113

Annual Report and Accounts 2014

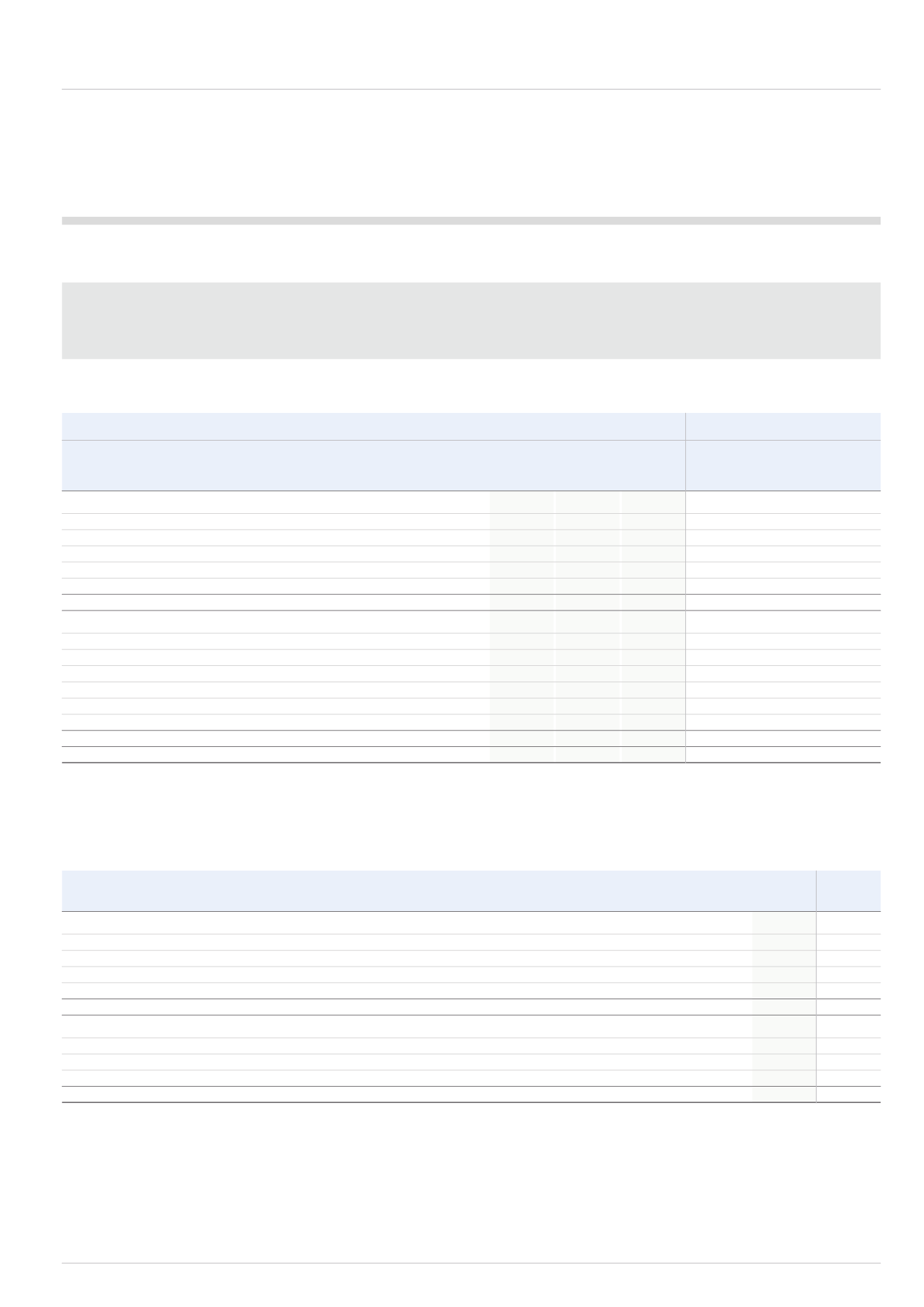

4.3 Net financing costs

This section details the income generated on the Group’s financial assets and the expense incurred on borrowings and other financial assets and liabilities.

The finance income and expense taken into account in arriving at adjusted earnings only includes the income and expense arising on cash balances,

borrowings and retirement benefit obligations. The finance income or expense on mark-to-market movements on interest and foreign exchange derivatives

and other financing costs are excluded from adjusted earnings per share.

Recognised in the income statement

2014

2013

Financial

Financial

Interest instruments

Total

Interest instruments

Total

£m

£m

£m

£m

£m

£m

Interest income on bank deposits

1.1

1.1

4.2

4.2

Financial instruments at fair value through profit or loss:

Designated hedges

0.8

0.8

1.3

1.3

Other economic hedges

- current year trading

7.1

7.1

12.9

12.9

- future year transactions

7.2

7.2

6.0

6.0

Financial income

1.1

15.1

16.2

4.2

20.2

24.4

Interest expense on interest-bearing loans and borrowings

(15.4)

(15.4)

(20.2)

(20.2)

Financial instruments at fair value through profit or loss:

Designated hedges

(0.8)

(0.8)

(1.3)

(1.3)

Other economic hedges

- current year trading

(7.2)

(7.2)

(9.4)

(9.4)

- future year transactions

(13.8)

(13.8)

(6.8)

(6.8)

Financial expense

(15.4)

(21.8)

(37.2)

(20.2)

(17.5)

(37.7)

Net finance charge relating to defined benefit pension schemes

(3.1)

(3.1)

(7.9)

(7.9)

Net financial (expense)/income

(17.4)

(6.7)

(24.1)

(23.9)

2.7

(21.2)

Included in financial instruments are current year trading gains and losses on economically effective transactions which for management reporting purposes

are included in segmental revenue and operating profit (see section 2.1). For statutory purposes these are required to be shown within net financial income and

expense above. Gains or losses for future year transactions are in respect of financial instruments held by the Group to provide stability of future trading cash flows.

