116

IMI plc

SECTION 4 – CAPITAL STRUCTURE AND FINANCING COSTS

Continued

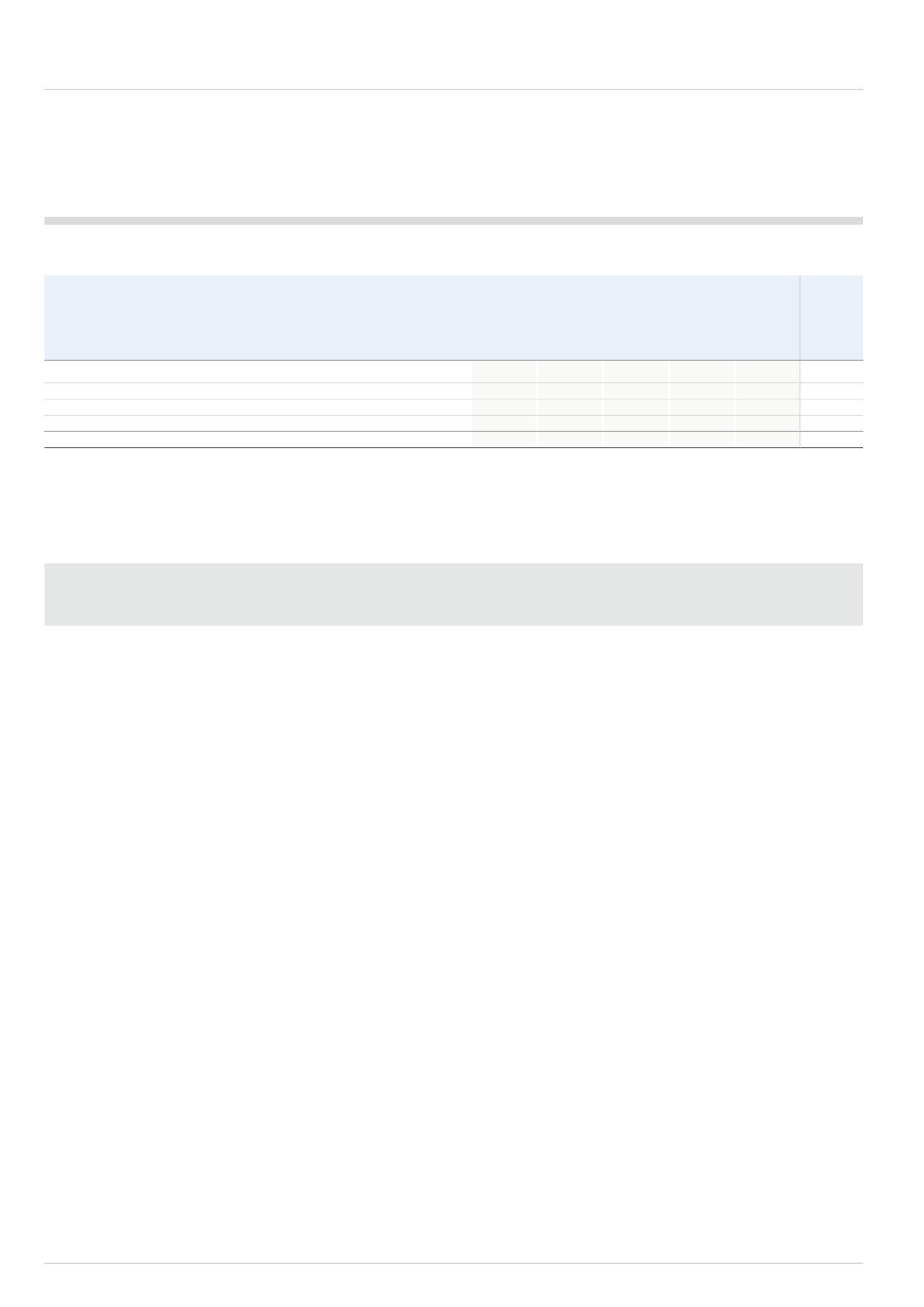

d) Currency profile of assets and liabilities

Net assets/

excluding

Exchange

cash & debt

Cash*

Debt

contracts Net assets

Net assets

2014

2014

2014

2014

2014

2013

£m

£m

£m

£m

£m

£m

Sterling

83

(23)

-

366

426

474

US Dollar

138

-

(218)

106

26

11

Euro

287

6

(1)

(302)

(10)

10

Other

246

38

(2)

(170)

112

153

Total

754

21

(221)

-

554

648

* Cash is stated net of overdrafts.

Exchange contracts and non-sterling debt are financial instruments used as currency hedges of overseas net assets.

4.4.3.2 Interest rate risk

The Group is exposed to a number of global interest rates through assets and liabilities denominated in jurisdictions to which these rates are applied,

most notably US, Eurozone and UK rates. The Group is exposed to these because market movements in these rates will increase or decrease the interest

charge recognised in the Group income statement.

a) Management of interest rate risk

The Group adopts a policy of maintaining a portion of its liabilities at fixed interest rates and reviewing the balance of the floating rate exposure to ensure that if interest

rates rise globally the effect on the Group’s income statement is manageable.

Interest rates are managed using fixed and floating rate debt and financial instruments including interest rate swaps. Floating rate liabilities comprise short-term debt

which bears interest at short-term bank rates and the liability side of exchange contracts where the interest element is based primarily on three month inter-bank rates.

The Group has raised US Dollar debt through the issuance of medium to long-term fixed rate loan notes. In 1999 US$30m of this fixed rate exposure was hedged

back to floating rates through the use of interest rate swaps covering loan notes which matured and were repaid in 2014. The interest component of the fair value

of this portion of the loan notes was designated as a hedged item and was revalued accordingly in the accounts. The fair value of these interest rate swaps,

which were settled in the year, was included in the 2013 balance sheet at £0.8m with a corresponding uplift in the value of the debt (the hedged item).

All cash surpluses are invested for short periods and are treated as floating rate investments.

Non-interest bearing financial assets and liabilities including short-term trade receivables and payables have been excluded from the following analysis.