112

IMI plc

SECTION 4 – CAPITAL STRUCTURE AND FINANCING COSTS

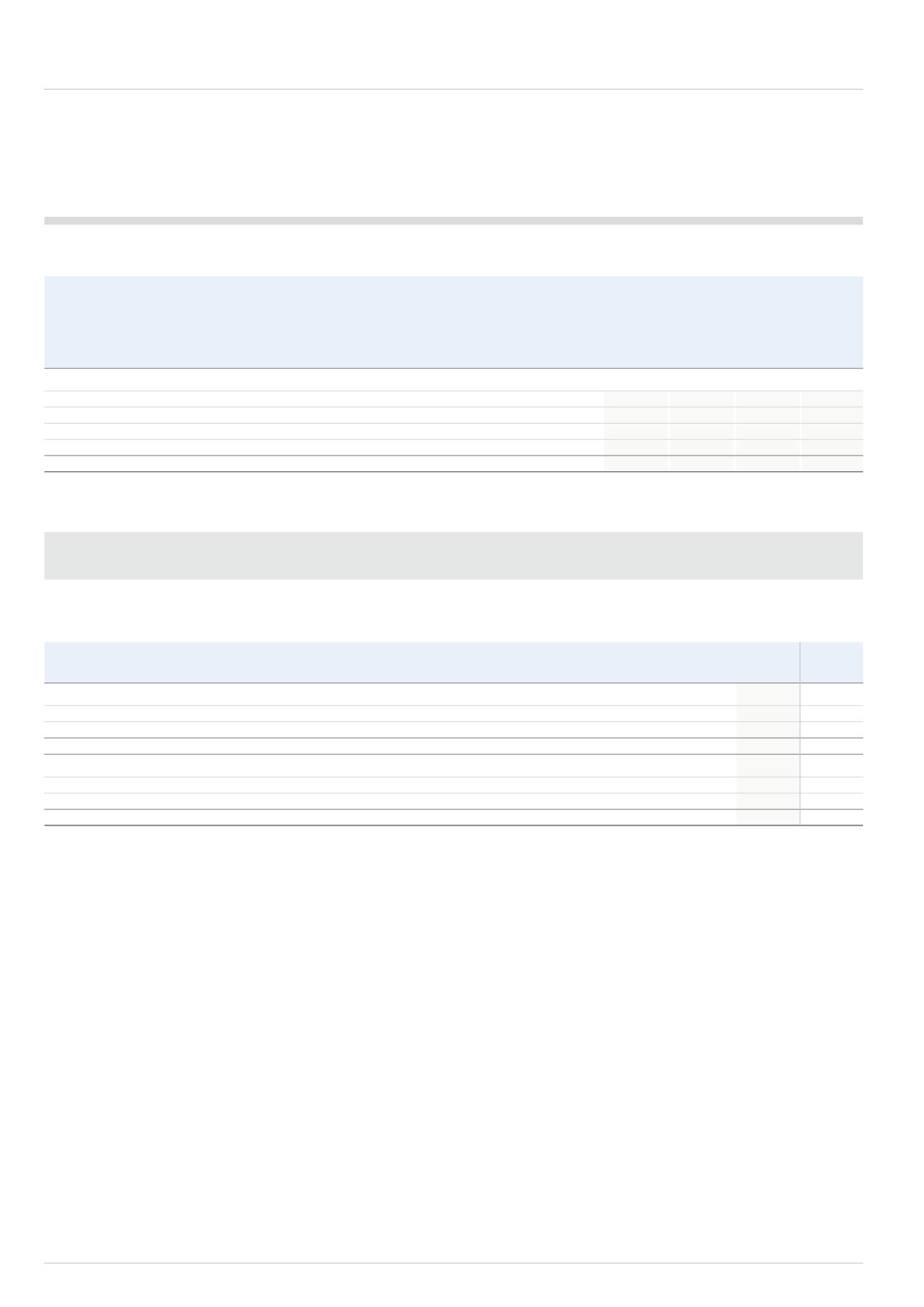

c) Analysis of net debt

Borrowings and

finance leases due

Cash and cash

within after more

Total

equivalents

one year than one year

net debt

£m

£m

£m

£m

At 1 January 2014

90.3

(80.8)

(208.9)

(199.4)

Net cash and cash equivalents disposed of

(29.0)

(29.0)

Cash flow excluding settlement of currency derivatives hedging balance sheet and net cash disposed of

(76.6)

78.7

2.0

4.1

Settlement of currency derivatives hedging balance sheet

36.7

36.7

Currency translation differences

(0.6)

0.1

(11.9)

(12.4)

At 31 December 2014

20.8

(2.0)

(218.8)

(200.0)

