110

IMI plc

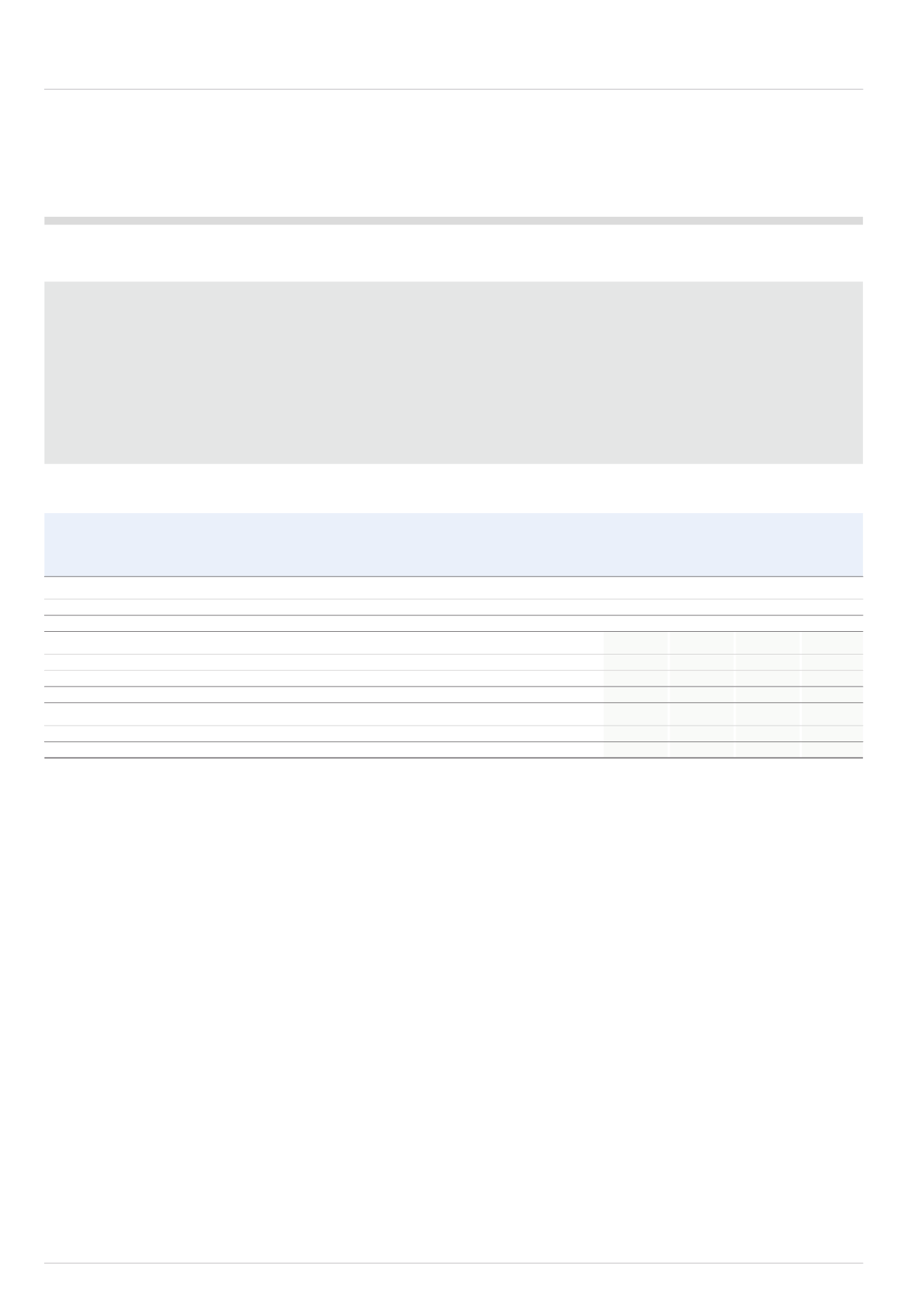

3.6 Provisions

A provision is recorded instead of a payable (see Section 3.1.3) when there is less certainty over how much cash will be paid and when the payment might be made.

When the Group has an obligation relating to previous events and when it is probable that cash will be paid to settle it, a provision rather than a payable is recorded.

In this situation, an estimate is required.

The principal estimates made in respect of the Group’s provisions concern the timing and amount of payments required to:

• cover the costs of known restructuring projects;

• reimburse customers for potential product warranty claims;

• ensure that current and former manufacturing sites meet relevant environmental standards;

• reflect the estimated outcome of ongoing legal disputes; and

• provide against indemnities following the disposal of subsidiaries.

Analysis of the Group’s provisions:

Environmental,

Trade

legal &

Restructuring warranties indemnity

Total

£m

£m

£m

£m

Current

8.3

8.7

3.1

20.1

Non-current

-

7.2

11.6

18.8

At 1 January 2014

8.3

15.9

14.7

38.9

Arising during the year

12.6

0.7

8.8

22.1

Utilised during the year

(15.1)

(1.7)

(5.1)

(21.9)

Exchange adjustment

(0.2)

(0.6)

0.8

-

At 31 December 2014

5.6

14.3

19.2

39.1

Current

4.4

6.9

11.4

22.7

Non-current

1.2

7.4

7.8

16.4

5.6

14.3

19.2

39.1

The restructuring provision reflects residual amounts committed but not spent in relation to a number of specific projects.

Trade warranties are given in the normal course of business and cover a range of periods, typically one to two years, with the expected amounts falling due in less than

and greater than one year separately analysed above. Amounts set aside represent the directors’ best estimate regarding the amount of the settlements and the timing

of resolution with customers.

Environmental and legal provisions recognise the Group’s obligation to remediate contaminated land at a number of current and former sites, together with current legal

cases for which a settlement is considered probable. Because of the long-term nature of the liabilities, the timescales are uncertain and the provisions represent the

directors’ best estimates of these costs.

Provisions for indemnities included in the agreed terms of disposals of subsidiaries are provided for based on the expected probability of indemnified losses that may

be suffered by the purchaser.

SECTION 3 – OPERATING ASSETS AND LIABILITIES

Continued