105

Annual Report and Accounts 2014

3.2 Intangible assets

The following section shows the non-physical assets used by the Group to generate revenues and profits. These assets include goodwill, customer relationships,

order books, patents, development costs and software development costs. The cost of these assets is the amount that the Group has paid for them or, when they

have arisen due to a business combination, the fair value of the specific intangible assets that could be sold separately or which arise from legal rights.

In the case of goodwill, its cost is the amount the Group has paid in acquiring a business over and above the fair value of the individual assets net of the liabilities

acquired. The value of the goodwill can arise from a number of sources, but in relation to our more recent acquisitions, it has been represented by post-acquisition

synergies and the skills and knowledge of the workforce. The value of the Group’s intangible assets, with the exception of goodwill, reduces over the number of

years over which the Group expects to use the asset, the useful life, via an annual amortisation charge to the income statement.

The Group splits its intangible assets between those arising on acquisitions and those which do not arise on acquisitions, because the amortisation of acquired

intangibles meets the definition of an exceptional item as described in section 2.2.

Where there are indications that the value of intangible assets is no longer representative of their value to the Group, for example where there is a customer

relationship recognised but revenues from that customer are reducing, or where goodwill was recognised on an acquisition but the performance of the business

acquired is below expectations, the Directors review the value of the assets to ensure they have not fallen below their amortised values. If this has happened,

a one-off impairment charge is made against profit. This section explains the overall carrying values of the intangible assets within the Group and the specific

judgements and estimates made by the Directors in arriving at these values.

