111

Annual Report and Accounts 2014

SECTION 4 – CAPITAL STRUCTURE AND FINANCING COSTS

What you will find in this section

This section outlines how the Group manages its capital and related financing costs. The directors determine the

appropriate capital structure for the Group, specifically, how much cash is raised from shareholders (equity) and how

much is borrowed from financial institutions (debt) in order to finance the Group’s activities both now and in the future.

The directors consider the Group’s capital structure and dividend policy at least twice a year ahead of announcing results

in the context of its ability to continue as a going concern and deliver its business plan.

The Board is mindful that equity capital cannot be easily flexed and in particular raising new equity would normally be

likely only in the context of an acquisition. Debt can be issued and repurchased more easily but frequent adjustments

lead to high transaction costs and debt holders are under no obligation to accept repurchase offers.

4.1 Net debt

Net cash/(debt) is the Group’s key measure used to evaluate total outstanding debt, net of the current cash resources. Some of the Group’s borrowings

(and cash) is held in foreign currencies. Movements in foreign exchange rates affect the sterling value of the net debt.

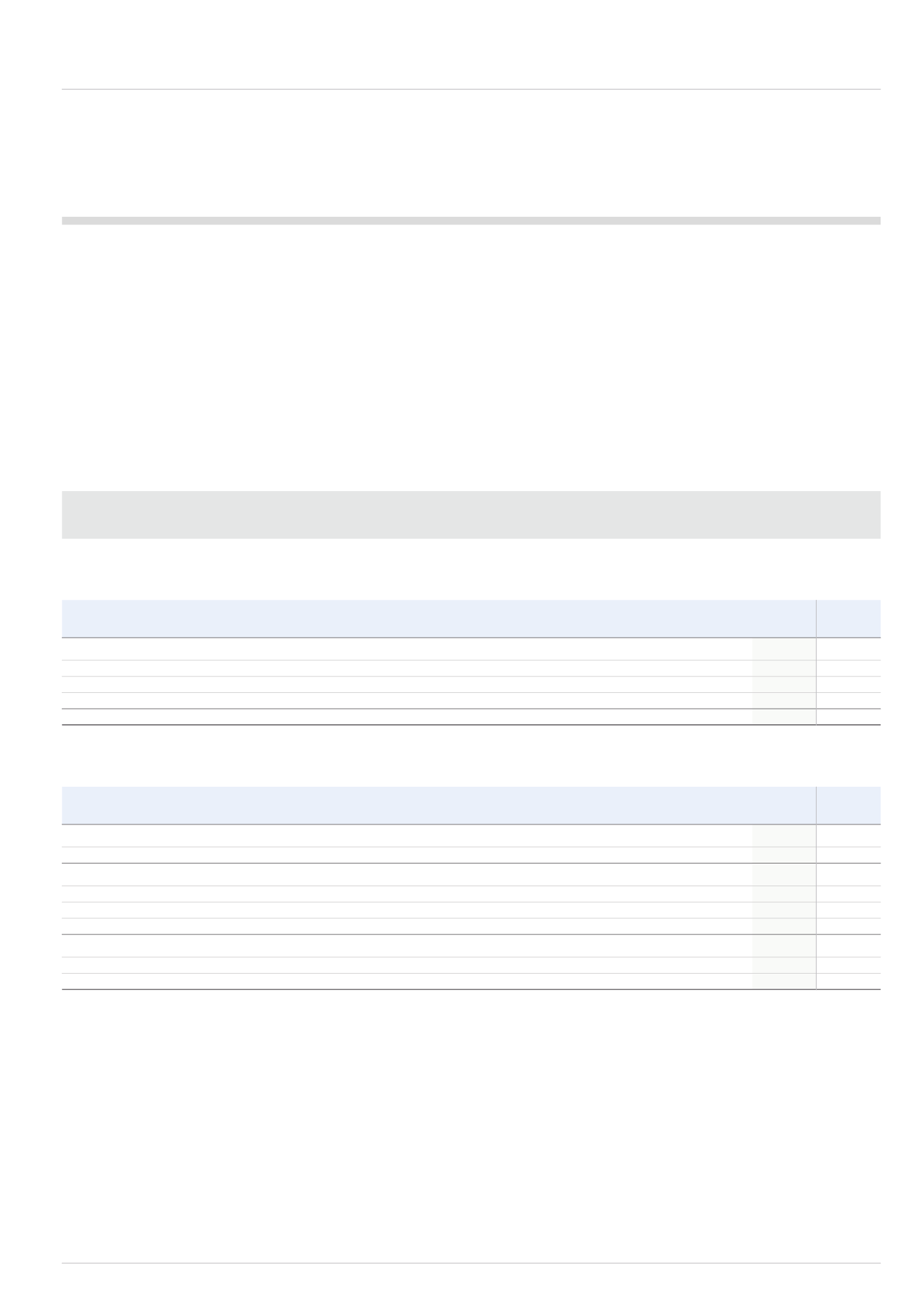

a) Reconciliation of cash and cash equivalents

2014

2013

£m

£m

Cash and cash equivalents in current assets

43.8

71.7

Bank overdraft in current liabilities

(23.0)

