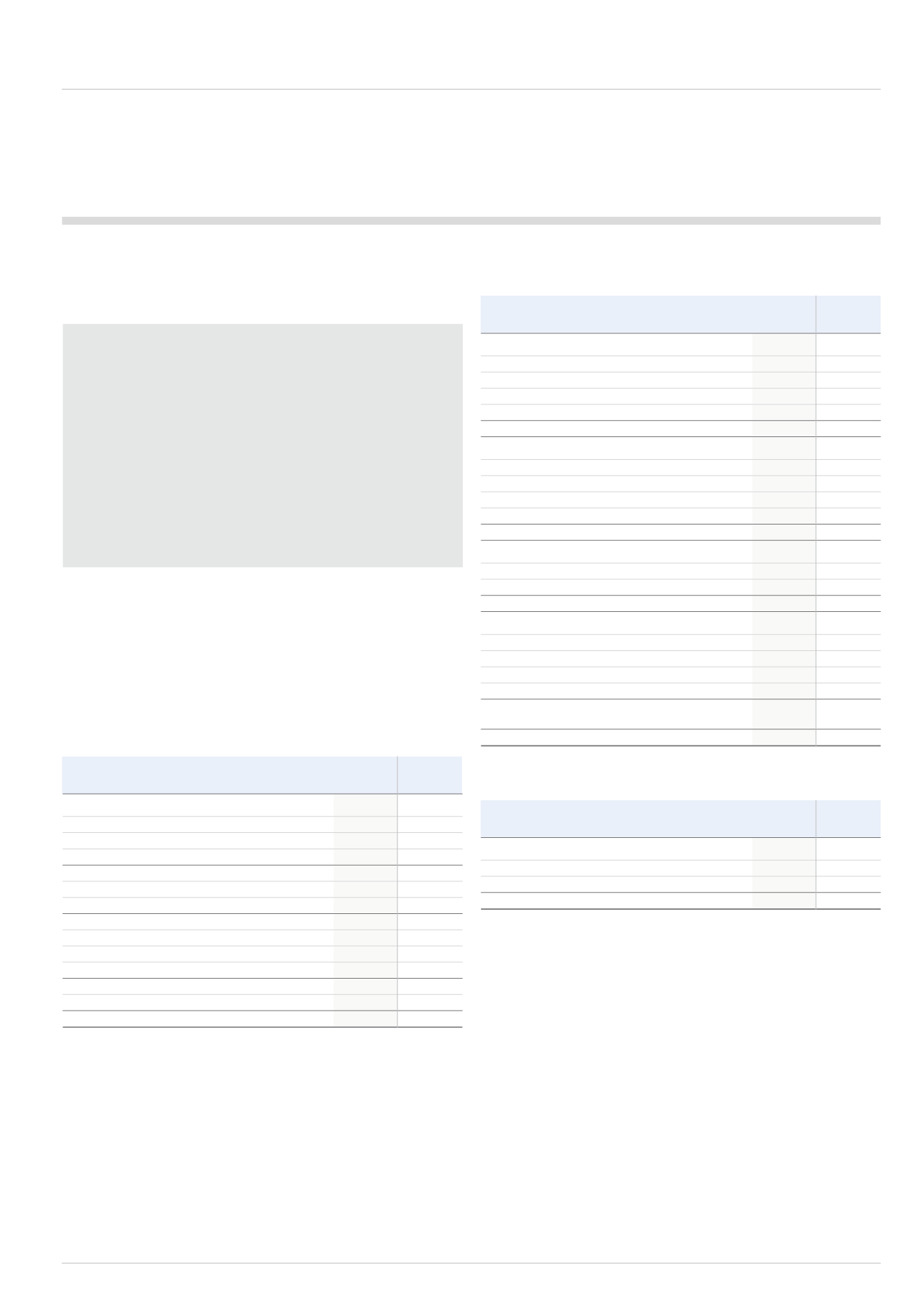

The major classes of assets and liabilities of the Retail Dispense businesses

classified as held for sale were as follows:

2014

2013

£m

£m

Segmental assets

Intangible assets

-

114.1

Property, plant and equipment

-

25.1

Inventories

-

50.8

Trade and other receivables

-

67.1

Total segmental assets

-

257.1

Non-segmental assets

Current tax

-

0.2

Deferred tax

-

3.8

Cash and cash equivalents

-

28.2

Investments

-

0.1

Total assets classified as held for sale

-

289.4

Segmental liabilities

Trade and other payables

-

(56.2)

Provisions

-

(5.4)

Total segmental liabilities

-

(61.6)

Non-segmental liabilities

Current tax

-

(3.2)

Deferred tax

-

(10.0)

Bank overdraft

-

(1.7)

Employee benefit obligations

-

(0.8)

Total liabilities associated with assets classified

as held for sale

-

(77.3)

Net assets directly associated with disposal group

-

212.1

Net cash flows from discontinued operations

2014

2013

£m

£m

Operating

(6.6)

53.8

Investing

661.6

(8.1)

Financing

-

(0.4)

Net cash inflow

655.0

45.3

The prior year discontinued cash flows relating to financing activities reported

above exclude any allocation of items relating to the entire Group such as

external dividends paid, share buybacks and drawdown of borrowings,

which has the net effect of significantly reducing the outflows reported

for the discontinued activities in comparison to the Group as a whole.

The disposals of Eley and AFP are not considered to be a major class of

business for the Group. As a result they are not classified as discontinued

operations under IFRS5. Details of all disposals are included within Section 3.5.