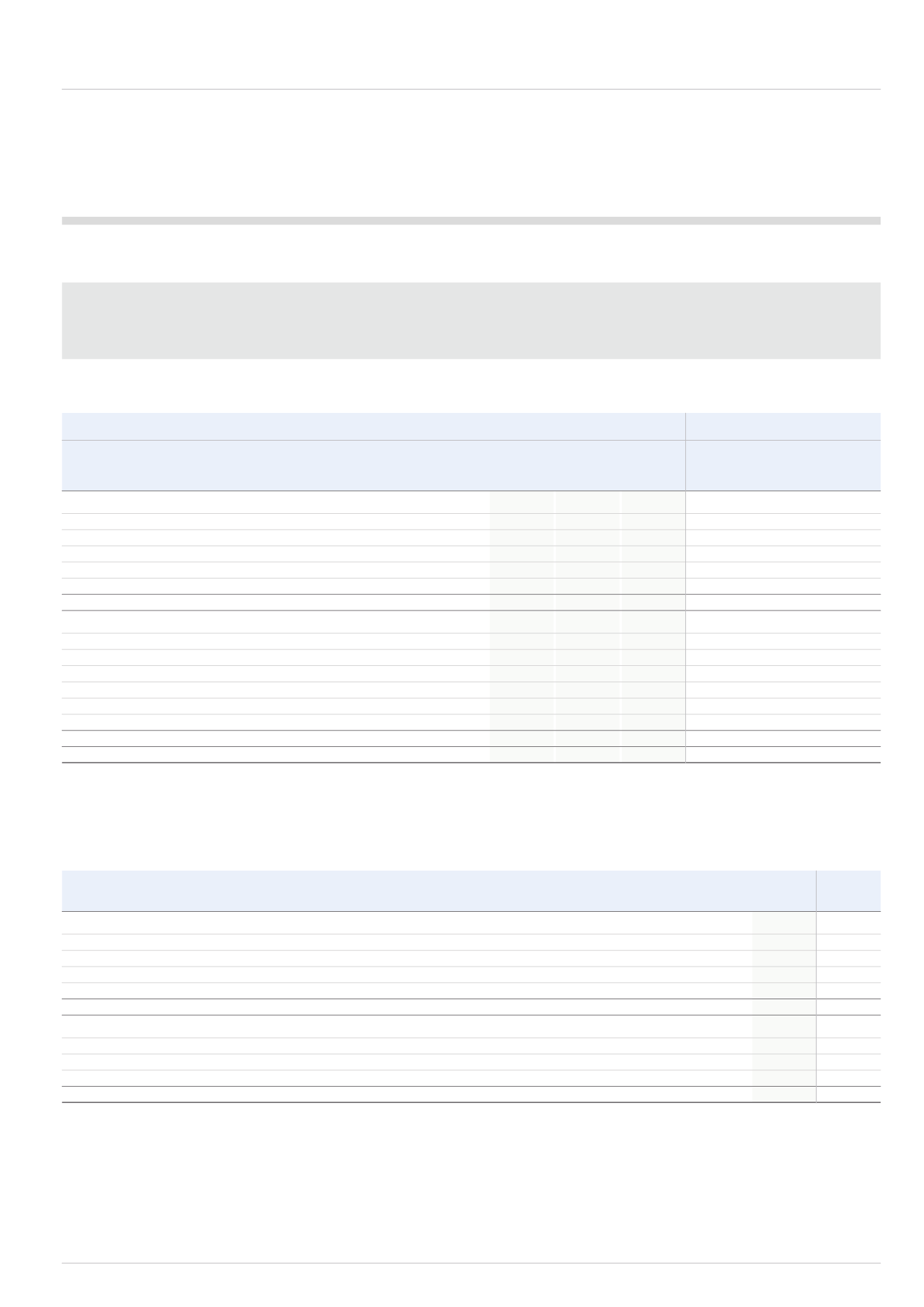

Recognised in other comprehensive income

2014

2013

£m

£m

Change in fair value of effective portion of net investment hedges

3.6

3.4

Foreign currency translation differences

(14.7)

(16.9)

Settlement of/change in fair value of deal contingent forward

(14.2)

14.2

Change in fair value of other financial assets

1.1

(0.5)

Income tax on items recognised in other comprehensive income

3.4

(2.5)

Total items recognised in other comprehensive income (net of tax)

(20.8)

(2.3)

Recognised in:

Hedging reserve

(8.3)

13.9

Translation reserve

(13.2)

(15.9)

Retained earnings

0.7

(0.3)

(20.8)

(2.3)