(7.9)

Cash and cash equivalents in assets held for sale

-

28.2

Bank overdraft in liabilities held for sale

-

(1.7)

Cash and cash equivalents

20.8

90.3

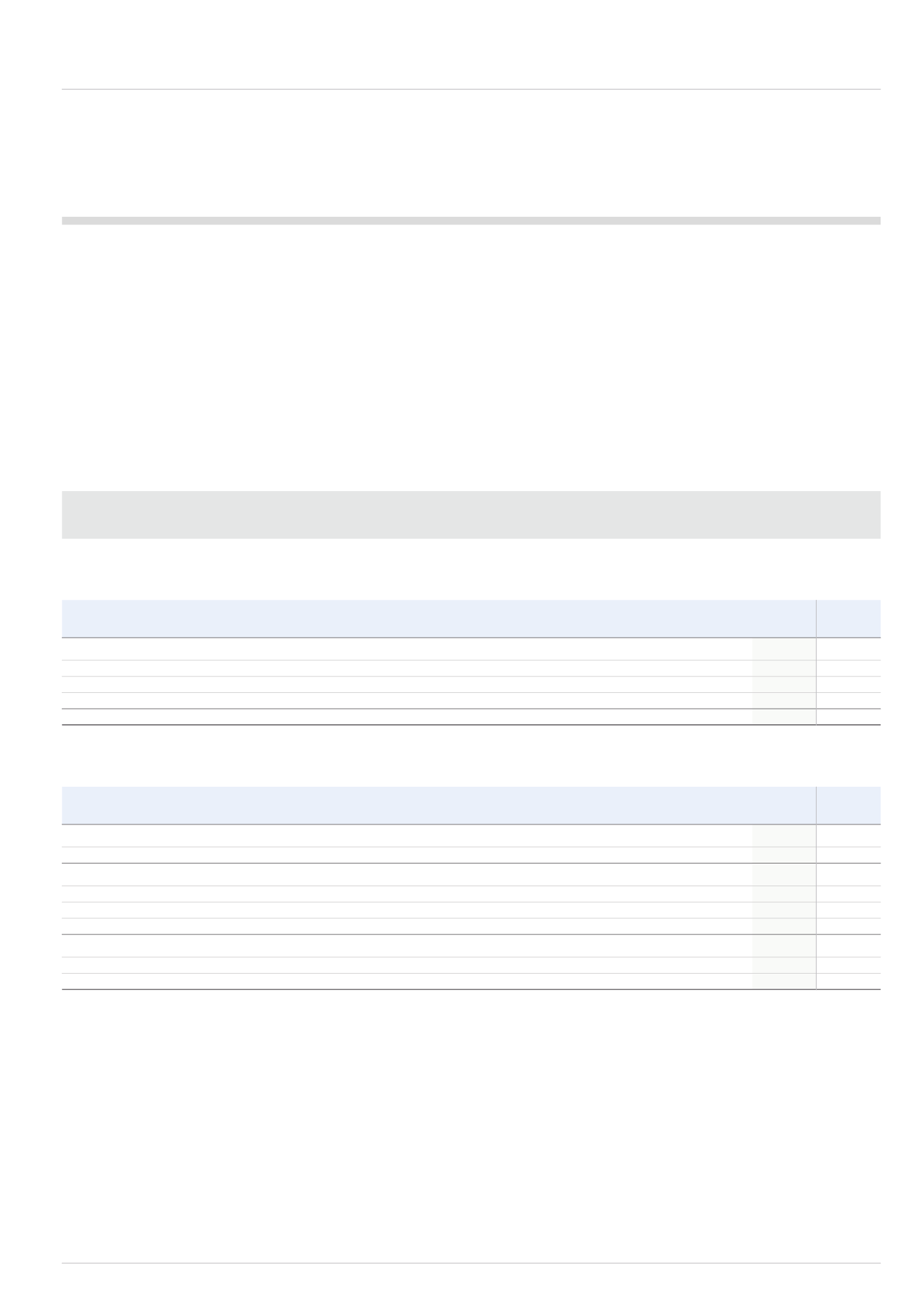

b) Reconciliation of net cash to movement in net borrowings

2014

2013

£m

£m

Net decrease in cash and cash equivalents excluding foreign exchange and net cash disposed/debt acquired

(39.9)

(4.7)

Net repayment/(drawdown) of borrowings

80.7

(51.0)

Increase in net debt before acquisitions and foreign exchange

40.8

(55.7)

Net cash disposed

(29.0)

-

Debt acquired

-

(2.5)

Currency translation differences

(12.4)

2.6

Movement in net borrowings in the year

(0.6)

(55.6)

Net borrowings at the start of the year

(199.4)

(143.8)

Net borrowings at the end of the year

(200.0)

(199.4)