104

IMI plc

What you will find in this section

This section shows the assets used to generate the Group’s trading performance and the liabilities incurred as a result.

Liabilities relating to the Group’s financing activities are addressed in Section 4. Deferred tax assets and liabilities

are shown in Section 2.4.7. On the following pages there are sections covering working capital, non-current assets,

acquisitions, other payables due after more than one year, provisions and pensions.

3.1

Working capital

Working capital represents the assets and liabilities the Group generates

through its trading activities. The Group therefore defines working capital

as trade and other receivables, inventory and trade and other payables.

Working capital is managed very carefully to ensure that the Group can

meet its trading and financing obligations within its ordinary operating cycle.

To provide the Executive Committee with insight into the management

of working capital, an important measure monitored is cash conversion.

Cash conversion is defined as the operating cash flow (as defined in the

commentary on the cash flow statement) divided by the segmental operating

profit which therefore represents the proportion of segmental operating profit

generated during the year that has been converted into cash.

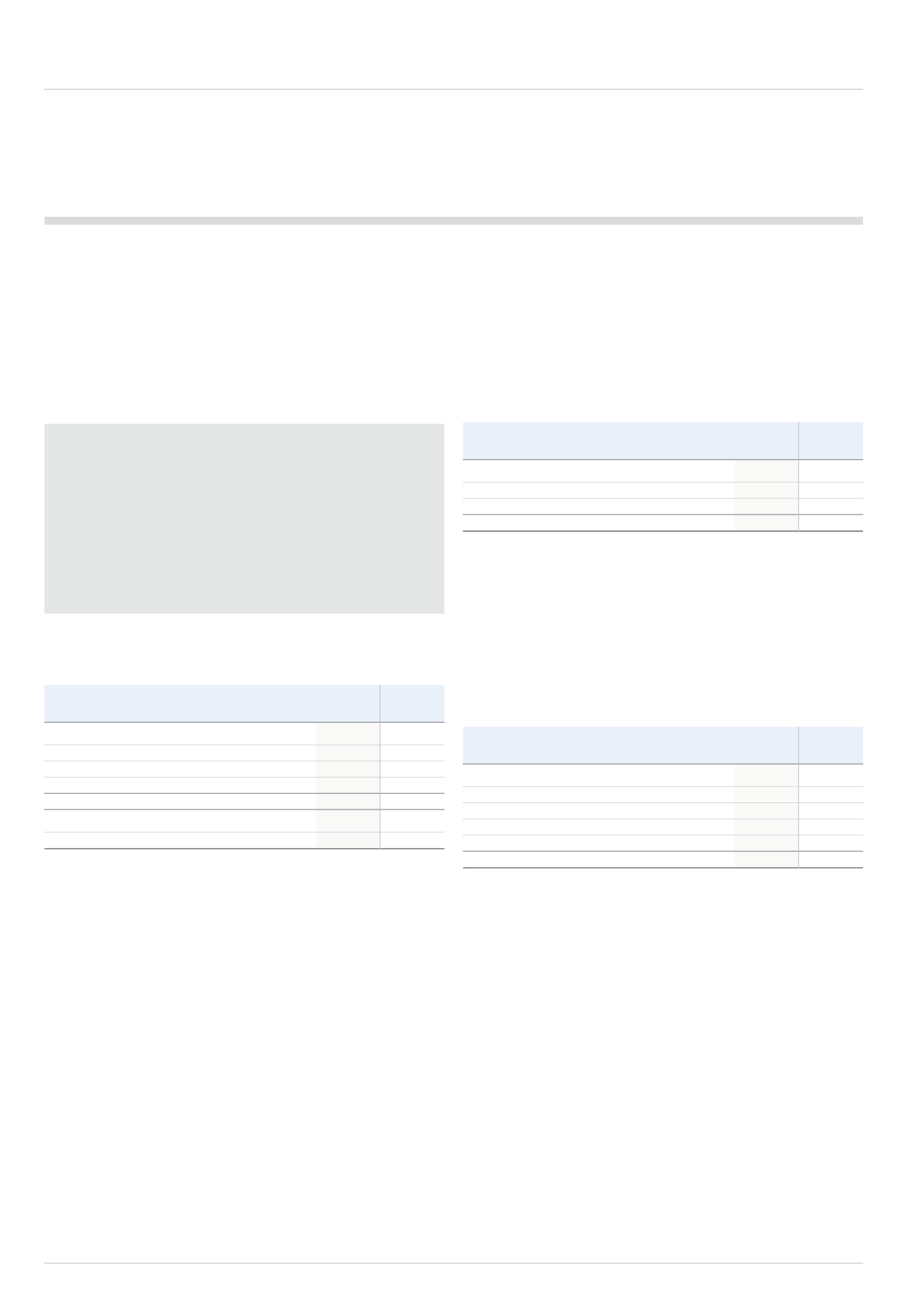

3.1.1

Trade and other receivables

2014

2013

£m

£m

Current

Trade receivables

318.0

293.5

Other receivables

34.8

33.0

Prepayments and accrued income

16.1

18.8

368.9

345.3

Receivables are stated after:

Allowance for impairment

7.1

8.1

The Group’s exposure to credit and market risks related to trade and other

receivables is disclosed in section 4.4.

3.1.2

Inventories

2014

2013

£m

£m

Raw materials and consumables

87.0

85.3

Work in progress

71.9

86.4

Finished goods

67.4

73.8

226.3

245.5

In 2014 the cost of inventories recognised as an expense within segmental

cost of sales amounted to £919.9m (2013: £948.8m). In 2014 the write-down

of inventories to net realisable value amounted to £7.9m (2013: £7.1m).

The reversal of write-downs amounted to £3.9m (2013: £2.1m). Write-downs

and reversals in both years relate to on-going assessments of inventory

obsolescence, excess inventory holding and inventory resale values across

all of the Group’s businesses.

3.1.3

Trade and other payables

2014

2013

£m

£m

Current

Trade payables

164.4

187.5

Social security and other taxation

26.1

23.1

Other payables

7.5

7.9

Accruals and deferred income

135.9

137.1

333.9

355.6

SECTION 3 – OPERATING ASSETS AND LIABILITIES