107

Annual Report and Accounts 2014

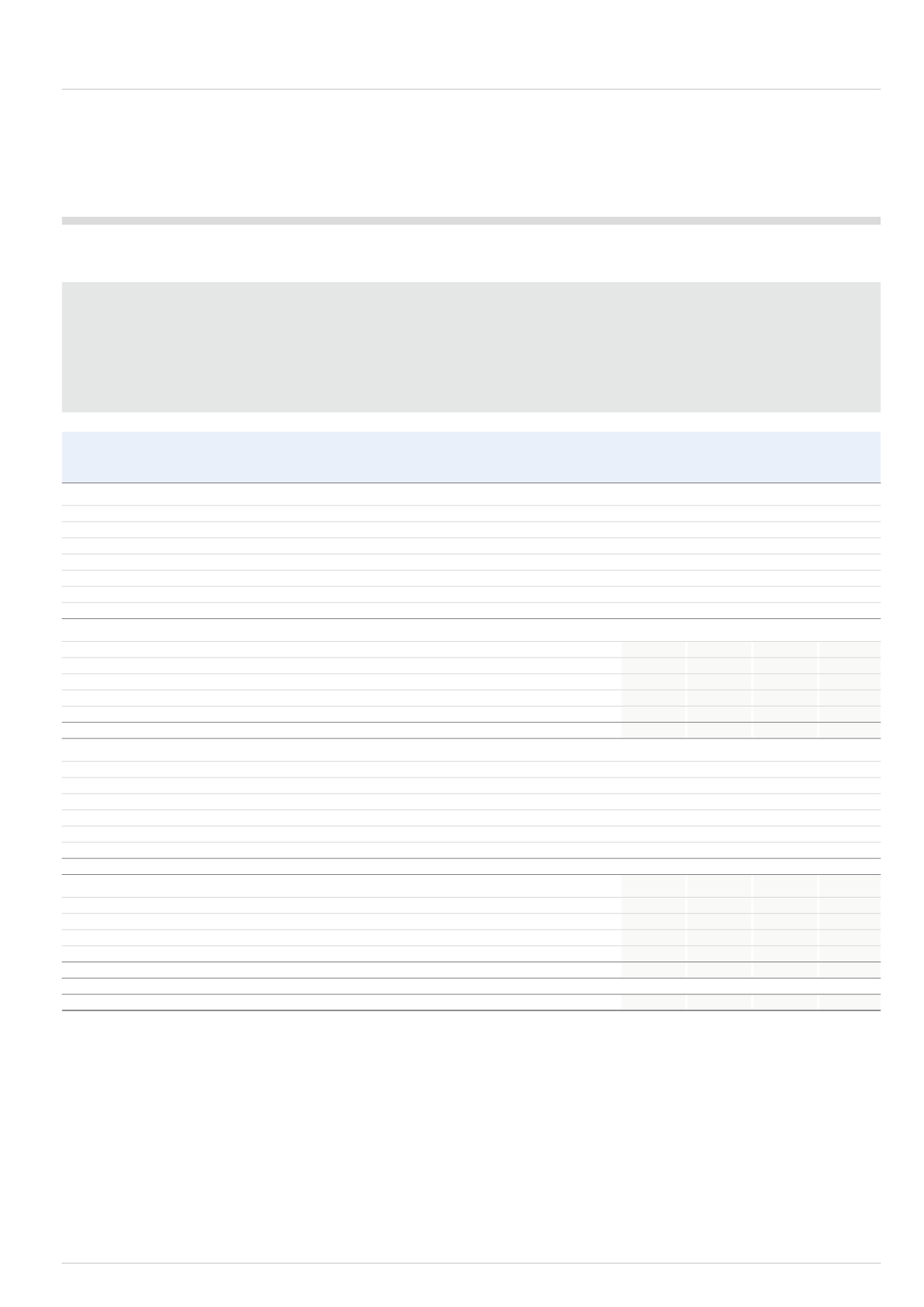

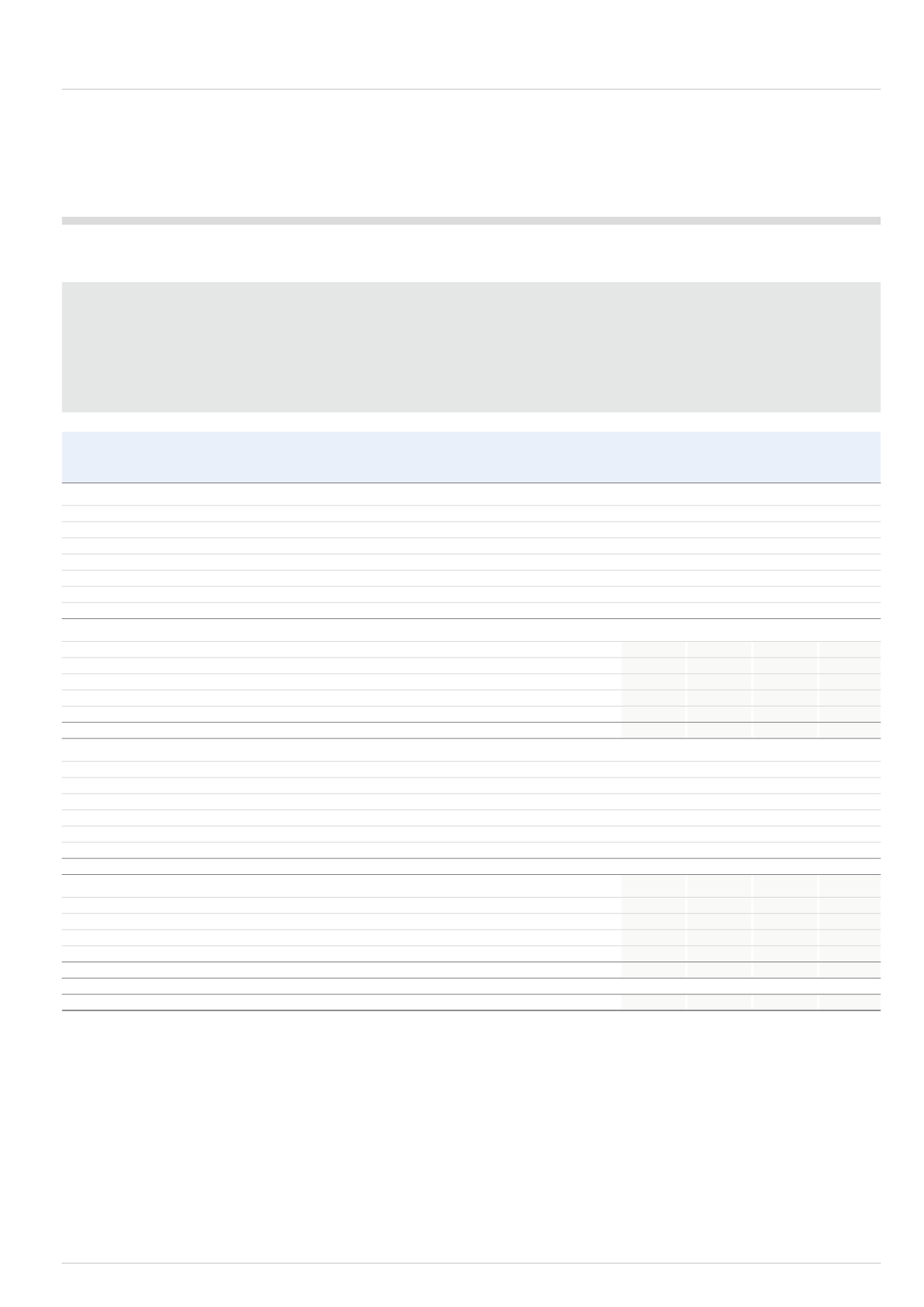

3.3 Property, plant and equipment

The following section concerns the physical assets used by the Group to generate revenues and profits. These assets include manufacturing, distribution and

office sites, as well as equipment used in the manufacture of the Group’s products. The cost of these assets represents the amount initially paid for them.

With the exception of the Group’s land and assets under construction which have not yet been brought into use, a depreciation expense is charged to the

income statement to reflect the annual wear and tear and the reduction in the value of the asset over time. Depreciation is calculated by reference to the

assets’ useful lives, by estimating the number of years over which the Group expects the asset to be used. As we do for our intangible assets (see Section 3.2),

if there has been a technological change or decline in business performance the directors review the value of the assets to ensure they have not fallen

below their depreciated value. If an asset’s value falls below its depreciated value a one-off impairment charge is made against profit.

Assets in the

Land &

Plant & course of

buildings equipment construction

Total

Cost

As at 1 January 2013

197.2

662.1

12.0

871.3

Exchange adjustments

(1.0)

(1.7)

(0.3)

(3.0)

Acquisitions

0.2

0.2

-

0.4

Additions

2.1

20.2

19.7

42.0

Transfers to assets held for sale

(22.0)

(99.4)

(3.2)

(124.6)

Transfers from assets in the course of construction

