114

IMI plc

SECTION 4 – CAPITAL STRUCTURE AND FINANCING COSTS

Continued

4.4

Financial risk management

The Group’s activities expose it to a variety of financial risks: interest rate;

foreign exchange and; base metal price movements in addition to funding and

liquidity risks. The financial instruments used to manage the underlying risks

themselves introduce exposure to credit risk, market risk and, liquidity risk.

This section presents information about the Group’s exposure to each of

these risks; the Group’s objectives, policies and processes for measuring

and managing risks, including each of the above risks; and the Group’s

management of capital.

4.4.1

Overview

The Board has overall responsibility for the establishment and oversight of

the Group’s risk management framework. As described in the Corporate

Governance Report on page 47 the Executive Committee monitors risk and

internal controls and the Audit Committee monitors financial risk, while the other

Board committees also play a part in contributing to the oversight of risk.

The Audit Committee oversees how management monitors compliance with

the Group’s financial risk management policies and procedures and reviews

the adequacy of the risk management framework in relation to the financial

risks faced by the Group. The Group Assurance Department undertakes

both regular and ad-hoc reviews of risk management controls and procedures,

the results of which are reported to the Audit Committee.

The following sections discuss the management of specific financial risk

factors in detail, including credit risk, foreign exchange risk, interest rate risk,

commodity risk and liquidity risk.

4.4.2

Credit risk

Credit risk is the risk of financial loss to the Group if a customer or

counterparty to a financial instrument fails to meet its contractual obligations,

and arises principally from the Group’s receivables from customers, cash

and cash equivalents held by the Group’s banks and other financial assets.

At the end of 2014 these totalled £423.2m (2013: £496.5m).

4.4.2.1

Managing credit risk arising

from customers

The Group’s exposure to credit risk is influenced mainly by the individual

characteristics of each customer. The demographics of the Group’s customer

base, including the default risk of the industry and country in which customers

operate, have less of an influence on credit risk. Our largest single customer

accounted for 3% of our 2014 revenues (2013: 4%).

Geographically there is no unusual concentration of credit risk. The Group’s

contract approval procedure ensures that large contracts are signed off at

executive director level at which time the risk profile of the contract, including

potential credit and foreign exchange risks, is reviewed. Credit risk is minimised

through due diligence on potential customers, appropriate credit limits, cash

flow management and the use of documentary credits where appropriate.

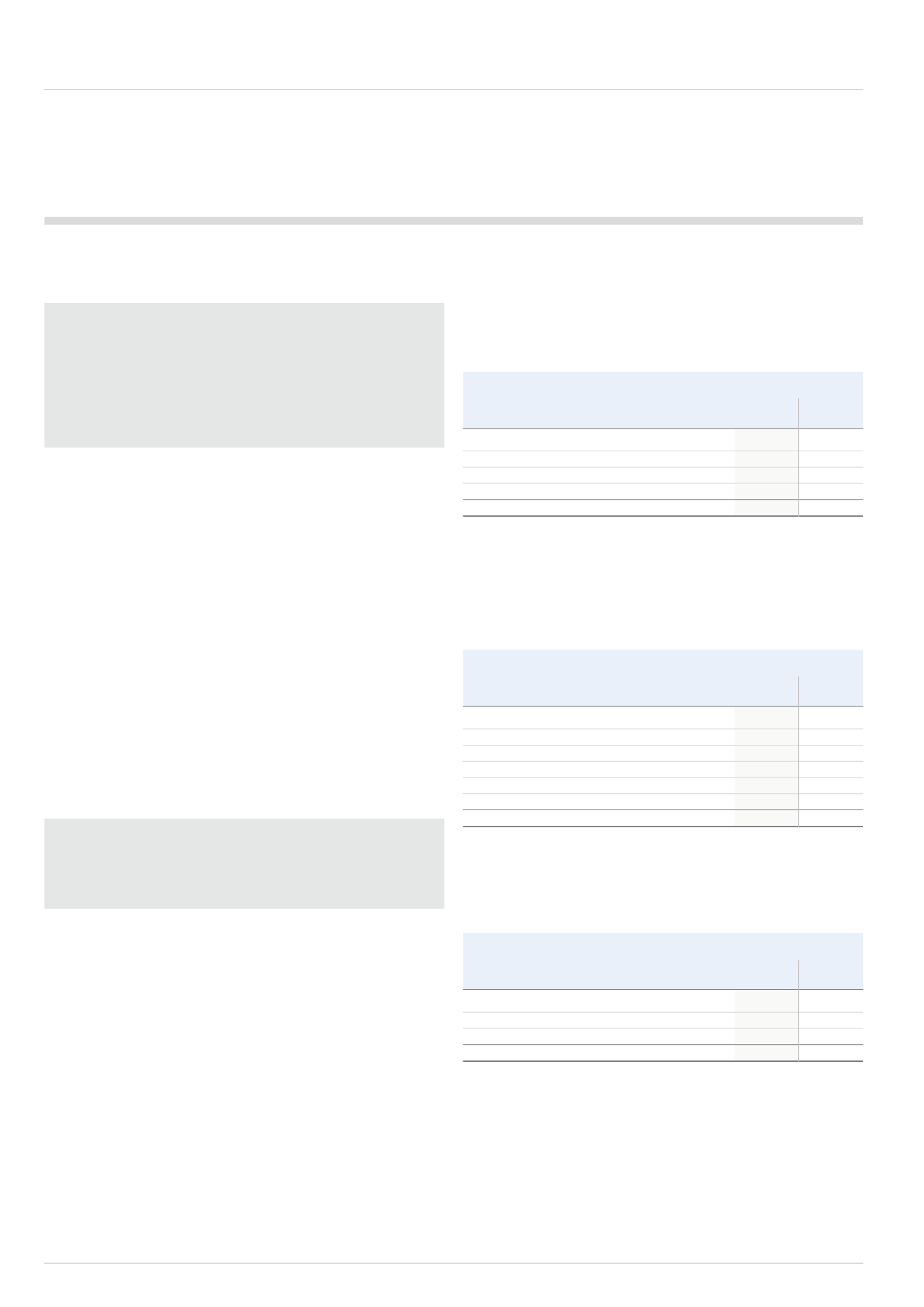

4.4.2.2

Exposure to credit risk in respect

of financial assets

The maximum exposure to credit risk for financial assets is represented by their

carrying value and is analysed below:

Carrying amount

2014

2013

£m

£m

Cash and cash equivalents*

43.8

99.9

Investments

26.9

20.2

Interest rate swaps

-

0.8

Forward exchange contracts

10.5

21.6

81.2

142.5

* Including £28.2m classified as held for sale in 2013.

4.4.2.3

Exposure to credit risk in respect

of trade receivables

Carrying amount

2014

2013

£m

£m

UK

23.7

18.8

Germany

23.5

26.2

Rest of Europe

89.3

105.2

USA

51.2

44.5

Asia Pacific

90.9

65.5

Rest of World

39.4

33.3

318.0

293.5

In 2013 there were a further £60.5m trade receivables, predominantly relating

to US customers, included in assets held for sale.

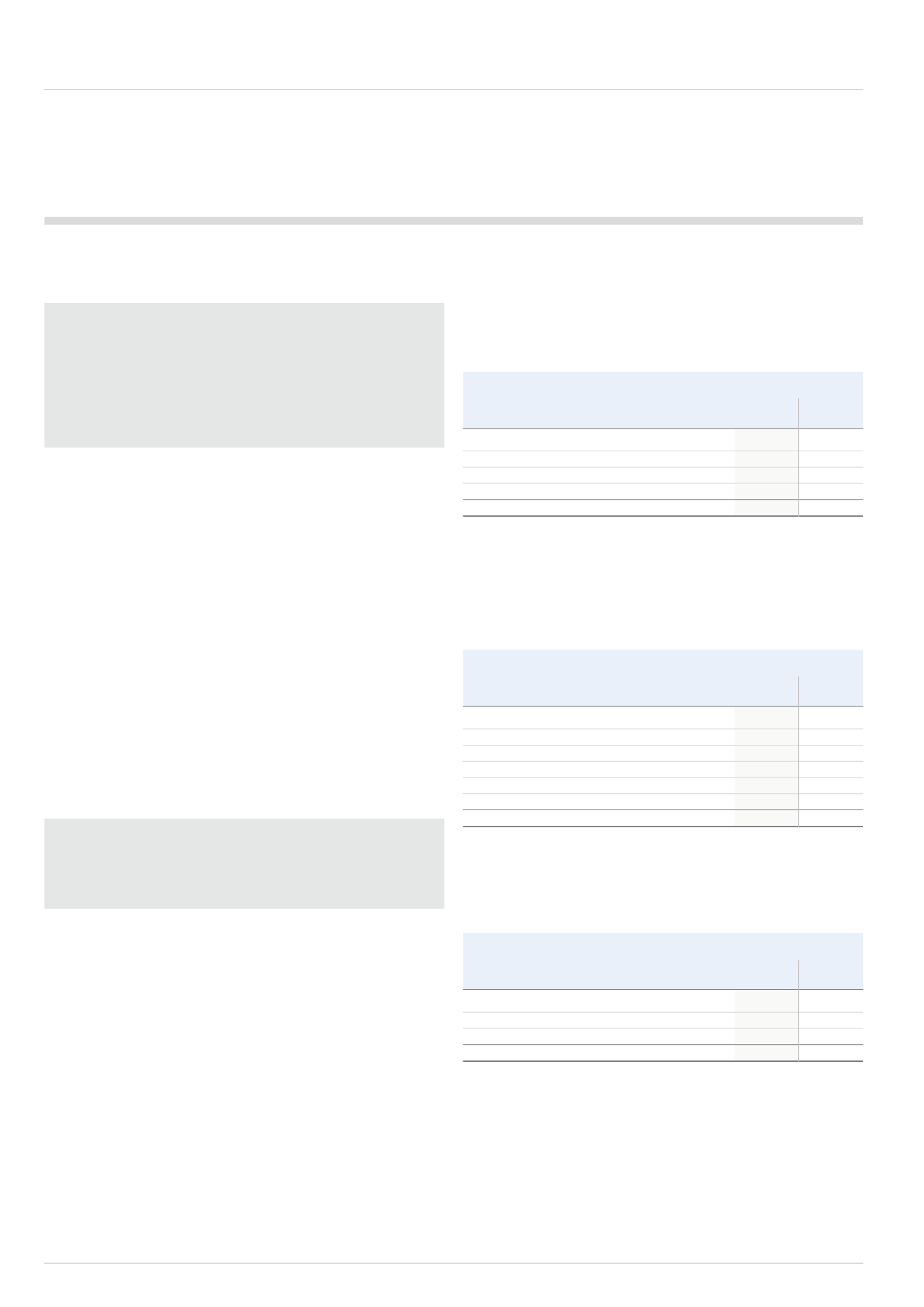

The maximum exposure to credit risk for trade receivables at the reporting

date by segment was as follows:

Carrying amount

2014

2013

£m

£m

IMI Critical Engineering

170.7

151.2

IMI Precision Engineering

111.2

103.0

IMI Hydronic Engineering

36.1

39.3

318.0

293.5

In 2013 there were a further £60.5m trade receivables, relating to the

Retail Dispense businesses, included in assets held for sale.