115

Annual Report and Accounts 2014

4.4.2.4

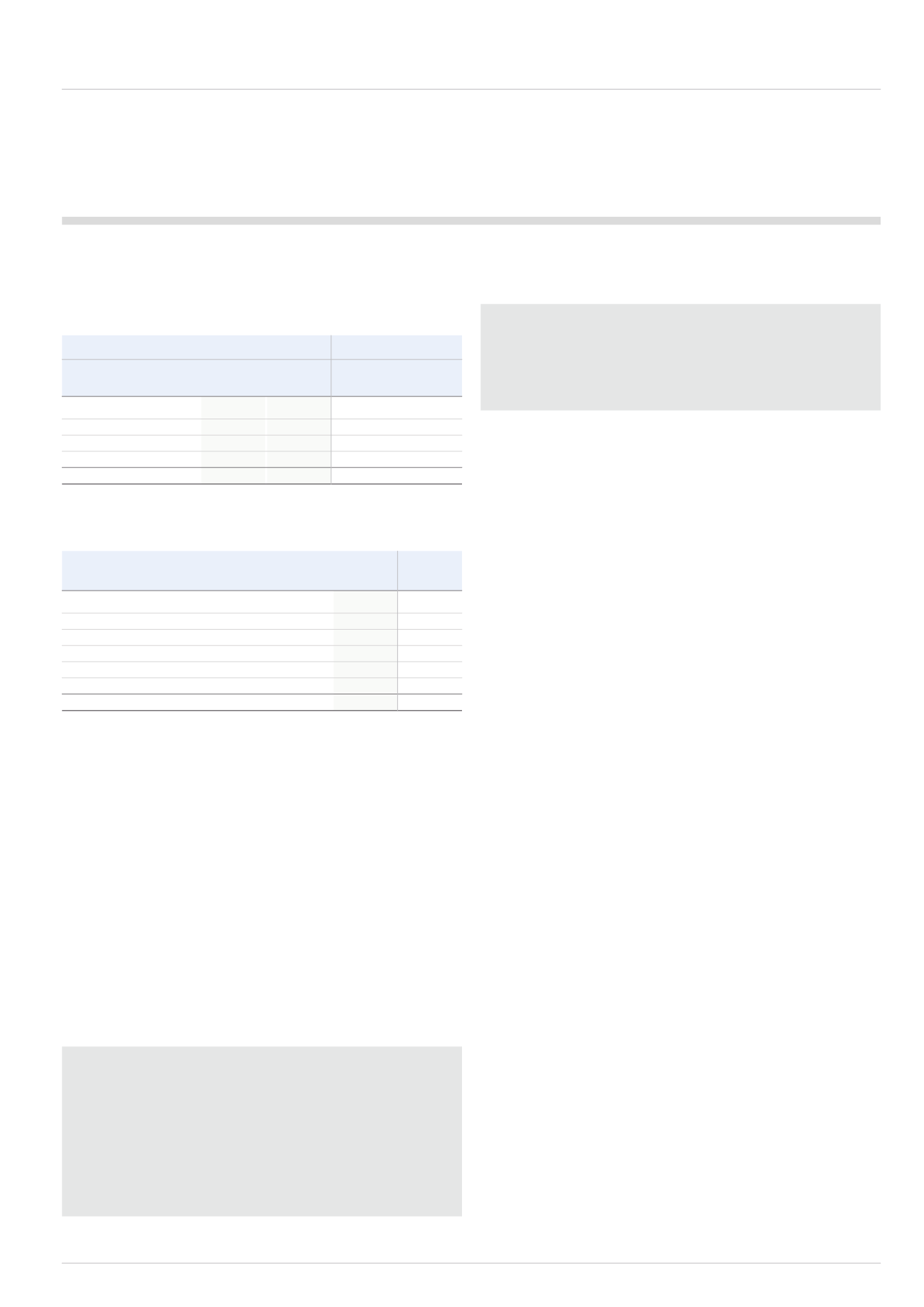

Impairment provisions for trade receivables

The ageing of trade receivables at the reporting date was:

2014

2013

Gross Impairment

Gross Impairment

£m

£m

£m

£m

Not past due

273.1

(0.5)

251.4

(0.2)

Past due 1-30 days

26.8

(0.6)

24.5

(0.1)

Past due 31-90 days

13.8

(0.6)

12.6

(0.1)

Past due over 90 days

11.4

(5.4)

13.1

(7.7)

Total

325.1

(7.1)

301.6

(8.1)

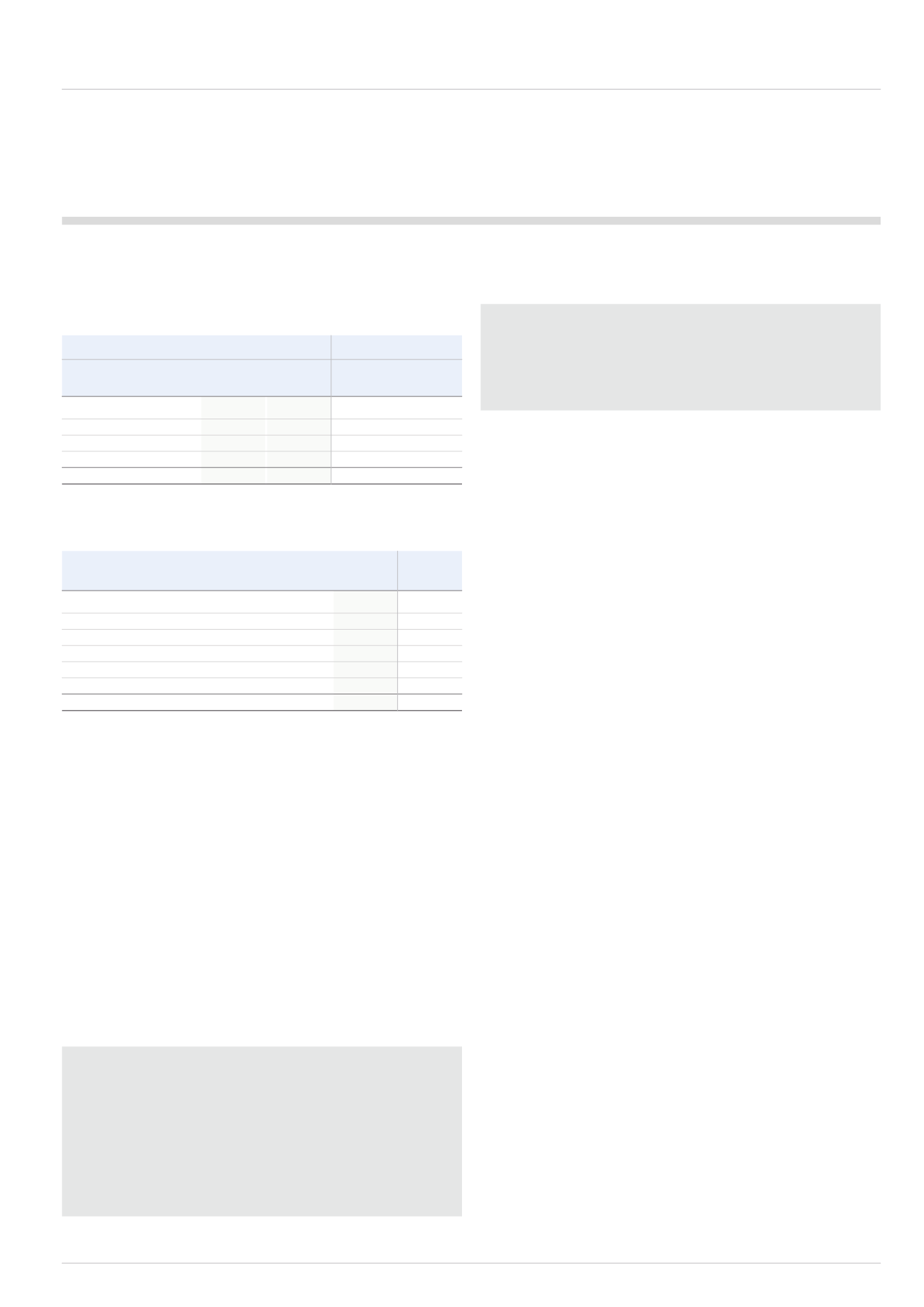

The net movement in the allowance for impairment in respect of trade

receivables during the year was as follows:

