109

Annual Report and Accounts 2014

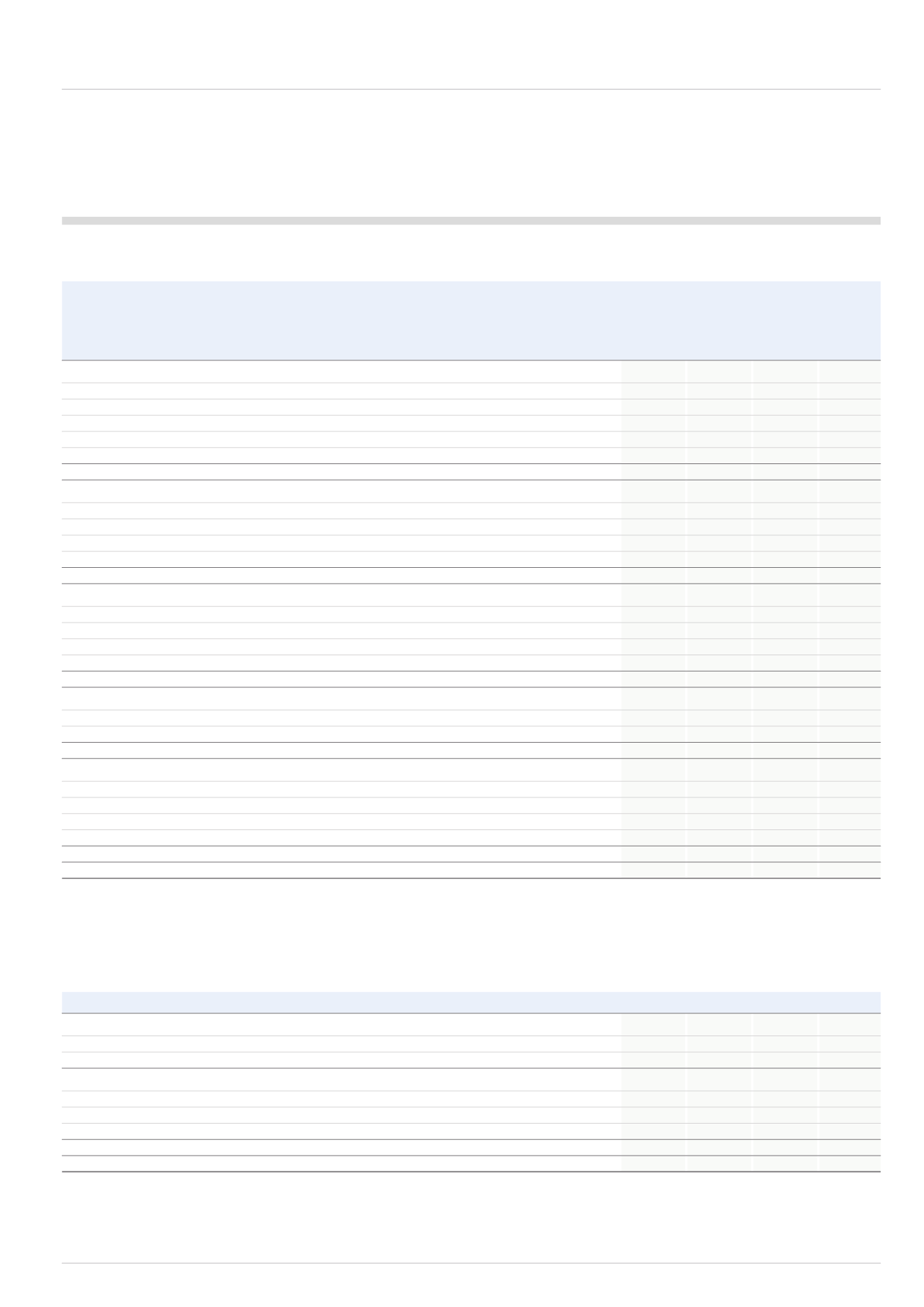

Details of the disposals are as follows:

Retail

Dispense

Eley

AFP

1 January 4 October 23 October

Total

2014

2014

2014

2014

£m

£m

£m

£m

Sale consideration*

691.2

41.6

3.4

736.2

Net assets disposed

(205.0)

(6.5)

(1.3)

(212.8)

Intercompany loans settled following completion

3.8

-

-

3.8

Costs of disposal

(13.9)

(2.0)

(1.0)

(16.9)

Foreign exchange gain transferred on disposal of operations

3.9

-

-

3.9

Taxation

(2.5)

-

-

(2.5)

Gain on disposal

477.5

33.1

1.1

511.7

Segmental assets

Intangible assets

114.1

-

0.1

114.2

Property, plant and equipment

25.1

2.8

0.2

28.1

Inventories

50.8

2.1

0.5

53.4

Trade and other receivables

67.1

1.6

0.4

69.1

Total segmental assets

257.1

6.5

1.2

264.8

Non-segmental assets

Current tax

0.2

-

0.3

0.5

Deferred tax

3.8

-

-

3.8

Cash and cash equivalents

28.2

2.3

0.2

30.7

Investments

0.1

-

-

0.1

Total assets

289.4

8.8

1.7

299.9

Segmental liabilities

Trade and other payables

(56.2)

(2.0)

(0.4)

(58.6)

Provisions

(5.4)

-

-

(5.4)

Total segmental liabilities

(61.6)

(2.0)

(0.4)

(64.0)

Non-segmental liabilities

Current tax

(3.2)

(0.3)

-

(3.5)

Deferred tax

(10.0)

-

-

(10.0)

Bank overdraft

(1.7)

-

-

(1.7)

Employee benefit obligations

(7.9)

-

-

(7.9)

Total liabilities

(84.4)

(2.3)

(0.4)

(87.1)

Net assets disposed

205.0

6.5

1.3

212.8

Movements between the net assets held for sale at 31 December 2013 for the Retail Dispense businesses and the eventual assets disposed principally represent a

minor change in the completion mechanism relating to the disposal of the employee benefit obligations, which increased by £7.1m to £7.9m. This resulted in a gain

of £2.8m, which is included within the gain on disposal.