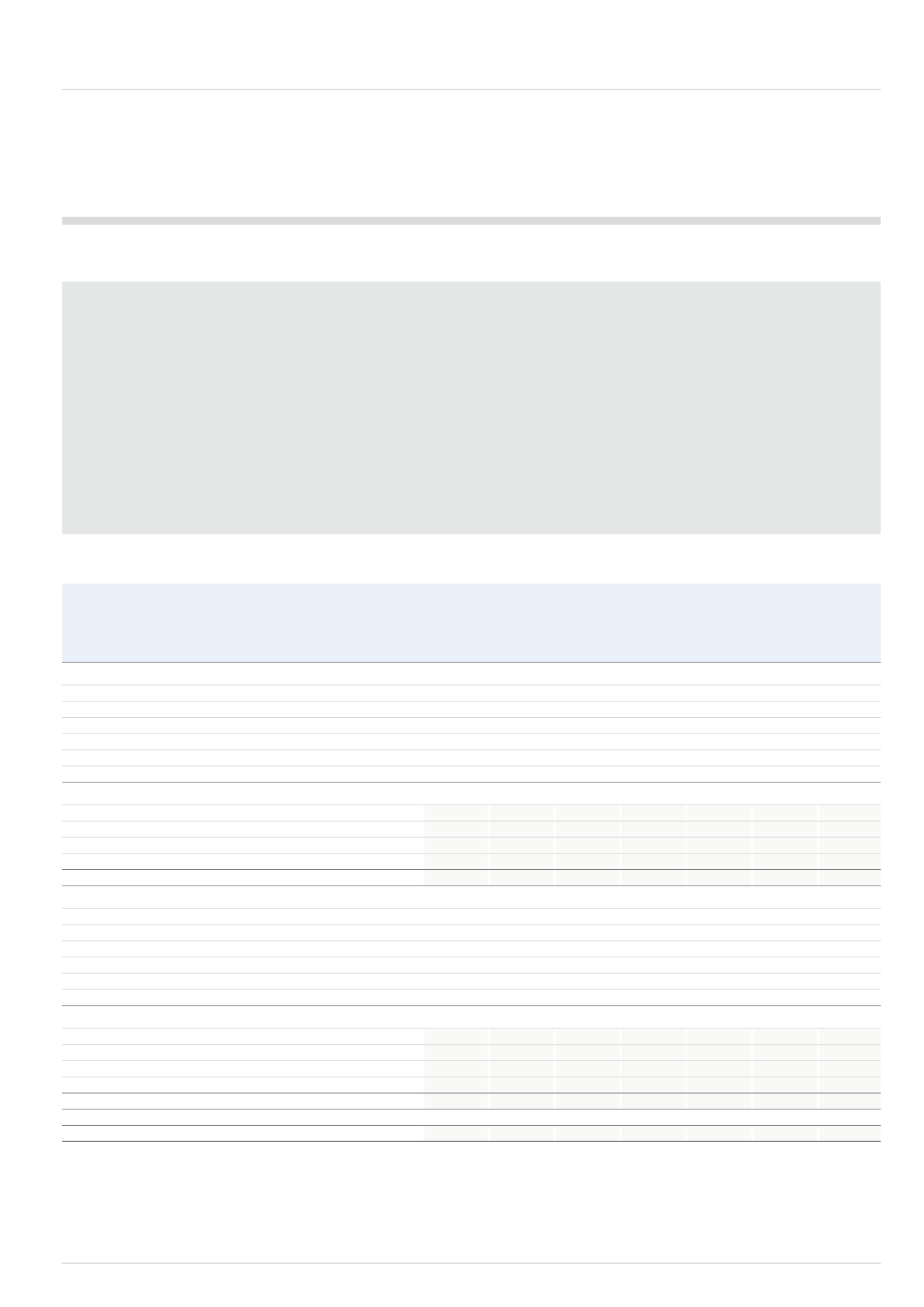

3.2.1 Analysis of intangible assets

Non-Acquired

Acquired

Other

Total

Other non-

intangibles

customer

acquired acquired acquired

under

Goodwill

relationships intangibles intangibles intangibles construction*

Total

£m

£m

£m

£m

£m

£m

£m

Cost

As at 1 January 2013

440.4

136.8

65.2

642.4

65.2

-

707.6

Exchange adjustments

0.3

0.4

(1.1)

(0.4)

-

-

(0.4)

Acquisitions

2.9

-

21.3

24.2

-

-

24.2

Transfers to assets held for sale

(113.6)

-

-

(113.6)

(23.9)

-

(137.5)

Additions

-

-

-

-

8.0

-

8.0

Disposals

-

-

-

-

(1.1)

-

(1.1)

As at 31 December 2013

330.0

137.2

85.4

552.6

48.2

-

600.8

Exchange adjustments

(9.3)

(6.0)

(3.3)

(18.6)

(2.5)

-

(21.1)

Additions

-

-

-

-

7.3

10.9

18.2

Transfers from assets in the course of construction

-

-

-

-

0.2

(0.2)

-

Disposals

-

-

-

-

(0.6)

-

(0.6)

As at 31 December 2014

320.7

131.2

82.1

534.0

52.6

10.7

597.3

Amortisation

As at 1 January 2013

-

59.8

60.8

120.6

42.5

-

163.1

Exchange adjustments

-

(0.4)

(0.1)

(0.5)

-

-

(0.5)

Transfers to assets held for sale

-

-

-

-

(20.0)

-

(20.0)

Disposals

-

-

-

-

(0.9)

-

(0.9)

Impairment

-

-

-

-

0.4

-

0.4

Amortisation for year

-

19.8

2.1

21.9

6.5

-

28.4

As at 31 December 2013

-

79.2

62.8

142.0

28.5

-

170.5

Exchange adjustments

-

(3.2)

(2.8)

(6.0)

(1.8)

-

(7.8)

Disposals

-

-

-

-

(0.5)

-

(0.5)

Impairment

27.8

-

12.9

40.7

2.1

-

42.8

Amortisation for year

-

16.9

2.7

19.6

5.0

-

24.6

As at 31 December 2014

27.8

92.9

75.6

196.3

33.3

-

229.6

Net book value at 31 December 2013

330.0

58.0

22.6

410.6

19.7

-

430.3

Net book value at 31 December 2014

292.9

38.3

6.5

337.7

19.3

10.7

367.7

* During the year the Group has made significant investment in IT software and new product development, which are currently in construction and not being

amortised. These assets have been separately disclosed in the table above. In the prior year these assets were not material and were included within other

non-acquired intangibles.