2014

2013

£m

£m

Net balance at 1 January

8.1

11.4

Utilised during the year

(1.5)

(1.5)

Charged to the income statement

2.3

2.4

Released

(1.1)

(3.3)

Transfer to assets held for sale

-

(1.1)

Exchange

(0.7)

0.2

Net balance at 31 December

7.1

8.1

The net impairment charge recognised of £1.2m (2013: gain of £0.9m) relates

to the movement in the Group’s assessment of the risk of non-recovery from

a range of customers across all of its businesses.

4.4.2.5

Managing credit risk arising

from counterparties

A group of relationship banks provides the bulk of the banking services,

with pre-approved credit limits set for each institution. Financial derivatives

are entered into with these core banks and the underlying credit exposure

to these instruments is included when considering the credit exposure to

the counterparties. At the end of 2014 credit exposure including cash

deposited did not exceed £7.5m with any single institution (2013: £13.0m).

4.4.3

Market risk

Market risk is the risk that changes in market prices, such as foreign

exchange rates, interest rates and commodity prices will affect the Group’s

income and cash flows or the value of its financial instruments. The objective

of market risk management is to manage and control market risk exposures

within acceptable parameters.

Under the management of the central treasury function, the Group enters

into derivatives in the ordinary course of business and also manages financial

liabilities in order to mitigate market risks. All such transactions are carried

out within the guidelines set by the Board and are undertaken only if they

relate to underlying exposures.

4.4.3.1

Foreign exchange risk

The Group publishes consolidated accounts in Sterling but conducts much

of its global business in other currencies. As a result it is subject to the risks

associated with foreign exchange movements affecting transaction costs

(‘transactional risk’), translation of foreign profits (‘profit translation risk’)

and translation of the underlying net assets of foreign operations

(‘asset translation risk’).

a) Management of transactional risk

The Group’s wide geographical spread both in terms of cost base and customer

locations helps to reduce the impact on profitability of swings in exchange

rates as well as creating opportunities for central netting of exposures. It is the

Group’s policy to minimise risk to exchange rate movements affecting sales and

purchases by economically hedging or netting currency exposures at the time

of commitment, or when there is a high probability of future commitment, using

currency instruments (primarily forward exchange contracts). A proportion of

forecast exposures are hedged depending on the level of confidence and hedging

is topped up following regular reviews. On this basis up to 50% of the Group’s

annual exposures are likely to be hedged at any point in time and the Group’s

net transactional exposure to different currencies varies from time to time.

As discussed in the commentary on the consolidated statement of

comprehensive income the Group used a deal-contingent forward to hedge

the foreign exchange exposure on the US denominated proceeds for the

Retail Dispense businesses resulting in a net pre-tax gain of £8.2m.

b) Management of profit translation risk

The Group is exposed to the translation of profits denominated in foreign

currencies into the Sterling-based income statement. The interest cost related

to the currency liabilities hedging the asset base provides a partial hedge to this

exposure. Short-term currency option contracts may be used to provide limited

protection against Sterling strength on an opportunistic basis. The translation

of US Dollar and Euro-based profits represent the most significant translation

exposures for the Group.

c) Management of asset translation risk

The Group hedges its net investments in its major overseas operations by way

of external currency loans and forward currency contracts. The intention is to

manage the Group’s exposure to gains and losses in Group equity resulting

from retranslation of currency net assets at balance sheet dates.

To the extent that an instrument used to hedge a net investment in a foreign

operation is determined to be an effective hedge, the gain or loss arising is

recognised directly in reserves. Any ineffective portion is recognised immediately

in the income statement.