* Sale consideration for AFP consists of a cash payment of £2.5m to the vendors offset by the settlement of a £5.9m contingent consideration creditor.

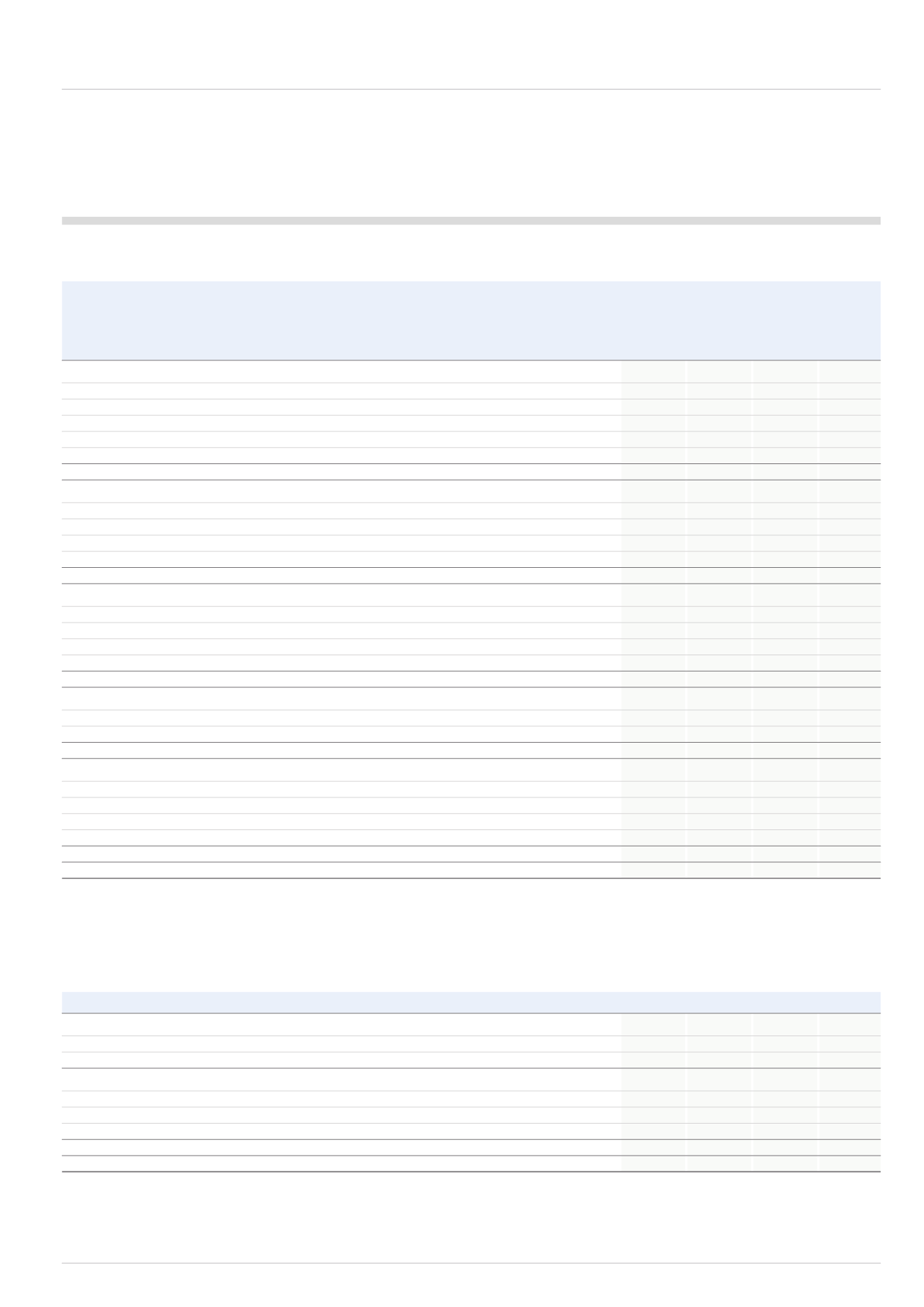

£m

£m

£m

£m

Net cash flow arising on disposal

Cash consideration/(settlement) at spot rate

680.0

41.6

(2.5)

719.1

Settlement of deal-contingent forward**

11.2

-

-

11.2

Sale consideration

691.2

41.6

(2.5)

730.3

Cost of deal-contingent forward**

(3.0)

-

-

(3.0)

Cash costs of disposal

(3.9)

(1.5)

(0.4)

(5.8)

Intercompany loans settled following completion

3.8

-

-

3.8

Net cash flow arising on disposal of operations

688.1

40.1

(2.9)

725.3

Net cash disposed on disposal of operations

(26.5)

(2.3)

(0.2)

(29.0)

** As at 31 December 2013 the deal-contingent forward used to manage the sterling-US dollar exposure on the consideration was valued at £11.2m. The net gain

on settlement of this contract was £8.2m which is net of the £3.0m option premium.