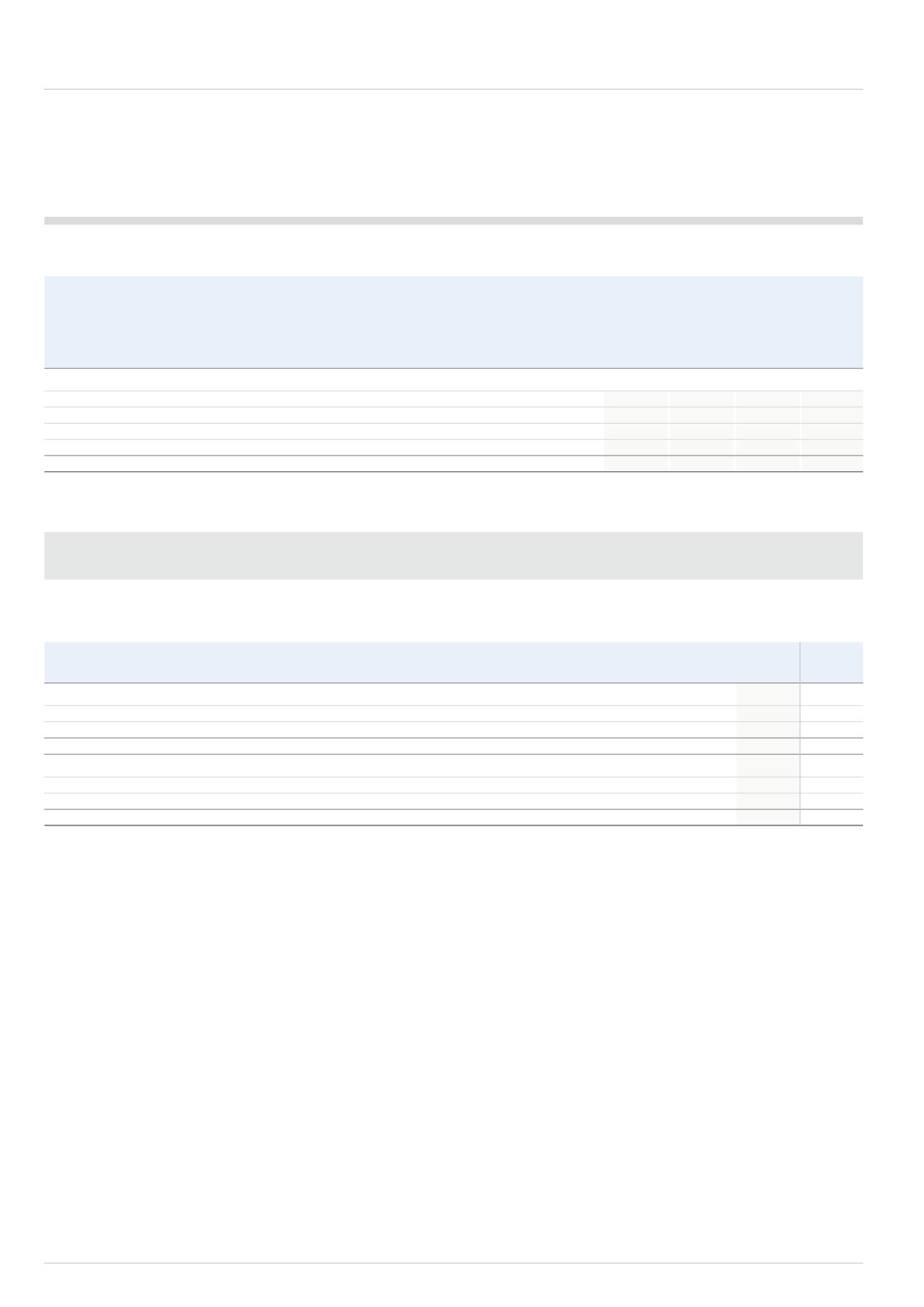

4.2 Interest-bearing loans and borrowings

The Group borrows money from financial institutions in the form of bonds and other financial instruments. These generally have fixed interest rates and are for

a fixed term or are drawn from committed borrowing facilities that generally have floating interest rates.

This section provides information about the terms of the Group’s interest-bearing loans and borrowings. For more information about the Group’s exposure to

interest rate and foreign currency risk, see section 4.4.3.

2014

2013

£m

£m

Current liabilities

Unsecured loan notes and other loans

1.3

80.0

Current portion of finance lease liabilities

0.7

0.8

2.0

80.8

Non-current liabilities

Unsecured loan notes and other loans

218.2

208.1

Finance lease liabilities

0.6

0.8

218.8

208.9

The reduction in unsecured notes and other loans is primarily due to the settlement of £79.0m of loans in the year.

Continued