0.5

10.4

(10.9)

-

Disposals

(3.4)

(22.9)

(0.1)

(26.4)

As at 31 December 2013

173.6

568.9

17.2

759.7

Exchange adjustments

(8.7)

(25.2)

(0.6)

(34.5)

Disposals of subsidiaries

(2.9)

(6.1)

(0.3)

(9.3)

Additions

1.0

26.9

24.7

52.6

Transfers from assets in the course of construction

1.2

19.8

(21.0)

-

Disposals

(0.8)

(50.5)

-

(51.3)

As at 31 December 2014

163.4

533.8

20.0

717.2

Depreciation

As at 1 January 2013

93.1

532.9

-

626.0

Exchange adjustments

(0.2)

(0.5)

-

(0.7)

Disposals

(2.1)

(22.6)

-

(24.7)

Transfers to assets held for sale

(14.4)

(86.7)

-

(101.1)

Impairment reversal

-

(0.5)

-

(0.5)

Depreciation

4.3

33.6

-

37.9

As at 31 December 2013

80.7

456.2

-

536.9

Exchange adjustments

(4.3)

(20.2)

-

(24.5)

Disposals of subsidiaries

(1.6)

(4.7)

-

(6.3)

Disposals

(0.6)

(48.5)

-

(49.1)

Impairment charge

-

0.7

-

0.7

Depreciation

3.5

29.5

-

33.0

As at 31 December 2014

77.7

413.0

-

490.7

NBV at 31 December 2013

92.9

112.7

17.2

222.8

NBV at 31 December 2014

85.7

120.8

20.0

226.5

A net impairment charge of £0.7m relating to continuing operations occurred during the year (2013: £0.5m reversal).

Group contracts in respect of future capital expenditure which had been placed at the balance sheet date relating to the continuing business amounted to

£7.6m (2013: £3.3m).

Included in the total net book value of plant and equipment is £1.0m (2013: £1.2m) in respect of assets acquired under finance leases. Depreciation for the

year on these assets was £0.3m (2013: £0.3m).